Answered step by step

Verified Expert Solution

Question

1 Approved Answer

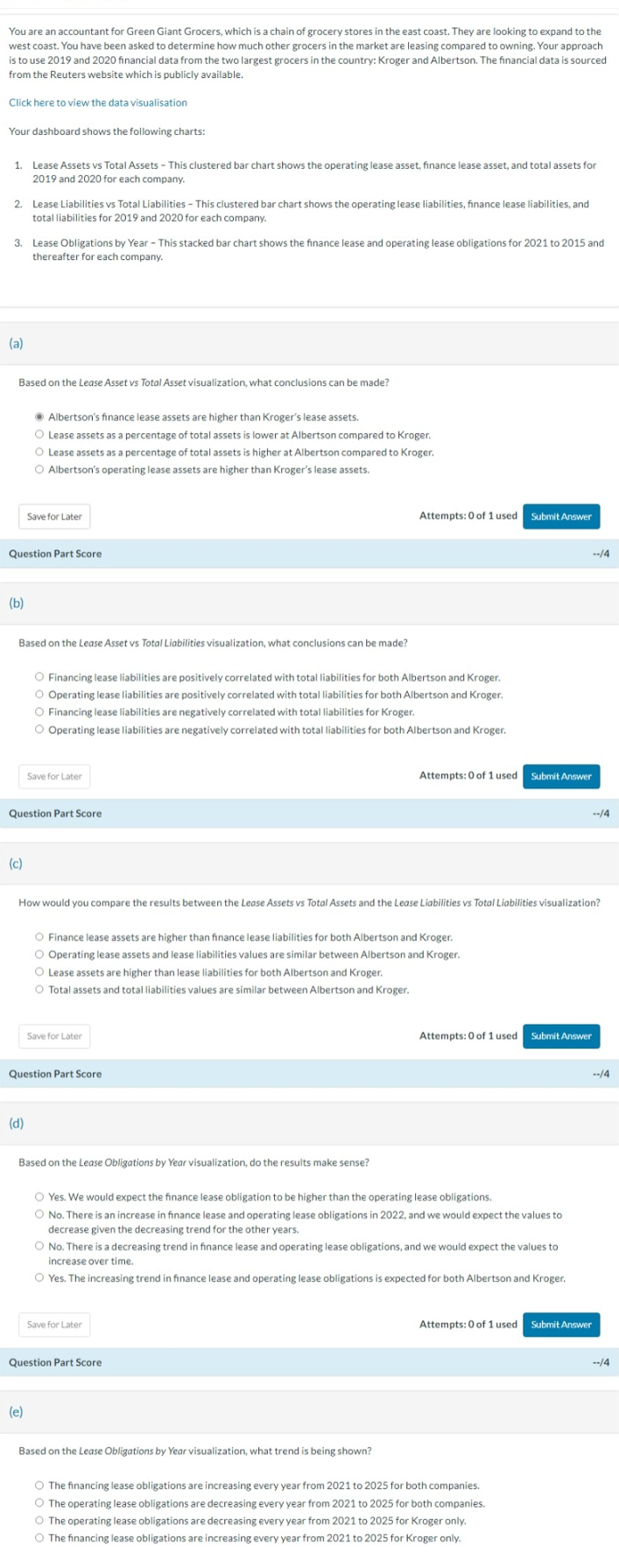

You are an accountant for Green Giant Grocers, which is a chain of grocery stores in the east coast. They are looking to expand to

You are an accountant for Green Giant Grocers, which is a chain of grocery stores in the east coast. They are looking to expand to the

west coast. You have been asked to determine how much other grocers in the market are leasing compared to owning. Your approach

is to use and financial data from the two largest grocers in the country: Kroger and Albertson. The financial data is sourced

from the Reuters website which is publicly available.

Click here to view the data visualisation

Your dashboard shows the following charts:

Lease Assets vs Total Assets This clustered bar chart shows the operating lease asset, finance lease asset, and total assets for

and for each company

Lease Liabilities vs Total Liabilities This clustered bar chart shows the operating lease liabilities, finance lease liabilities, and

total liabilities for and for each company

Lease Obligations by Year This stacked bar chart shows the finance lease and operating lease obligations for to and

thereafter for each company.

a

Based on the Lease Asset vs Total Asset visualization, what conclusions can be made?

Albertson's finance lease assets are higher than Kroger's lease assets.

Lease assets as a percentage of total assets is lower at Albertson compared to Kroger.

Lease assets as a percentage of total assets is higher at Albertson compared to Kroger

Albertson's operating lease assets are higher than Kroger's lease assets.

Attempts: of used

b

Based on the Lease Asset vs Total Liabilities visualization, what conclusions can be made?

Financing lease liabilities are positively correlated with total liabilities for both Albertson and Kroger.

Operating lease liabilities are positively correlated with total liabilities for both Albertson and Kroger

Financing lease liabilities are negatively correlated with total liabilities for Kroger

Operating lease liabilities are negatively correlated with total liabilities for both Albertson and Kroger.

Attempts: of used

c

How would you compare the results between the Lease Assets vs Total Assets and the Lease Liabilities vs Total Liabilities visualization?

Finance lease assets are higher than finance lease liabilities for both Albertson and Kroger.

Operating lease assets and lease liabilities values are similar between Albertson and Kroger.

Lease assets are higher than lease liabilities for both Albertson and Kroger.

Total assets and total lliabilities values are similar between Albertson and Kroger.

d

Based on the Lease Obligations by Year visualization, do the results make sense?

Yes. We would expect the finance lease obligation to be higher than the operating lease obligations.

No There is an increase in finance lease and operating lease obligations in and we would expect the values to

decrease given the decreasing trend for the other years.

No There is a decreasing trend in finance lease and operating lease obligations, and we would expect the values to

increase over time.

Yes. The increasing trend in finance lease and operating lease obligations is expected for both Albertson and Kroger.

e

Based on the Lease Obligations by Year visualization, what trend is being shown?

The financing lease obligations are increasing every year from to for both companies.

The operating lease obligations are decreasing every year from to for both companies.

The operating lease obligations are decreasing every year from to for Kroger only.

The financing lease obligations are increasing every year from to for Kroger only.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started