Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an analyst for a small commercial bank. The bank has an investment portfolio of US bonds and stocks with a market value of

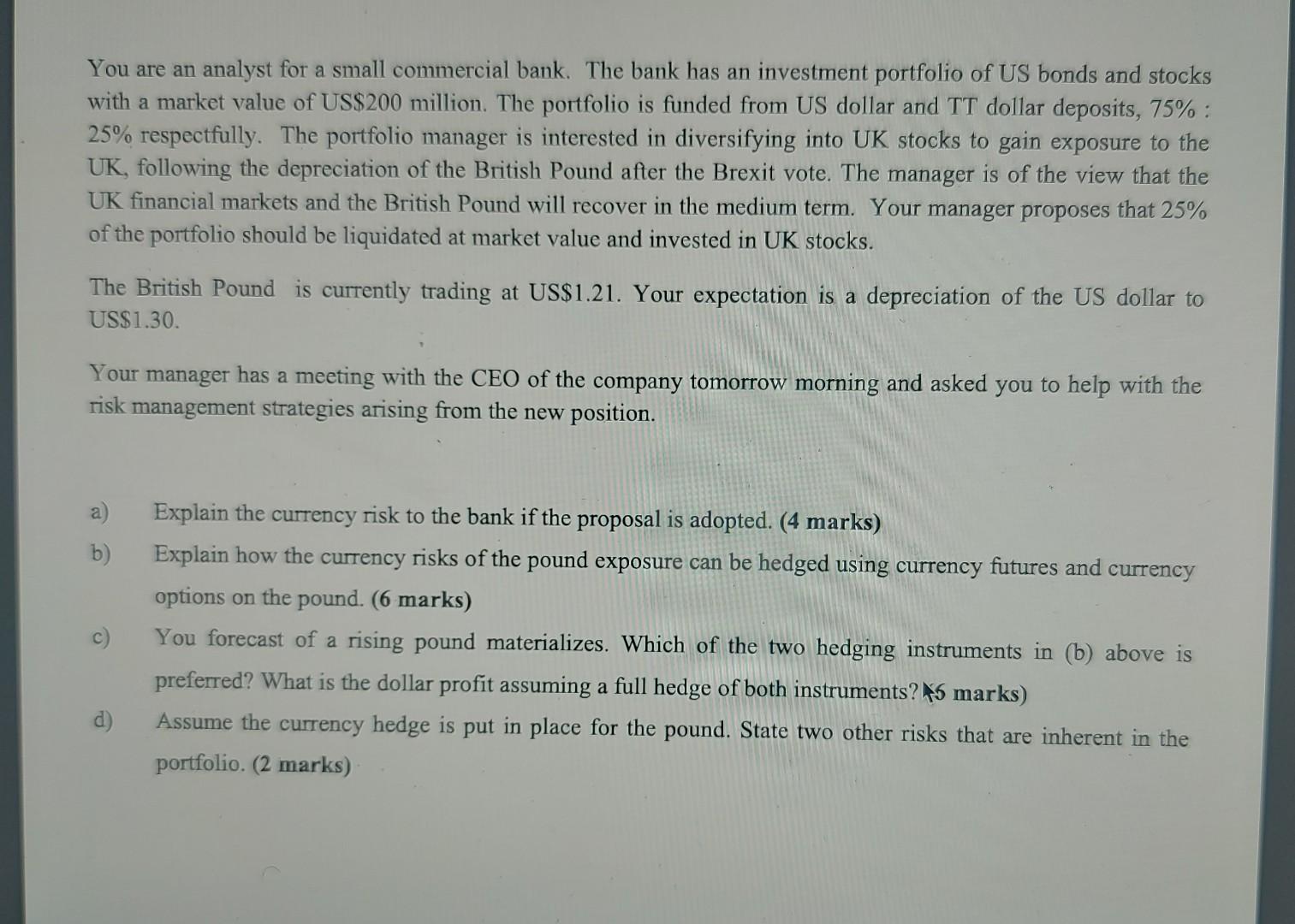

You are an analyst for a small commercial bank. The bank has an investment portfolio of US bonds and stocks with a market value of US $200 million. The portfolio is funded from US dollar and TT dollar deposits, 75\% : 25% respectfully. The portfolio manager is interested in diversifying into UK stocks to gain exposure to the UK, following the depreciation of the British Pound after the Brexit vote. The manager is of the view that the UK financial markets and the British Pound will recover in the medium term. Your manager proposes that 25% of the portfolio should be liquidated at market value and invested in UK stocks. The British Pound is currently trading at US\$1.21. Your expectation is a depreciation of the US dollar to USS1.30 Your manager has a meeting with the CEO of the company tomorrow morning and asked you to help with the risk management strategies arising from the new position. a) Explain the currency risk to the bank if the proposal is adopted. (4 marks) b) Explain how the currency risks of the pound exposure can be hedged using currency futures and currency options on the pound. ( 6 marks) c) You forecast of a rising pound materializes. Which of the two hedging instruments in (b) above is preferred? What is the dollar profit assuming a full hedge of both instruments? $6 marks) d) Assume the currency hedge is put in place for the pound. State two other risks that are inherent in the portfolio. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started