Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a Treasurer in the US and you have the following situation: 1) Your New Zealand subsidiary has surplus funds in the amount

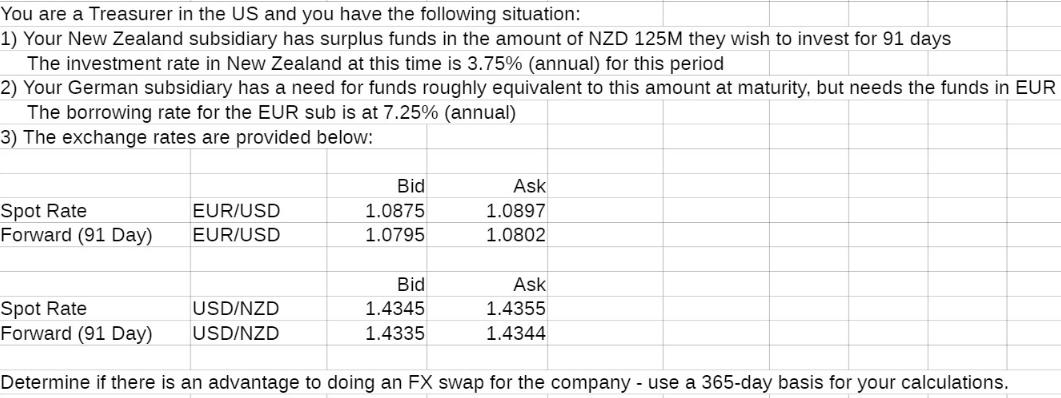

You are a Treasurer in the US and you have the following situation: 1) Your New Zealand subsidiary has surplus funds in the amount of NZD 125M they wish to invest for 91 days The investment rate in New Zealand at this time is 3.75% (annual) for this period 2) Your German subsidiary has a need for funds roughly equivalent to this amount at maturity, but needs the funds in EUR The borrowing rate for the EUR sub is at 7.25% (annual) 3) The exchange rates are provided below: Spot Rate Forward (91 Day) EUR/USD EUR/USD Bid 1.0875 1.0795 Bid 1.4345 1.4335 Ask 1.0897 1.0802 Ask 1.4355 1.4344 Spot Rate USD/NZD Forward (91 Day) USD/NZD Determine if there is an advantage to doing an FX swap for the company - use a 365-day basis for your calculations.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine if there is an advantage to doing an FX swap for the company we need to compare the return on investing in New Zealand with the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started