Answered step by step

Verified Expert Solution

Question

1 Approved Answer

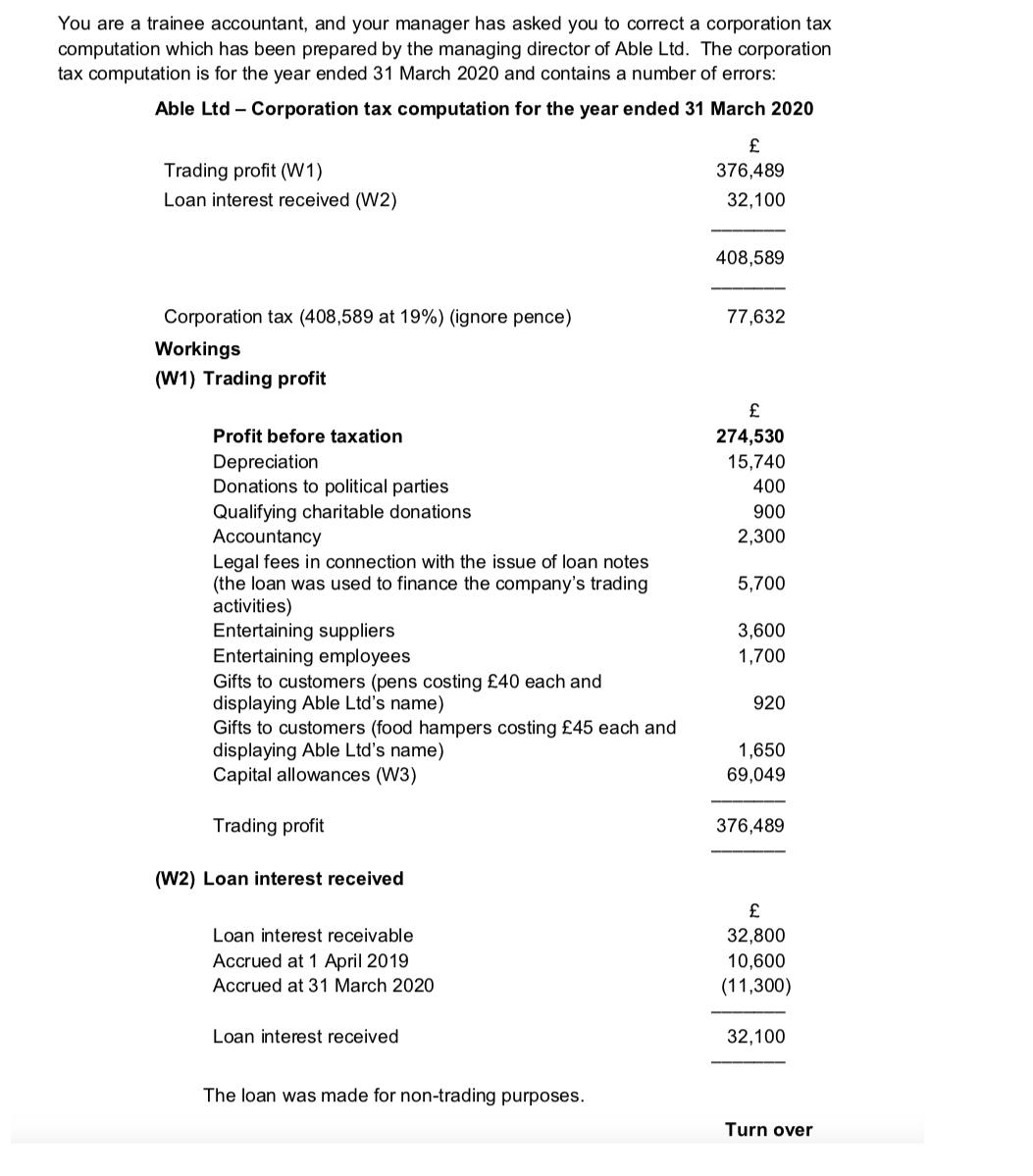

You are a trainee accountant, and your manager has asked you to correct a corporation tax computation which has been prepared by the managing

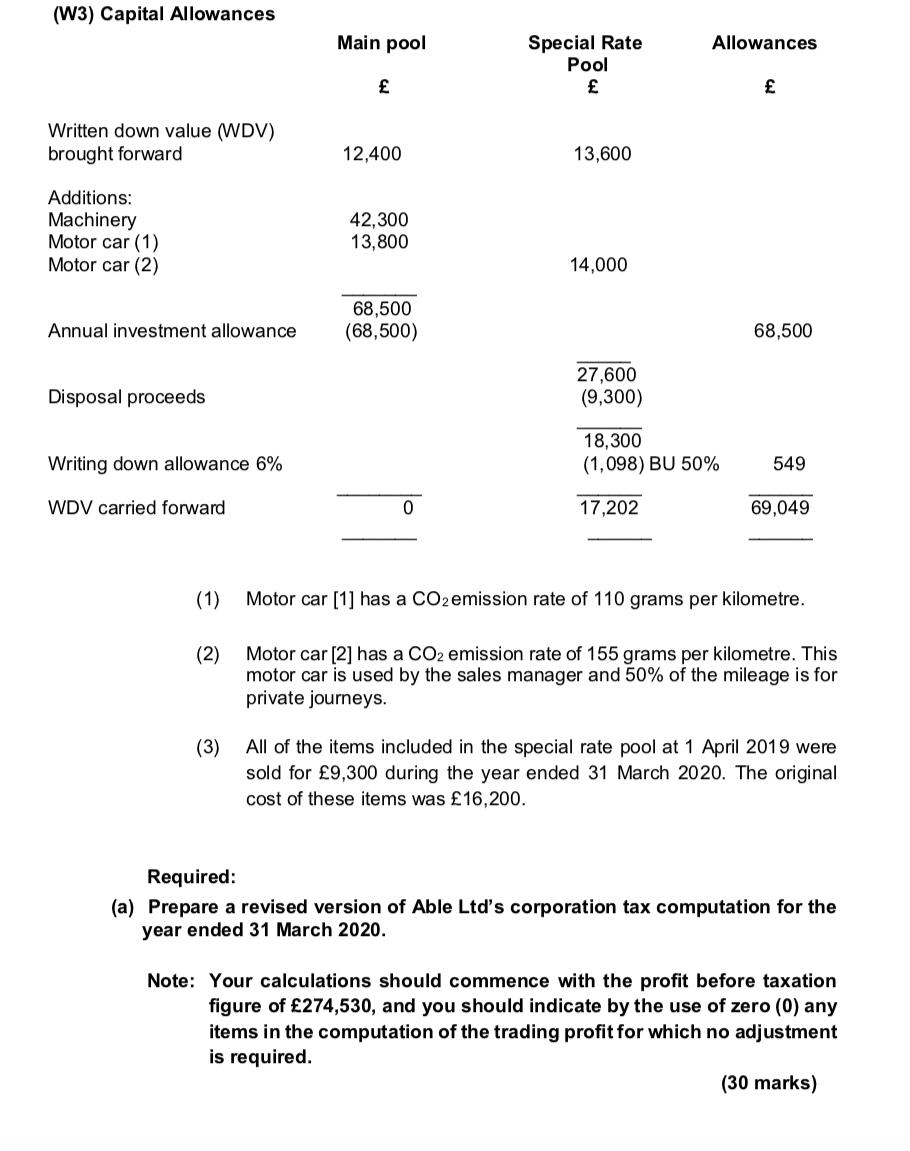

You are a trainee accountant, and your manager has asked you to correct a corporation tax computation which has been prepared by the managing director of Able Ltd. The corporation tax computation is for the year ended 31 March 2020 and contains a number of errors: Able Ltd - Corporation tax computation for the year ended 31 March 2020 Trading profit (W1) Loan interest received (W2) Corporation tax (408,589 at 19%) (ignore pence) Workings (W1) Trading profit Profit before taxation Depreciation Donations to political parties Qualifying charitable donations Accountancy Legal fees in connection with the issue of loan notes (the loan was used to finance the company's trading activities) Entertaining suppliers Entertaining employees Gifts to customers (pens costing 40 each and displaying Able Ltd's name) Gifts to customers (food hampers costing 45 each and displaying Able Ltd's name) Capital allowances (W3) Trading profit (W2) Loan interest received Loan interest receivable Accrued at 1 April 2019 Accrued at 31 March 2020 Loan interest received The loan was made for non-trading purposes. 376,489 32,100 408,589 77,632 274,530 15,740 400 900 2,300 5,700 3,600 1,700 920 1,650 69,049 376,489 32,800 10,600 (11,300) 32,100 Turn over (W3) Capital Allowances Written down value (WDV) brought forward Additions: Machinery Motor car (1) Motor car (2) Annual investment allowance Disposal proceeds Writing down allowance 6% WDV carried forward (1) (2) Main pool 12,400 42,300 13,800 68,500 (68,500) 0 Special Rate Pool 13,600 14,000 27,600 (9,300) Allowances 18,300 (1,098) BU 50% 17,202 68,500 549 69,049 Motor car [1] has a CO2 emission rate of 110 grams per kilometre. Motor car [2] has a CO2 emission rate of 155 grams per kilometre. This motor car is used by the sales manager and 50% of the mileage is for private journeys. (3) All of the items included in the special rate pool at 1 April 2019 were sold for 9,300 during the year ended 31 March 2020. The original cost of these items was 16,200. Required: (a) Prepare a revised version of Able Ltd's corporation tax computation for the year ended 31 March 2020. Note: Your calculations should commence with the profit before taxation figure of 274,530, and you should indicate by the use of zero (0) any items in the computation of the trading profit for which no adjustment is required. (30 marks)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started