Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are about to retire, and you have $350,000 saved. You expect to live 10 years, and inflation is expected to be 2.5%. If

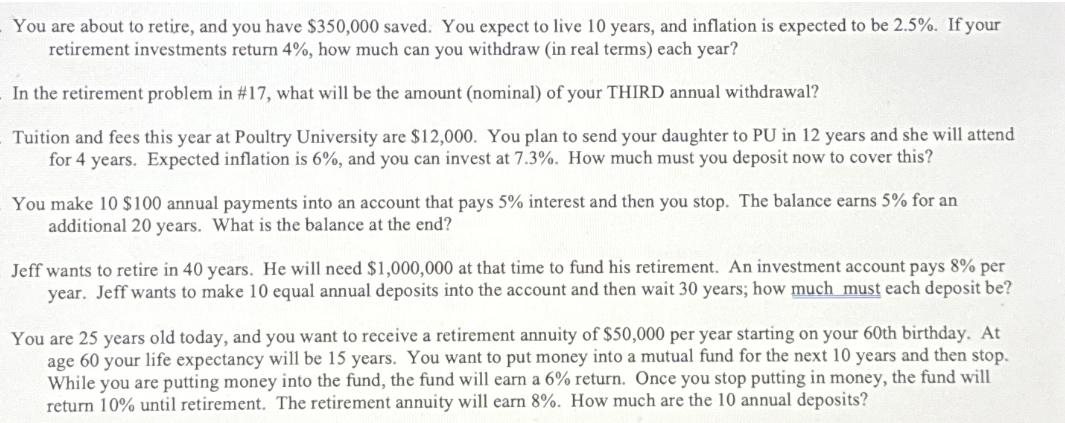

You are about to retire, and you have $350,000 saved. You expect to live 10 years, and inflation is expected to be 2.5%. If your retirement investments return 4%, how much can you withdraw (in real terms) each year? In the retirement problem in #17, what will be the amount (nominal) of your THIRD annual withdrawal? Tuition and fees this year at Poultry University are $12,000. You plan to send your daughter to PU in 12 years and she will attend for 4 years. Expected inflation is 6%, and you can invest at 7.3%. How much must you deposit now to cover this? You make 10 $100 annual payments into an account that pays 5% interest and then you stop. The balance earns 5% for an additional 20 years. What is the balance at the end? Jeff wants to retire in 40 years. He will need $1,000,000 at that time to fund his retirement. An investment account pays 8% per year. Jeff wants to make 10 equal annual deposits into the account and then wait 30 years; how much must each deposit be? You are 25 years old today, and you want to receive a retirement annuity of $50,000 per year starting on your 60th birthday. At age 60 your life expectancy will be 15 years. You want to put money into a mutual fund for the next 10 years and then stop. While you are putting money into the fund, the fund will earn a 6% return. Once you stop putting in money, the fund will return 10% until retirement. The retirement annuity will earn 8%. How much are the 10 annual deposits?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you analyze the retirement problem and find the amount you can withdraw each year Given You are about to retire You have 350000 saved You expect to live 10 years Inflation is expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started