Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an airline analyst and are evaluating the shares of Freedom Airways Ltd. It paid a dividend per share of $2 per share

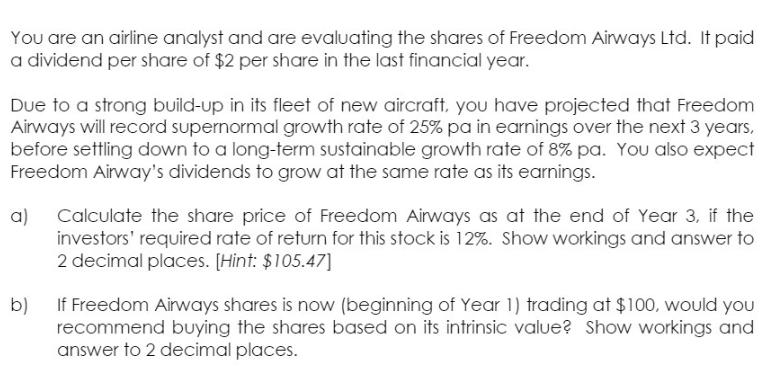

You are an airline analyst and are evaluating the shares of Freedom Airways Ltd. It paid a dividend per share of $2 per share in the last financial year. Due to a strong build-up in its fleet of new aircraft, you have projected that Freedom Airways will record supernormal growth rate of 25% pa in earnings over the next 3 years, before settling down to a long-term sustainable growth rate of 8% pa. You also expect Freedom Airway's dividends to grow at the same rate as its earnings. a) Calculate the share price of Freedom Airways as at the end of Year 3, if the investors' required rate of return for this stock is 12%. Show workings and answer to 2 decimal places. [Hint: $105.47] b) If Freedom Airways shares is now (beginning of Year 1) trading at $100, would you recommend buying the shares based on its intrinsic value? Show workings and answer to 2 decimal places.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the share price of Freedom Airways at the end of Year 3 we need to calculate the expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started