Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an audit partner in the major firm of Garcia and Garnett LLP Chartered Accountants that has been appointed to perform the annual

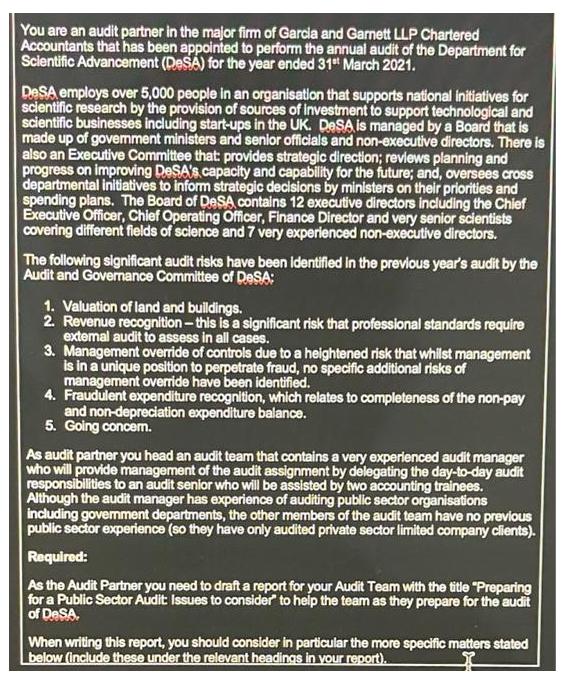

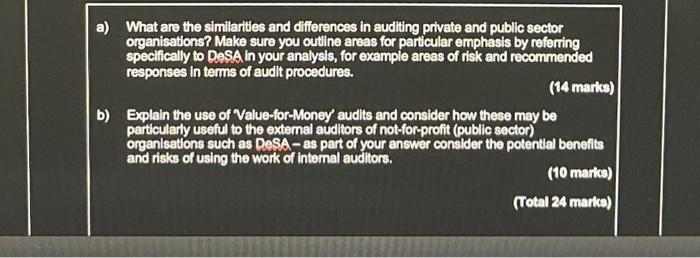

You are an audit partner in the major firm of Garcia and Garnett LLP Chartered Accountants that has been appointed to perform the annual audit of the Department for Scientific Advancement (DeSA) for the year ended 31st March 2021. DeSA employs over 5,000 people in an organisation that supports national initiatives for scientific research by the provision of sources of investment to support technological and scientific businesses including start-ups in the UK. DeSA is managed by a Board that is made up of government ministers and senior officials and non-executive directors. There is also an Executive Committee that: provides strategic direction; reviews planning and progress on improving DeSA's capacity and capability for the future; and, oversees cross departmental initiatives to inform strategic decisions by ministers on their priorities and spending plans. The Board of DeSA contains 12 executive directors including the Chief Executive Officer, Chief Operating Officer, Finance Director and very senior scientists covering different fields of science and 7 very experienced non-executive directors. The following significant audit risks have been identified in the previous year's audit by the Audit and Governance Committee of DeSA: 1. Valuation of land and buildings. 2. Revenue recognition - this is a significant risk that professional standards require extemal audit to assess in all cases. 3. Management override of controls due to a heightened risk that whilst management is in a unique position to perpetrate fraud, no specific additional risks of management override have been identified. 4. Fraudulent expenditure recognition, which relates to completeness of the non-pay and non-depreciation expenditure balance. 5. Going concern. As audit partner you head an audit team that contains a very experienced audit manager who will provide management of the audit assignment by delegating the day-to-day audit responsibilities to an audit senior who will be assisted by two accounting trainees. Although the audit manager has experience of auditing public sector organisations including government departments, the other members of the audit team have no previous public sector experience (so they have only audited private sector limited company clients). Required: As the Audit Partner you need to draft a report for your Audit Team with the title "Preparing for a Public Sector Audit Issues to consider to help the team as they prepare for the audit of DeSA. When writing this report, you should consider in particular the more specific matters stated below (include these under the relevant headings in your report). a) What are the similarities and differences in auditing private and public sector organisations? Make sure you outline areas for particular emphasis by referring specifically to DeSA in your analysis, for example areas of risk and recommended responses in terms of audit procedures. (14 marks) b) Explain the use of Value-for-Money' audits and consider how these may be particularly useful to the external auditors of not-for-profit (public sector) organisations such as DeSA-as part of your answer consider the potential benefits and risks of using the work of internal auditors. (10 marks) (Total 24 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started