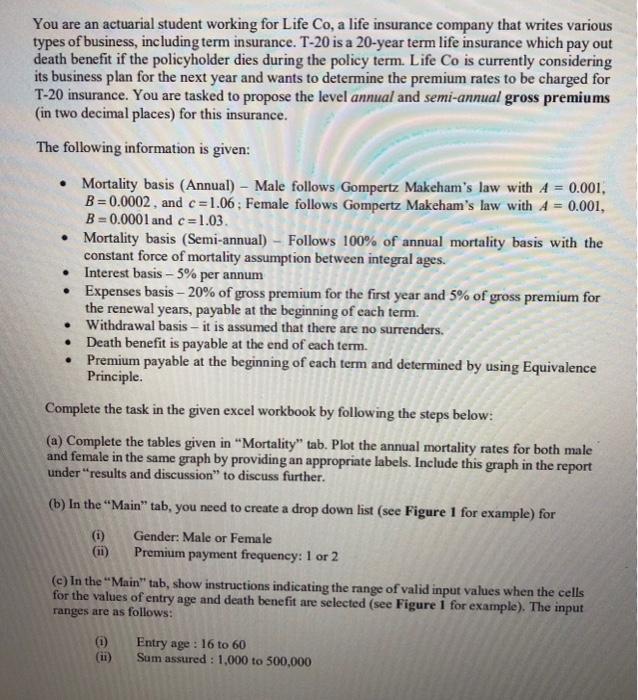

You are an actuarial student working for Life Co, a life insurance company that writes various types of business, including term insurance. T-20 is a 20-year term life insurance which pay out death benefit if the policyholder dies during the policy term. Life Co is currently considering its business plan for the next year and wants to determine the premium rates to be charged for T-20 insurance. You are tasked to propose the level annual and semi-annual gross premiums (in two decimal places) for this insurance. The following information is given: . Mortality basis (Annual) - Male follows Gompertz Makeham's law with A = 0.001, B = 0.0002, and c=1.06 : Female follows Gompertz Makeham's law with A = 0.001, B = 0.0001 and c=1.03. Mortality basis (Semi-annual) - Follows 100% of annual mortality basis with the constant force of mortality assumption between integral ages. Interest basis - 5% per annum Expenses basis 20% of gross premium for the first year and 5% of gross premium for the renewal years, payable at the beginning of each term. Withdrawal basis - it is assumed that there are no surrenders. Death benefit is payable at the end of each term. Premium payable at the beginning of each term and determined by using Equivalence Principle. Complete the task in the given excel workbook by following the steps below: (a) Complete the tables given in "Mortality" tab. Plot the annual mortality rates for both male and female in the same graph by providing an appropriate labels. Include this graph in the report under "results and discussion" to discuss further. (b) In the "Main" tab, you need to create a drop down list (see Figure 1 for example) for (i) (11) Gender: Male or Female Premium payment frequency: 1 or 2 (c) In the "Main" tab, show instructions indicating the range of valid input values when the cells for the values of entry age and death benefit are selected (see Figure 1 for example). The input ranges are as follows: (ii) Entry age : 16 to 60 Sum assured : 1,000 to 500,000 You are an actuarial student working for Life Co, a life insurance company that writes various types of business, including term insurance. T-20 is a 20-year term life insurance which pay out death benefit if the policyholder dies during the policy term. Life Co is currently considering its business plan for the next year and wants to determine the premium rates to be charged for T-20 insurance. You are tasked to propose the level annual and semi-annual gross premiums (in two decimal places) for this insurance. The following information is given: . Mortality basis (Annual) - Male follows Gompertz Makeham's law with A = 0.001, B = 0.0002, and c=1.06 : Female follows Gompertz Makeham's law with A = 0.001, B = 0.0001 and c=1.03. Mortality basis (Semi-annual) - Follows 100% of annual mortality basis with the constant force of mortality assumption between integral ages. Interest basis - 5% per annum Expenses basis 20% of gross premium for the first year and 5% of gross premium for the renewal years, payable at the beginning of each term. Withdrawal basis - it is assumed that there are no surrenders. Death benefit is payable at the end of each term. Premium payable at the beginning of each term and determined by using Equivalence Principle. Complete the task in the given excel workbook by following the steps below: (a) Complete the tables given in "Mortality" tab. Plot the annual mortality rates for both male and female in the same graph by providing an appropriate labels. Include this graph in the report under "results and discussion" to discuss further. (b) In the "Main" tab, you need to create a drop down list (see Figure 1 for example) for (i) (11) Gender: Male or Female Premium payment frequency: 1 or 2 (c) In the "Main" tab, show instructions indicating the range of valid input values when the cells for the values of entry age and death benefit are selected (see Figure 1 for example). The input ranges are as follows: (ii) Entry age : 16 to 60 Sum assured : 1,000 to 500,000