Question

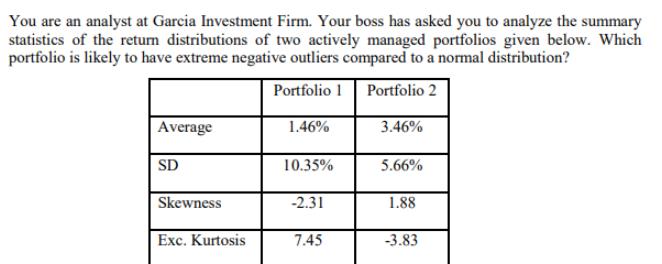

You are an analyst at Garcia Investment Firm. Your boss has asked you to analyze the summary statistics of the return distributions of two

You are an analyst at Garcia Investment Firm. Your boss has asked you to analyze the summary statistics of the return distributions of two actively managed portfolios given below. Which portfolio is likely to have extreme negative outliers compared to a normal distribution? Portfolio 1 Portfolio 2 Average SD Skewness Exc. Kurtosis 1.46% 10.35% -2.31 7.45 3.46% 5.66% 1.88 -3.83

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine which portfolio is likely to have extreme negative outliers compared to a normal distri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Statement Analysis

Authors: K. R. Subramanyam, John Wild

11th edition

78110963, 978-0078110962

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App