Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a young entrepreneur who has recently been granted a startup fund to establish your company that will provide engineering products and services. To

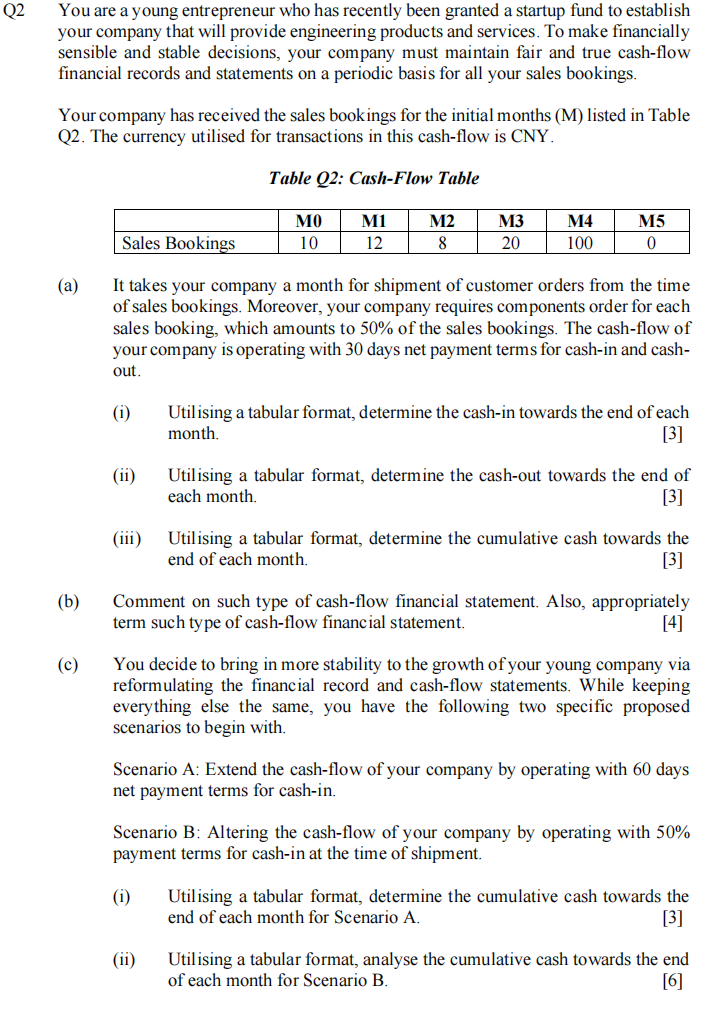

You are a young entrepreneur who has recently been granted a startup fund to establish your company that will provide engineering products and services. To make financially sensible and stable decisions, your company must maintain fair and true cash-flow financial records and statements on a periodic basis for all your sales bookings. Your company has received the sales bookings for the initial months (M) listed in Table Q2. The currency utilised for transactions in this cash-flow is CNY. Table Q2: Cash-Flow Table (a) It takes your company a month for shipment of customer orders from the time of sales bookings. Moreover, your company requires components order for each sales booking, which amounts to 50% of the sales bookings. The cash-flow of your company is operating with 30 days net payment terms for cash-in and cashout. (i) Util ising a tabular format, determine the cash-in towards the end of each month. [3] (ii) Utilising a tabular format, determine the cash-out towards the end of each month. [3] (iii) Utilising a tabular format, determine the cumulative cash towards the end of each month. [3] (b) Comment on such type of cash-flow financial statement. Also, appropriately term such type of cash-flow financial statement. [4] (c) You decide to bring in more stability to the growth of your young company via reformulating the financial record and cash-flow statements. While keeping everything else the same, you have the following two specific proposed scenarios to begin with. Scenario A: Extend the cash-flow of your company by operating with 60 days net payment terms for cash-in. Scenario B: Altering the cash-flow of your company by operating with 50% payment terms for cash-in at the time of shipment. (i) Utilising a tabular format, determine the cumulative cash towards the end of each month for Scenario A. [3] (ii) Utilising a tabular format, analyse the cumulative cash towards the end of each month for Scenario B. [6] d) Critically contrast between both these proposed scenarios along with the original scenario analysed in Q2.(a) above while demonstrating your company's preferred way to move forward. [3]

You are a young entrepreneur who has recently been granted a startup fund to establish your company that will provide engineering products and services. To make financially sensible and stable decisions, your company must maintain fair and true cash-flow financial records and statements on a periodic basis for all your sales bookings. Your company has received the sales bookings for the initial months (M) listed in Table Q2. The currency utilised for transactions in this cash-flow is CNY. Table Q2: Cash-Flow Table (a) It takes your company a month for shipment of customer orders from the time of sales bookings. Moreover, your company requires components order for each sales booking, which amounts to 50% of the sales bookings. The cash-flow of your company is operating with 30 days net payment terms for cash-in and cashout. (i) Util ising a tabular format, determine the cash-in towards the end of each month. [3] (ii) Utilising a tabular format, determine the cash-out towards the end of each month. [3] (iii) Utilising a tabular format, determine the cumulative cash towards the end of each month. [3] (b) Comment on such type of cash-flow financial statement. Also, appropriately term such type of cash-flow financial statement. [4] (c) You decide to bring in more stability to the growth of your young company via reformulating the financial record and cash-flow statements. While keeping everything else the same, you have the following two specific proposed scenarios to begin with. Scenario A: Extend the cash-flow of your company by operating with 60 days net payment terms for cash-in. Scenario B: Altering the cash-flow of your company by operating with 50% payment terms for cash-in at the time of shipment. (i) Utilising a tabular format, determine the cumulative cash towards the end of each month for Scenario A. [3] (ii) Utilising a tabular format, analyse the cumulative cash towards the end of each month for Scenario B. [6] d) Critically contrast between both these proposed scenarios along with the original scenario analysed in Q2.(a) above while demonstrating your company's preferred way to move forward. [3] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started