Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an accountant at Rein LLC, a private environmental service company. Your primary task is simplifying the accounting function within company operations to

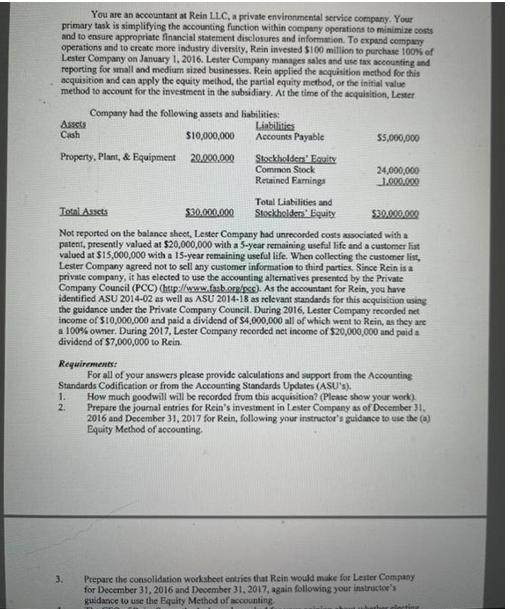

You are an accountant at Rein LLC, a private environmental service company. Your primary task is simplifying the accounting function within company operations to minimize costs and to ensure appropriate financial statement disclosures and information. To expand company operations and to create more industry diversity, Rein invested $100 million to purchase 100% of Lester Company on January 1, 2016. Lester Company manages sales and use tax accounting and reporting for small and medium sized businesses. Rein applied the acquisition method for this acquisition and can apply the equity method, the partial equity method, or the initial value method to account for the investment in the subsidiary. At the time of the acquisition, Lester Company had the following assets and liabilities: Liabilities $10,000,000 Accounts Payable Property, Plant, & Equipment 20,000,000 Assets Cash Stockholders Equity Common Stock Retained Earnings 1. 2. Total Liabilities and Stockholders Equity 3. $5,000,000 Total Assets $30,000,000 $30.000.000 Not reported on the balance sheet, Lester Company had unrecorded costs associated with a patent, presently valued at $20,000,000 with a 5-year remaining useful life and a customer list valued at $15,000,000 with a 15-year remaining useful life. When collecting the customer list, Lester Company agreed not to sell any customer information to third parties. Since Rein is a private company, it has elected to use the accounting alternatives presented by the Private Company Council (PCC) (http://www.fasb.org/pcs). As the accountant for Rein, you have identified ASU 2014-02 as well as ASU 2014-18 as relevant standards for this acquisition using the guidance under the Private Company Council. During 2016, Lester Company recorded net income of $10,000,000 and paid a dividend of $4,000,000 all of which went to Rein, as they are a 100% owner. During 2017, Lester Company recorded net income of $20,000,000 and paid a dividend of $7,000,000 to Rein 24,000,000 1.000.000 Requirements: For all of your answers please provide calculations and support from the Accounting Standards Codification or from the Accounting Standards Updates (ASU's). How much goodwill will be recorded from this acquisition? (Please show your work) Prepare the journal entries for Rein's investment in Lester Company as of December 31, 2016 and December 31, 2017 for Rein, following your instructor's guidance to use the (a) Equity Method of accounting. Prepare the consolidation worksheet entries that Rein would make for Lester Company for December 31, 2016 and December 31, 2017, again following your instructor's guidance to use the Equity Method of accounting barelecting

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets go through each requirement step by step 1 Calculation of Goodwill Goo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started