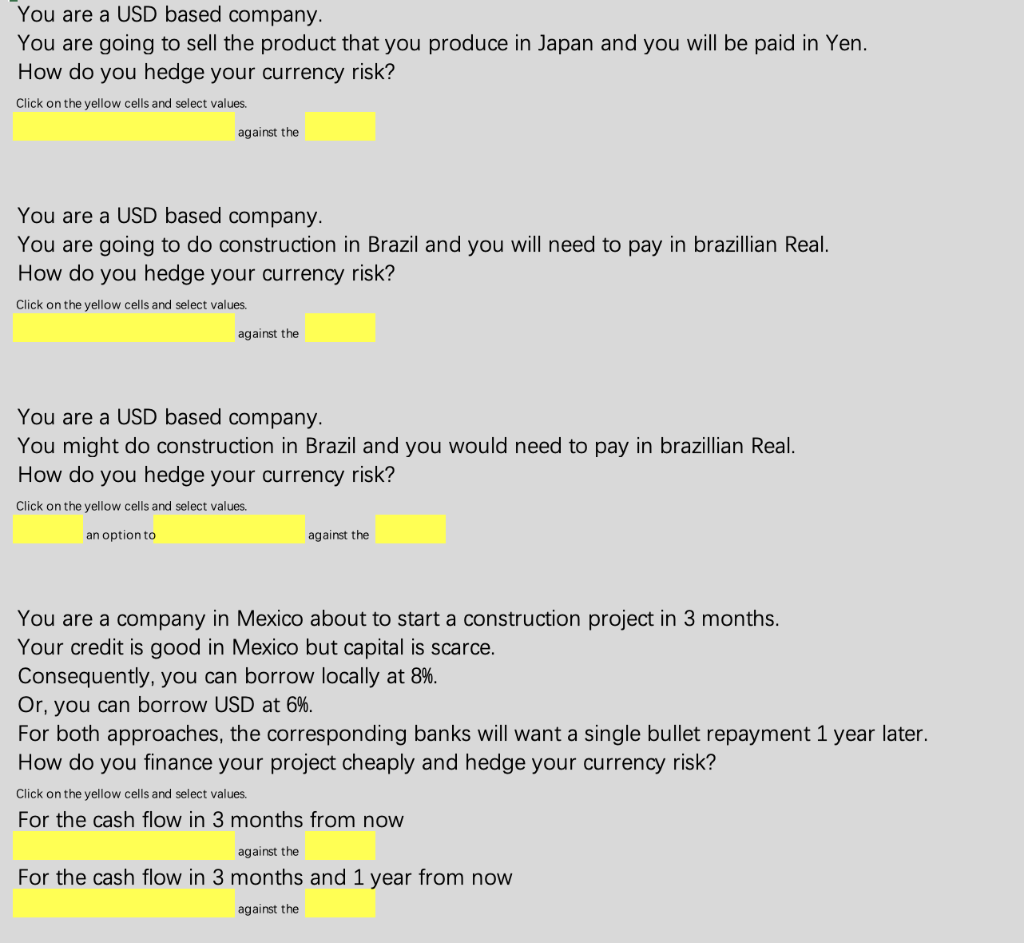

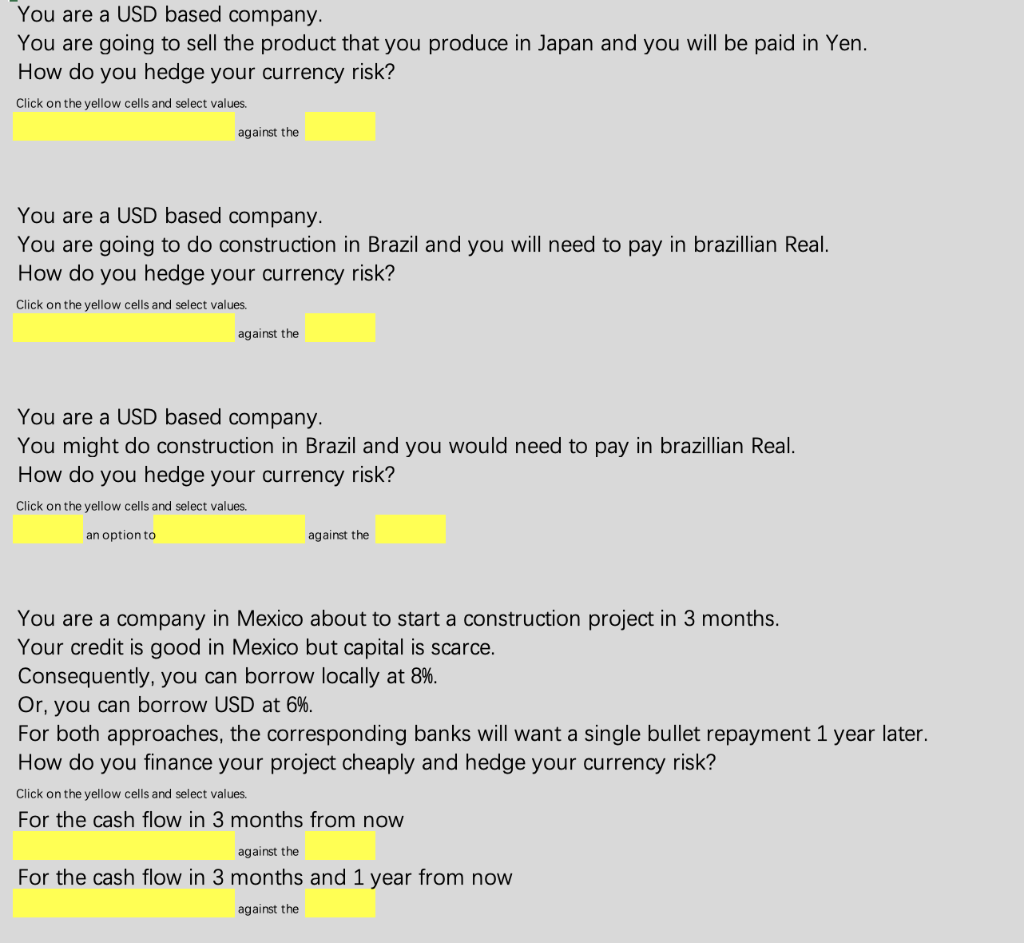

You are a USD based company. You are going to sell the product that you produce in Japan and you will be paid in Yen. How do you hedge your currency risk? Click on the yellow cells and select values. against the You are a USD based company. You are going to do construction in Brazil and you will need to pay in brazillian Real. How do you hedge your currency risk? Click on the yellow cells and select values. against the You are a USD based company. You might do construction in Brazil and you would need to pay in brazillian Real. How do you hedge your currency risk? Click on the yellow cells and select values. an option to against the You are a company in Mexico about to start a construction project in 3 months. Your credit is good in Mexico but capital is scarce. Consequently, you can borrow locally at 8%. Or, you can borrow USD at 6%. For both approaches, the corresponding banks will want a single bullet repayment 1 year later. How do you finance your project cheaply and hedge your currency risk? Click on the yellow cells and select values. For the cash flow in 3 months from now against the For the cash flow in 3 months and 1 year from now against the You are a USD based company. You are going to sell the product that you produce in Japan and you will be paid in Yen. How do you hedge your currency risk? Click on the yellow cells and select values. against the You are a USD based company. You are going to do construction in Brazil and you will need to pay in brazillian Real. How do you hedge your currency risk? Click on the yellow cells and select values. against the You are a USD based company. You might do construction in Brazil and you would need to pay in brazillian Real. How do you hedge your currency risk? Click on the yellow cells and select values. an option to against the You are a company in Mexico about to start a construction project in 3 months. Your credit is good in Mexico but capital is scarce. Consequently, you can borrow locally at 8%. Or, you can borrow USD at 6%. For both approaches, the corresponding banks will want a single bullet repayment 1 year later. How do you finance your project cheaply and hedge your currency risk? Click on the yellow cells and select values. For the cash flow in 3 months from now against the For the cash flow in 3 months and 1 year from now against the