Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a trader on an options desk. Assume your horizon is one year to maturity. Assume you are trading three strikes: 95 (22

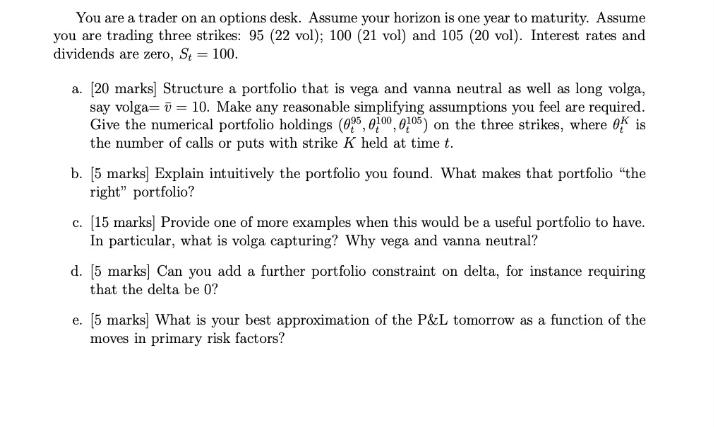

You are a trader on an options desk. Assume your horizon is one year to maturity. Assume you are trading three strikes: 95 (22 vol); 100 (21 vol) and 105 (20 vol). Interest rates and dividends are zero, S, = 100. a. [20 marks] Structure a portfolio that is vega and vanna neutral as well as long volga, say volga= = 10. Make any reasonable simplifying assumptions you feel are required. Give the numerical portfolio holdings (095, 0100, 0105) on the three strikes, where OK is the number of calls or puts with strike K held at time t. b. [5 marks] Explain intuitively the portfolio you found. What makes that portfolio "the right" portfolio? c. [15 marks] Provide one of more examples when this would be a useful portfolio to have. In particular, what is volga capturing? Why vega and vanna neutral? d. [5 marks] Can you add a further portfolio constraint on delta, for instance requiring that the delta be 0? e. [5 marks] What is your best approximation of the P&L tomorrow as a function of the moves in primary risk factors?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To structure a portfolio that is vega and vanna neutral while being long volga we need to balance the vega and vanna exposures across the strikes wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started