Question

You are an analyst working in a private equity investment company and have been assigned to cover the sustainable food industry for Unity Fund, a

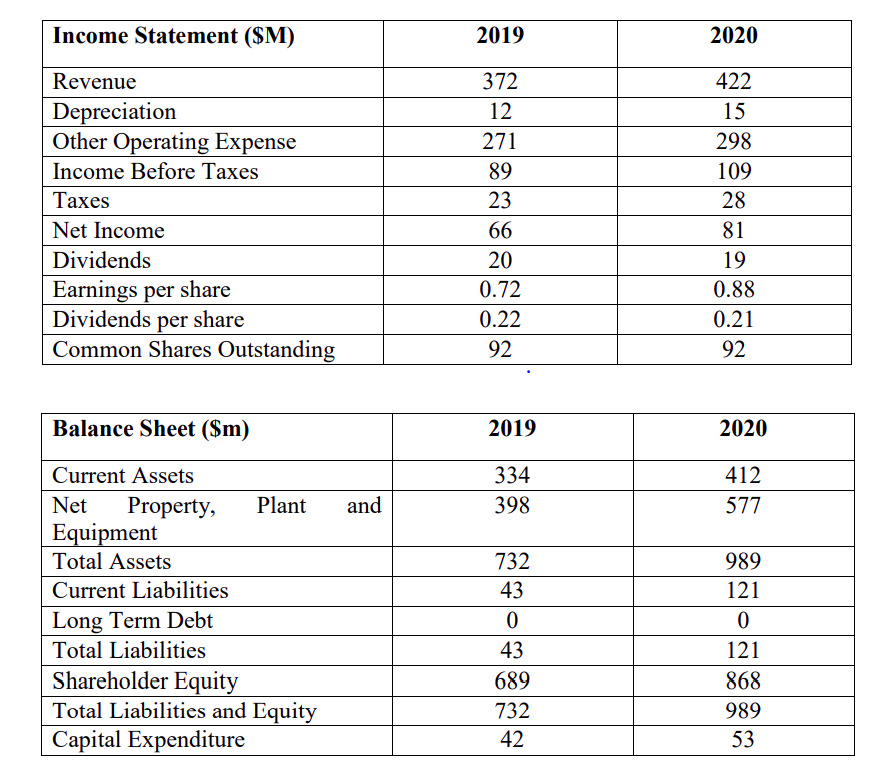

You are an analyst working in a private equity investment company and have been assigned to cover the sustainable food industry for Unity Fund, a private vehicle investment fund. Your fund is considering the privatisation of Oceania Limited, a public listed company on the local stock exchange. This company currently has 92 million outstanding stock available. Company stock is currently trading at $52.20 per share. Oceanias financial extract are as listed below:

Your fund has an observed beta of 1.05 and a debt ratio of 40% with a cost of debt at 6.5%. Typically, your will issue fresh equity to raise capital to acquire new investment targets. Dividends will grow at 20% in the next two years and will grow at a constant rate of 6% per year from Year 3 onwards. It is anticipated that the Depreciation, Earnings, Working Capital and Capital Expenditure will increase proportionately with Free Cash Flow to Equity (FCFE). You have been advised that the FCFE will grow at 20% per year for two years and at 8% per year thereafter. Your research team has identified that the market risk premium is 6% while the risk-free rate is 4.5%. The Industry Beta is observed to be 1.3. You have requested for industry relative ratios for reference and they have provided you with the following: Industry P/E 18 Industry P/S 5 Industry P/BV 4.5 Question 1 You have been asked to recommend a suitable discount rate for the investment financial model. You are asked specifically to review the cost of equity and the weighted average cost of capital.

Question 1(a) Recommend the appropriate choice of discount rate considering only cost of equity and weighted average cost of capital. (9 marks)

(b) Compute the recommended discount rate which you would use to value the company. (6 marks)

Question 2 You are required to assess the growth rate for Oceanic Limited and have been told that the company has gone into a stable growth phase. Appraise the method you will be using and compute the sustainable growth rate. (15 marks)

Please provide a detailed solution thank you!

Income Statement ($M) 2019 2020 Revenue Depreciation Other Operating Expense Income Before Taxes Taxes Net Income Dividends Earnings per share Dividends per share Common Shares Outstanding 372 12 271 89 23 66 20 0.72 0.22 92 422 15 298 109 28 81 19 0.88 0.21 92 Balance Sheet ($m) 2019 2020 412 334 398 and 577 Current Assets Net Property, Plant Equipment Total Assets Current Liabilities Long Term Debt Total Liabilities Shareholder Equity Total Liabilities and Equity Capital Expenditure 732 43 0 43 689 732 42 989 121 0 121 868 989 53 Income Statement ($M) 2019 2020 Revenue Depreciation Other Operating Expense Income Before Taxes Taxes Net Income Dividends Earnings per share Dividends per share Common Shares Outstanding 372 12 271 89 23 66 20 0.72 0.22 92 422 15 298 109 28 81 19 0.88 0.21 92 Balance Sheet ($m) 2019 2020 412 334 398 and 577 Current Assets Net Property, Plant Equipment Total Assets Current Liabilities Long Term Debt Total Liabilities Shareholder Equity Total Liabilities and Equity Capital Expenditure 732 43 0 43 689 732 42 989 121 0 121 868 989 53Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started