Answered step by step

Verified Expert Solution

Question

1 Approved Answer

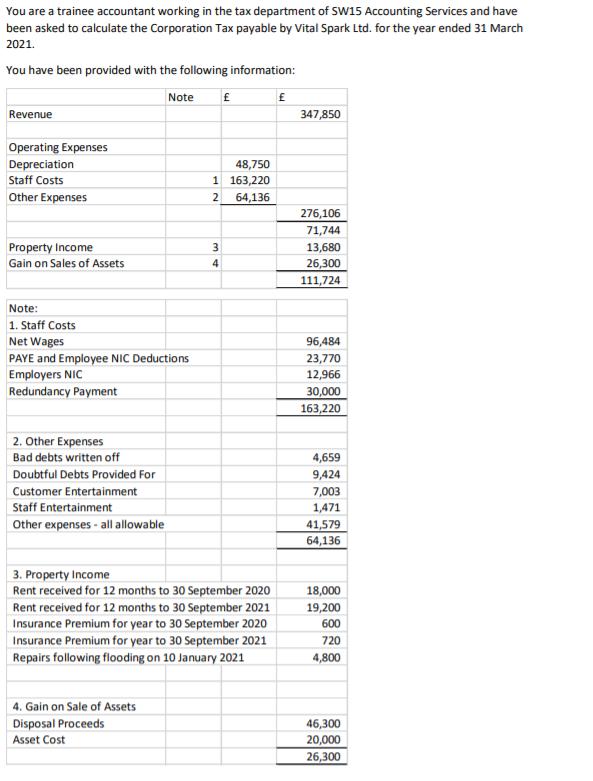

You are a trainee accountant working in the tax department of SW15 Accounting Services and have been asked to calculate the Corporation Tax payable

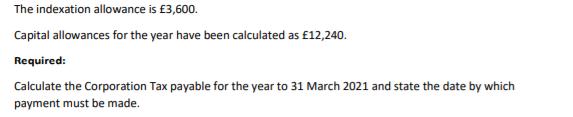

You are a trainee accountant working in the tax department of SW15 Accounting Services and have been asked to calculate the Corporation Tax payable by Vital Spark Ltd. for the year ended 31 March 2021. You have been provided with the following information: Revenue Operating Expenses Depreciation Staff Costs Other Expenses Property Income Gain on Sales of Assets Note: 1. Staff Costs Net Wages PAYE and Employee NIC Deductions Employers NIC Redundancy Payment 2. Other Expenses Bad debts written off Doubtful Debts Provided For Customer Entertainment Staff Entertainment Other expenses - all allowable Note 4. Gain on Sale of Assets Disposal Proceeds Asset Cost 48,750 1 163,220 2 64,136 3 4 3. Property Income Rent received for 12 months to 30 September 2020 Rent received for 12 months to 30 September 2021 Insurance Premium for year to 30 September 2020 Insurance Premium for year to 30 September 2021 Repairs following flooding on 10 January 2021 347,850 276,106 71,744 13,680 26,300 111,724 96,484 23,770 12,966 30,000 163,220 4,659 9,424 7,003 1,471 41,579 64,136 18,000 19,200 600 720 4,800 46,300 20,000 26,300 The indexation allowance is 3,600. Capital allowances for the year have been calculated as 12,240. Required: Calculate the Corporation Tax payable for the year to 31 March 2021 and state the date by which payment must be made.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the Corporation Tax payable for Vital Spark Ltd for the year ended 31 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started