Question

You are an audit senior in Koeman & Co and you are planning the audit of a new client, Goodison Co, for the year-ended 31

You are an audit senior in Koeman & Co and you are planning the audit of a new client,

Goodison Co, for the year-ended 31 August 20X5. The audit manager has already held a

planning meeting with the finance director. He has provided you with the following notes of his

meeting and financial statement extracts.

The company recognizes revenue when the customer places an order as 95% of orders are

processed and dispatched the day they are received.

The allowance for doubtful receivables has been reduced from 4% of receivables to 2% of

receivables, as management claim there is a lower risk of irrecoverable debts since the company

employed an additional person in the credit control department.

Inventory is initially valued at cost, and management then performs a review of the aged

inventory listing to identify any write downs required. Inventory that is more than 180 days old

is written down by 20%.

The directors have agreed to pay themselves a profit related bonus for the year.

Financial statement extracts for year ending 31 August 2021 ?

Based on the above scenario, you are required to answer the following questions:

A: Explain the purpose of THREE contents required for all audit documentation.

B : Calculate FIVE ratios, for BOTH years, which would assist in planning the audit of Goodison

Co.

C : Using the information provided and the ratios calculated, describe Two audit risks and explain

the auditor’s response to each risk in planning the audit of Goodison Co.

Note: Prepare your answer using two columns headed Audit risk and Auditor's responsibility

respectively.

D : Describe substantive procedures the auditor should perform at the final audit to obtain

sufficient and appropriate audit evidence over the year-end inventory balance.

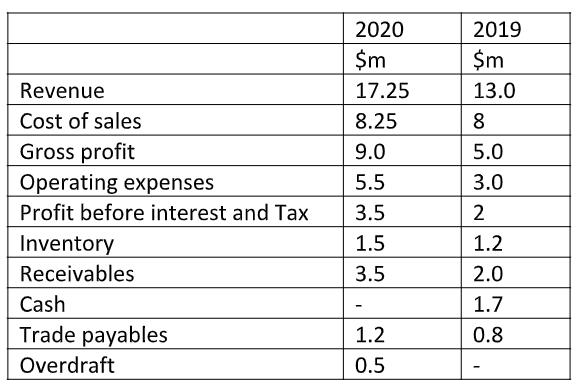

Revenue Cost of sales Gross profit Operating expenses Profit before interest and Tax Inventory Receivables Cash Trade payables Overdraft 2020 $m 17.25 8.25 9.0 5.5 3.5 1.5 3.5 - 1.2 0.5 2019 $m 13.0 8 5.0 3.0 2 1.2 2.0 1.7 0.8

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Step 14 Answers A The purpose of three contents required for all audit documentation are Working papers These are documentation that suppor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started