You are an analyst at an asset management fund. The fund currently has five bonds in its portfolio with the attributes shown below. The funds

You are an analyst at an asset management fund. The fund currently has five bonds in its portfolio with the attributes shown below.

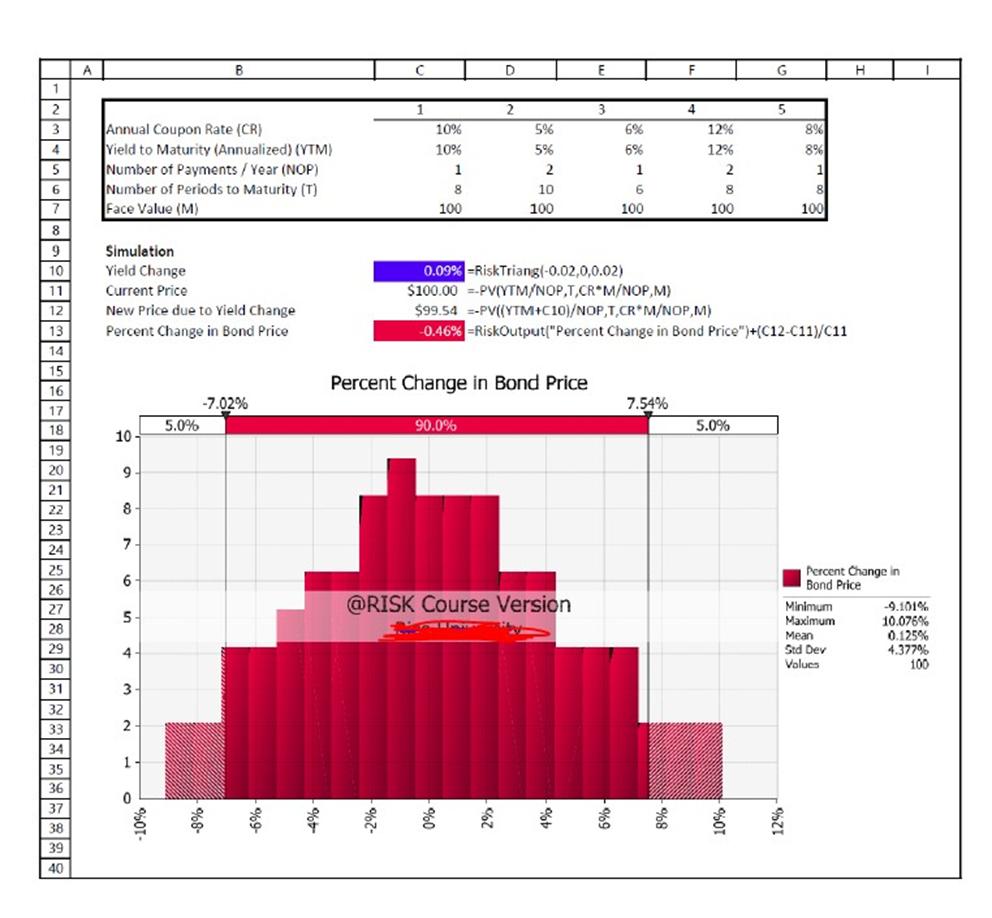

The fund’s founder believes that it is most likely that bond yields stay the same, but that it is possible (but very unlikely) that the yields for all of the bonds could drop as much as 200 basis points or rise by as much as 200 basis points. Your colleague has been working on a Monte Carlo analysis of the price risk faced by these potential interest rate moves. Their simulation model and output are on the following page. The simulated data can be found in the Q3 Data tab of the spreadsheet. Unfortunately, they only sent you a screenshot of the model and the data, so you cannot immediately tell which bond they were analyzing (since they named the input cells and all the bonds are currently trading at par).

Annual Coupon Rate (CR) | 1 | 2 | 3 | 4 | 5 |

10% | 5% | 6% | 12% | 8% | |

Yield to Maturity (Annualized) (YTM) | 10% | 5% | 6% | 12% | 8% |

Number of Payments / Year (NOP) | 1 | 2 | 1 | 2 | 1 |

Number of Periods to Maturity (T) | 8 | 10 | 6 | 8 | 8 |

Face Value (M) | 100 | 100 | 100 | 100 | 100 |

A B D G H 1 2. 4 Annual Coupon Rate (CR) Yield to Maturity (Annualized) (VTM) Number of Payments/ Year (NOP) Number of Periods to Maturity (T) Face Value (M) 3 10% 5% 6% 12% 8% 4 10% 5% 6% 12% 8% 1 2 1 2 8 10 6. 100 100 100 100 100 Simulation 0.09% -RiskTriang(-0.02,0,0.02) $100.00 =-PV(YTM/NOP,T,CR M/NOP,M) $99.54 =-PV((YTM+C10)/NOP,T,CR*M/NOP,M) -0.46% =RiskOutput("Percent Change in Bond Price")+(C12-C11)/C11 10 Yield Change 11 Current Price 12 New Price due to Yield Change 13 Percent Change in Bond Price 14 15 Percent Change in Bond Price 16 -7.02% 7.54% 17 18 5.0% 90.0% 5.0% 10 19 20 9 - 21 22 8- 23 7. 24 25 6- Percent Change in Bond Price 26 @RISK Course Version Minimum Maximum -9.101% 10.076% 0.125% 4.377% 100 27 5- 28 ean 29 Std Dev Volues 4 30 31 3 32 33 34 1- 35 36 37 38 39 40 10%- -%8 %9 %8-

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

RISK Data Name Percent Change in Bond Price Yield Change Description Output RiskTriang0020002 Iteration Cell C13 C10 1 401 077 2 024 004 3 515 100 4 0...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

61b9a6c4bfb7b_890392.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started