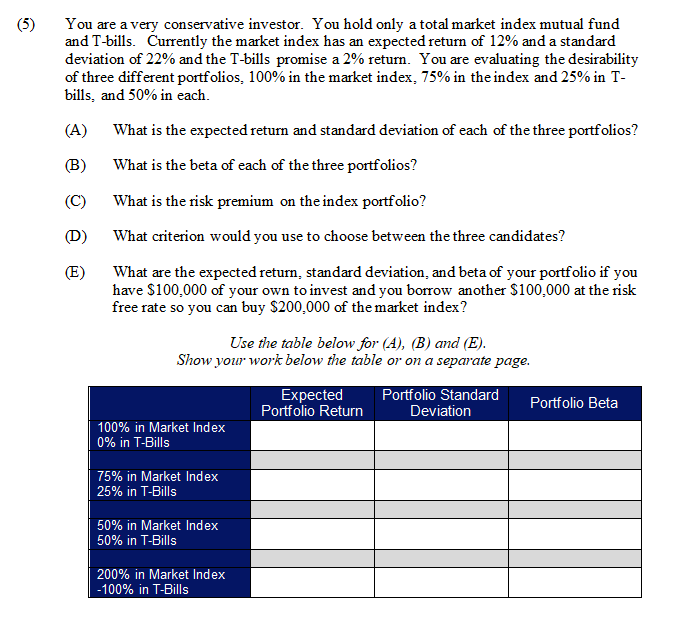

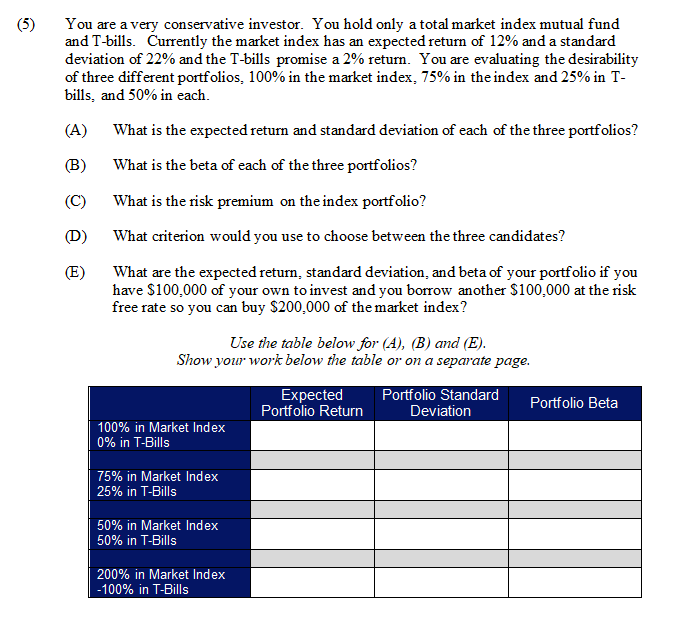

You are a very conservative investor. You hold only a total market index mutual fund and T-bills. Currently the market index has an expected return of 12% and a standard deviation of 22% and the T-bills promise a 2% return. You are evaluating the desirability of three different portfolios. 100% in the market index, 75% in the index and 25% in T- bills, and 50% in each. (A) What is the expected return and standard deviation of each of the three portfolios? B) What is the beta of each of the three portfolios? (C) What is the risk premium on the index portfolio? (D) What criterion would you use to choose between the three candidates? (E) What are the expected return, standard deviation, and beta of your portfolio if you have $100,000 of your own to invest and you borrow another $100.000 at the risk free rate so you can buy $200,000 of the market index? Use the table below for (A), (B) and (E). Show your work below the table or on a separate page. Expected Portfolio Standard Portfolio Return Deviation Portfolio Beta 100% in Market Index 0% in T-Bills 75% in Market Index 25% in T-Bills 50% in Market Index 50% in T-Bills 200% in Market Index -100% in T-Bills You are a very conservative investor. You hold only a total market index mutual fund and T-bills. Currently the market index has an expected return of 12% and a standard deviation of 22% and the T-bills promise a 2% return. You are evaluating the desirability of three different portfolios. 100% in the market index, 75% in the index and 25% in T- bills, and 50% in each. (A) What is the expected return and standard deviation of each of the three portfolios? B) What is the beta of each of the three portfolios? (C) What is the risk premium on the index portfolio? (D) What criterion would you use to choose between the three candidates? (E) What are the expected return, standard deviation, and beta of your portfolio if you have $100,000 of your own to invest and you borrow another $100.000 at the risk free rate so you can buy $200,000 of the market index? Use the table below for (A), (B) and (E). Show your work below the table or on a separate page. Expected Portfolio Standard Portfolio Return Deviation Portfolio Beta 100% in Market Index 0% in T-Bills 75% in Market Index 25% in T-Bills 50% in Market Index 50% in T-Bills 200% in Market Index -100% in T-Bills