Question: You are a trader for a bond mutual fund. You contact a bond dealer for quotes on the Boeing 7.500% coupon bond that matures

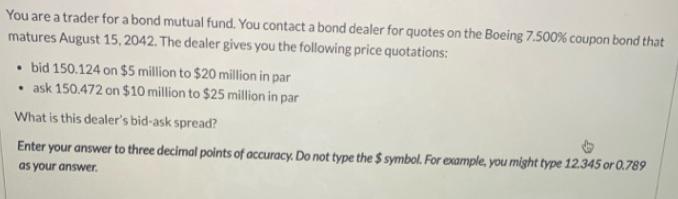

You are a trader for a bond mutual fund. You contact a bond dealer for quotes on the Boeing 7.500% coupon bond that matures August 15, 2042. The dealer gives you the following price quotations: bid 150.124 on $5 million to $20 million in par ask 150.472 on $10 million to $25 million in par What is this dealer's bid-ask spread? Enter your answer to three decimal points of accuracy. Do not type the $ symbol. For example, you might type 12.345 or 0.789 as your answer.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

IF ANY QUERY FEEL FREE T... View full answer

Get step-by-step solutions from verified subject matter experts