Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a team of financial consultants hired to assist the client, Mr. Bansal. Instructions Read the case individually and jot down your notes. Discuss

You are a team of financial consultants hired to assist the client, Mr. Bansal.

Instructions

- Read the case individually and jot down your notes.

- Discuss the case with your group.

- Evaluate the proposed project for Mr. Bansal using the capital budgeting techniques (including IRR) you have learnt in the course so far (Chapter 8 NPV and other investment criteria). Assume the opportunity cost of capital is 12% (that is, 15% net of 20% tax).

- Also, include a sensitivity analysis if Mr. Bansal decides to provide a fee reduction in the expected revenue for 5 years as follows:

Note: Use the following revised expected revenue structure with the fee reduction (all other assumptions remain the same as given in Exhibit 3). Fees are in Indian Rupees

Year 1 | Year 2 | Years 3-5 (per year) | |

Total strength | 35 | 50 | 80 |

New enrolments | 35 | 25 | 40 |

Returning | 0 | 25 | 40 |

Fees – New students (one time and annual) | 17,500 | 18,000 | 18,500 |

Fees – Returning students (annual) | 15,500 | 16,000 |

- In 700-800, words discuss whether your group feels the project is financially viable, supported by your group’s calculation(s) and discussion. Make a recommendation to the client based on your group’s analysis in Steps 1-4. Please submit one Word document submission per group (and any supporting calculations using Excel) and upload it in the Assignment dropbox (25 marks)

- In place of an in-class group presentation (given that we are not on campus), create a short video in Zoom. You have the option to nominate one group member to be your spokesperson or have more than one group member participate in this video. In 4-5 minutes create a ‘make your pitch’ video; highlight for the client the importance of capital budgeting techniques in decision-making including the use of NPV and IRR. Briefly explain to the client how the various techniques are used to base your team’s recommendation and determining whether the project is financially viable. Include the recording (MP4 file) when you upload your group’s submission (5 marks).

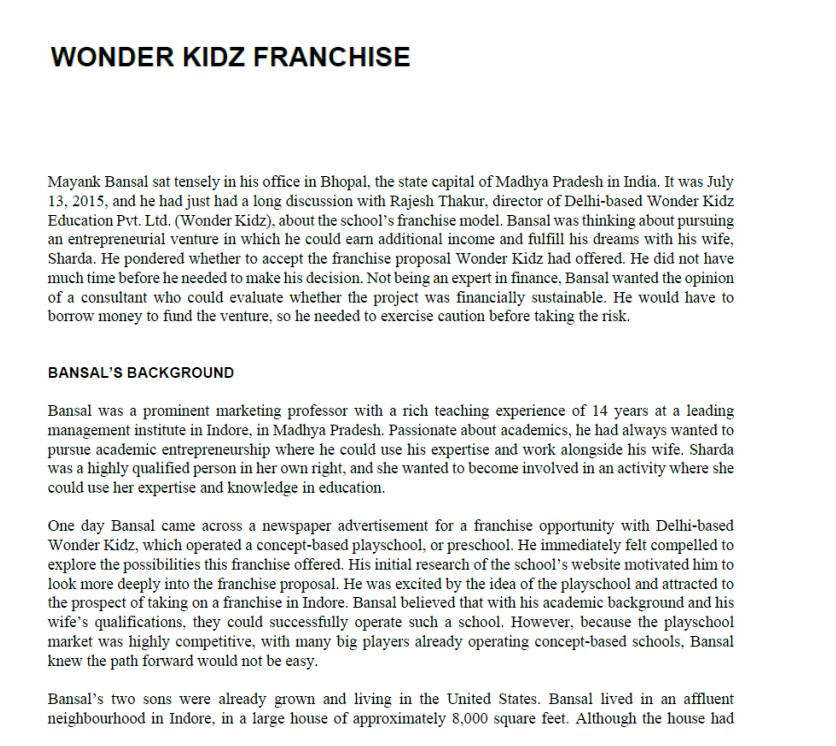

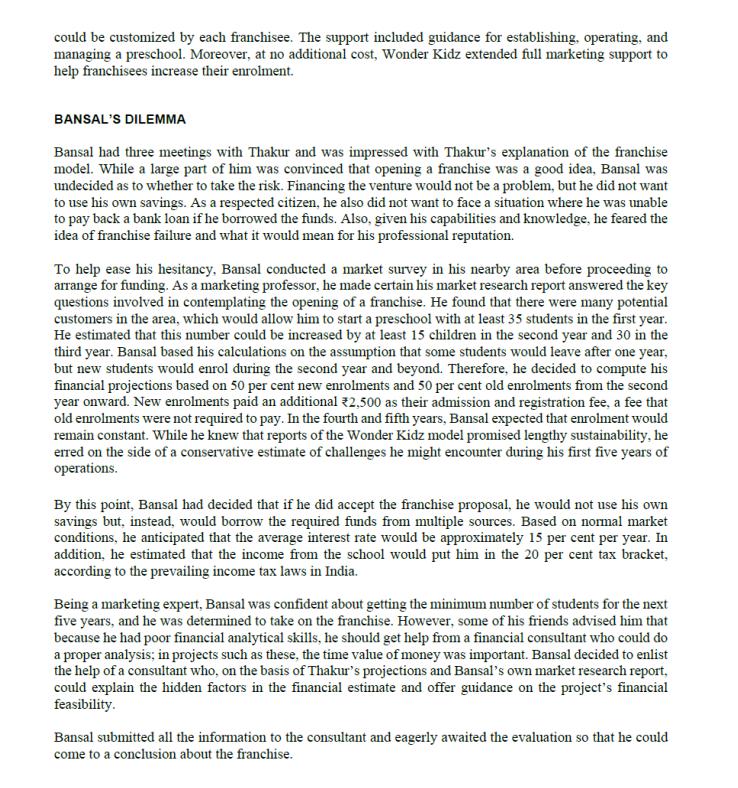

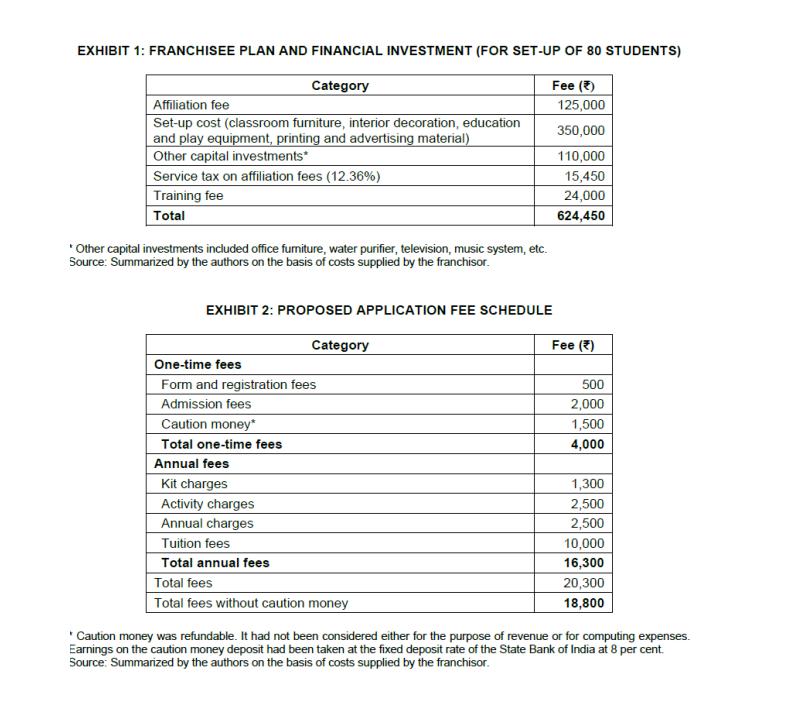

WONDER KIDZ FRANCHISE Mayank Bansal sat tensely in his office in Bhopal, the state capital of Madhya Pradesh in India. It was July 13, 2015, and he had just had a long discussion with Rajesh Thakur, director of Delhi-based Wonder Kidz Education Pvt. Ltd. (Wonder Kidz), about the school s franchise model. Bansal was thinking about pursuing an entrepreneurial venture in which he could earn additional income and fulfill his dreams with his wife, Sharda. He pondered whether to accept the franchise proposal Wonder Kidz had offered. He did not have much time before he needed to make his decision. Not being an expert in finance, Bansal wanted the opinion of a consultant who could evaluate whether the project was financially sustainable. He would have to borrow money to fund the venture, so he needed to exercise caution before taking the risk. BANSAL S BACKGROUND Bansal was a prominent marketing professor with a rich teaching experience of 14 years at a leading management institute in Indore, in Madhya Pradesh. Passionate about academics, he had always wanted to pursue academic entrepreneurship where he could use his expertise and work alongside his wife. Sharda was a highly qualified person in her own right, and she wanted to become involved in an activity where she could use her expertise and knowledge in education. One day Bansal came across a newspaper advertisement for a franchise opportunity with Delhi-based Wonder Kidz, which operated a concept-based playschool, or preschool. He immediately felt compelled to explore the possibilities this franchise offered. His initial research of the school s website motivated him to look more deeply into the franchise proposal. He was excited by the idea of the playschool and attracted to the prospect of taking on a franchise in Indore. Bansal believed that with his academic background and his wife s qualifications, they could successfully operate such a school. However, because the playschool market was highly competitive, with many big players already operating concept-based schools, Bansal knew the path forward would not be easy. Bansal s two sons were already grown and living in the United States. Bansal lived in an affluent neighbourhood in Indore, in a large house of approximately 8,000 square feet. Although the house had ample room in which to start the school, Bansal thought that renting premises in the nearby area would be preferable. PRESCHOOL MARKET IN INDIA An increase in family income, as well as the demand for quality education, had kindled the growth of preschools in India. A report from Kaizen Private Equity estimated the 2014 size of the preschool market in India at approximately US$800 million. Future growth of 30 per cent was expected as a result of three key drivers: a higher level of parental awareness of the importance of early education, hectic working schedules of both parents, and a willingness to pay for children s education. Additional potential for growth lay in the fact that the market had limited application of technology in terms of computers and other modem equipment in children s education. Also, the market was being driven by major investments from private equity funds and venture capitalists, with a very low, or no, regulatory framework. The market was hugely attractive because of its minimal infrastructure requirements-costs that were considerable in Tier 1 cities and even more significant in Tier 2 and 3 cities. Reports suggested that the preschool market was concentrated only in metropolitan areas and Tier 1 cities. However, experts anticipated that the market would soon begin to emerge within Tier 2 and Tier 3 cities. ABOUT WONDER KIDZ Founded in 1999, Wonder Kidz was the fastest-growing chain of preschools and formal schools in India. An ISO 9001:2008 certified company, Wonder Kidz had more than 1,000 franchises spread across the country. Through its innovative and groundbreaking training and education system, the company was committed to helping children develop into wonder kids by motivating them and developing their full potential. The company s objectives were to help children become competent at facing the challenges of rapidly changing modern life by providing structural learning programs based on each child s distinct needs. The programs used age-appropriate learning activities, developed critical-thinking skills, and fostered awareness of diversity and multiculturalism. The founders of Wonder Kidz regarded the information age as a time of perplexing professional choices made more challenging by tough competition from peers; hence, every child needed to be a wonder child to successfully compete. Its centres offered both indoor and outdoor activities-part of the children s regular schedule that provided them with a congenial environment and a positive atmosphere. The founders believed this atmosphere motivated children to attend school regularly. The school s curriculum was imbued with the learning by doing concept, which ensured the application of highly systematic and step-by-step processes. The unique, child-oriented curriculum was based on a core of activities that included traditional Indian games like the tower-making game using small wooden cubes, snakes and ladders (an ancient Indian board game), the inquisition game (an action role-playing video game), as well as the next generation educational requirements based on the Four Cs: Curiosity, Confidence. Creativity, and Continuity. (The Four Cs concept was derived by the Wonder Kidz team to help students learn by having fun). The school also boasted exclusive smart classrooms in which education was provided through a projector and a talking pen. The talking pen was an innovative tool used to develop inquisitiveness and motivate children to practice listening and learning habits. The pen was included in a kit composed of a book containing a chip through which sentences, rhymes, and stories were recognized by the pen. The pen then converted the information into audio, which was played through speakers built into the pen itself. Both children and teachers expressed that this novel pen concept was an enjoyable and brilliant addition to education. WONDER KIDZ FRANCHISE MODEL Thakur, the director of Wonder Kidz, promoted the uniqueness of the franchise proposal as a minimum investment for a maximum return. He believed that the education sector was virtually recession-proof. meaning there was minimal risk of franchisees losing their investment. An initial investment of approximately *625,000 was required. This amount included the registration cost payable to the franchise and the franchisee cost to initiate the centre. It did not include infrastructure costs such as land and building. but it did include set-up costs such as classrooms, furniture, teaching and play equipment, wall designing (the classroom walls were decorated with paintings of cartoons and interesting characters), teacher training. and other ancillary expenses (see Exhibit 1). The investor was also required to have access to constructed premises of approximately 1,200-1,600 square feet, preferably in an affluent residential area. These premises needed to provide three to four rooms, ideally on the ground floor. Each centre was allowed to charge a maximum of 20,000 per year for each registered child (see Exhibit 2). Parents could pay the fee in its entirety at the time of registration or spread their payments out over a maximum of four instalments. Although the franchise agreement was flexible enough to provide franchisees discretion regarding offering discounted registration fees, Thakur recommended that no discount be offered. He strongly believed that a franchise, with little effort, could generate a profit during its first year. Thakur provided profitability projections for the first three years of a centre s operation; these were tentative projections based on a franchise s estimated expenses, which were shared with potential new franchisees (see Exhibit 3). The franchise proposal allowed for a centre s premises to be used for other activities. For example, a centre could allocate four hours in the morning for Wonder Kidz and the remaining time for other activities. These other activities might include skill development for young as well as older children, all of which could be conducted to increase the profitability of the centre. Activities could include abacus, handwriting improvement, calligraphy, speed math, Vedic math, drawing and painting, dance, music, and other indoor activities. Beyond the attractiveness of the financial investment, the franchise model was an enticing one. According to Indian law, no affiliation or approval whatsoever was required from regulatory authorities to open a preschool. Wonder Kidz guaranteed that all franchisee schools would receive support for their day-to-day activities, including a full curriculum plan and syllabus, periodic teacher training, a call centre (available 24 hours a day, 7 days a week), and a detailed operations manual with a daily operating activities chart that could be customized by each franchisee. The support included guidance for establishing, operating, and managing a preschool. Moreover, at no additional cost, Wonder Kidz extended full marketing support to help franchisees increase their enrolment. BANSAL S DILEMMA Bansal had three meetings with Thakur and was impressed with Thakur s explanation of the franchise model. While a large part of him was convinced that opening a franchise was a good idea, Bansal was undecided as to whether to take the risk. Financing the venture would not be a problem, but he did not want to use his own savings. As a respected citizen, he also did not want to face a situation where he was unable to pay back a bank loan if he borrowed the funds. Also, given his capabilities and knowledge, he feared the idea of franchise failure and what it would mean for his professional reputation. To help ease his hesitancy, Bansal conducted a market survey in his nearby area before proceeding to arrange for funding. As a marketing professor, he made certain his market research report answered the key questions involved in contemplating the opening of a franchise. He found that there were many potential customers in the area, which would allow him to start a preschool with at least 35 students in the first year. He estimated that this number could be increased by at least 15 children in the second year and 30 in the third year. Bansal based his calculations on the assumption that some students would leave after one year, but new students would enrol during the second year and beyond. Therefore, he decided to compute his financial projections based on 50 per cent new enrolments and 50 per cent old enrolments from the second year onward. New enrolments paid an additional 2,500 as their admission and registration fee, a fee that old enrolments were not required to pay. In the fourth and fifth years, Bansal expected that enrolment would remain constant. While he knew that reports of the Wonder Kidz model promised lengthy sustainability, he erred on the side of a conservative estimate of challenges he might encounter during his first five years of operations. By this point, Bansal had decided that if he did accept the franchise proposal, he would not use his own savings but, instead, would borrow the required funds from multiple sources. Based on normal market conditions, he anticipated that the average interest rate would be approximately 15 per cent per year. In addition, he estimated that the income from the school would put him in the 20 per cent tax bracket, according to the prevailing income tax laws in India. Being a marketing expert, Bansal was confident about getting the minimum number of students for the next five years, and he was determined to take on the franchise. However, some of his friends advised him that because he had poor financial analytical skills, he should get help from a financial consultant who could do a proper analysis; in projects such as these, the time value of money was important. Bansal decided to enlist the help of a consultant who, on the basis of Thakur s projections and Bansal s own market research report, could explain the hidden factors in the financial estimate and offer guidance on the project s financial feasibility. Bansal submitted all the information to the consultant and eagerly awaited the evaluation so that he could come to a conclusion about the franchise. EXHIBIT 1: FRANCHISEE PLAN AND FINANCIAL INVESTMENT (FOR SET-UP OF 80 STUDENTS) Category Fee (*) 125,000 350,000 110,000 15,450 24,000 624,450 Affiliation fee Set-up cost (classroom furniture, interior decoration, education and play equipment, printing and advertising material) Other capital investments* Service tax on affiliation fees (12.36%) Training fee Total *Other capital investments included office furniture, water purifier, television, music system, etc. Source: Summarized by the authors on the basis of costs supplied by the franchisor. EXHIBIT 2: PROPOSED APPLICATION FEE SCHEDULE One-time fees Form and registration fees Admission fees Caution money* Total one-time fees Annual fees Kit charges Category Activity charges Annual charges Tuition fees Total annual fees Total fees Total fees without caution money Fee (2) 500 2,000 1,500 4,000 1,300 2,500 2,500 10,000 16,300 20,300 18,800 k Caution money was refundable. It had not been considered either for the purpose of revenue or for computing expenses. Earnings on the caution money deposit had been taken at the fixed deposit rate of the State Bank of India at 8 per cent. Source: Summarized by the authors on the basis of costs supplied by the franchisor. EXHIBIT 3: PROJECTED ANNUAL PROFITABILITY/CASH FLOW ANALYSIS FOR FIVE YEARS (INE) Expected number of enrolments for 5 years New enrolments Old enrolments Total expected strength in each year Expected revenue for 5 years Fee collection from new students (one time + annual) Fee collection from old students (annual) Total fee collection (without caution money) (A) Year 1 = 18,800 x 35 Year 2 = (18,800 x 25) + (16,300 x 25) Year 3 (18,800 x 40) + (16,300 x 40) Anticipated expenses for 5 years Royalty at 1,200 per registration payable to franchisor Salary of one senior trainer/faculty Salary of junior faculty (two required in year 1; three required in year 2; five required in year 3) Salary of nanny (two nannies required in year 1 and 2; three required in year 3) Rent Electricity Office expenses Advertising Total expenses (B) Operational profit (A - B) or earnings before interest & tax Add: Interest on caution money at 8% Less: Interest on borrowed funds at 15% Earnings before tax Less: Tax 20% Earnings after tax (cash flows) Note: Depreciation on assets was not considered in the case. Year 1 35 0 35 Year 2 25 25 50 18,800 18,800 11,240 44,960 42,000 84,000 96,000 1,80,000 18,800 16,300 16,300 658,000 877,500 1,404,000 60,000 72,000 180,000 198,000 12,000 15,000 18,000 24,000 24,000 30,000 516,000 142,000 4,200 90,000 56,200 118,500 23,700 94,800 Year 3 & onward 60,000 96,000 96,000 1,08,000 3,60,000 40 40 80 675,000 202,500 6,000 90,000 108,000 216,000 18,000 30,000 30,000 966,000 438,000 9,600 90,000 357,600 71,520 286,080

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Duty As a financial consultant I should be able to Evaluate Thakurs forecasts and Bansals market analysis for the Wonder Kidz franchise project in Indore Identify any hidden costs Provide advice on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started