Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an actuary at a medium-sized general insurance company. One of the business units writes two annually renewable binding authorities, whereby underwriting authority

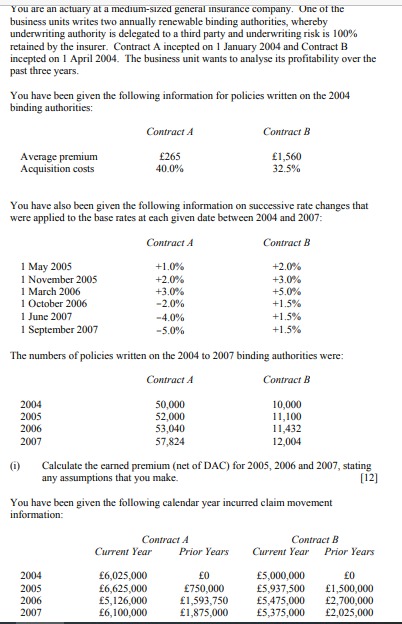

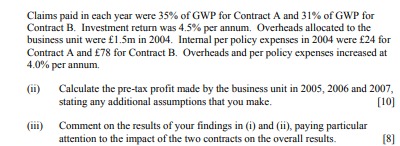

You are an actuary at a medium-sized general insurance company. One of the business units writes two annually renewable binding authorities, whereby underwriting authority is delegated to a third party and underwriting risk is 100% retained by the insurer. Contract A incepted on 1 January 2004 and Contract B incepted on 1 April 2004. The business unit wants to analyse its profitability over the past three years. You have been given the following information for policies written on the 2004 binding authorities: Average premium Acquisition costs 1 May 2005 1 November 2005 (1) 1 March 2006 1 October 2006 You have also been given the following information on successive rate changes that were applied to the base rates at each given date between 2004 and 2007: Contract A Contract B 1 June 2007 1 September 2007 Contract A 2004 2005 2006 2007 265 40.0% 2004 2005 2006 2007 +1.0% +2.0% +3.0% -2.0% -4.0% -5.0% The numbers of policies written on the 2004 to 2007 binding authorities were: Contract A Contract B Current Year 6,025,000 6,625,000 5,126,000 6,100,000 50,000 52,000 53,040 57,824 Contract B Contract A 1,560 32.5% Calculate the earned premium (net of DAC) for 2005, 2006 and 2007, stating any assumptions that you make. [12] You have been given the following calendar year incurred claim movement information: Prior Years +2.0% +3.0% +5.0% +1.5% +1.5% +1.5% 0 750,000 1,593,750 1,875,000 10,000 11,100 11,432 12,004 Contract B Current Year 5,000,000 5,937,500 5,475,000 5,375,000 Prior Years 0 1,500,000 2,700,000 2,025,000 Claims paid in each year were 35% of GWP for Contract A and 31% of GWP for Contract B. Investment return was 4.5% per annum. Overheads allocated to the business unit were 1.5m in 2004. Internal per policy expenses in 2004 were 24 for Contract A and 78 for Contract B. Overheads and per policy expenses increased at 4.0% per annum. (11) @ Calculate the pre-tax profit made by the business unit in 2005, 2006 and 2007, stating any additional assumptions that you make. [10] Comment on the results of your findings in (i) and (ii), paying particular attention to the impact of the two contracts on the overall results. [8]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The earned premium net of DAC for each contract and year is shown in th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started