Question

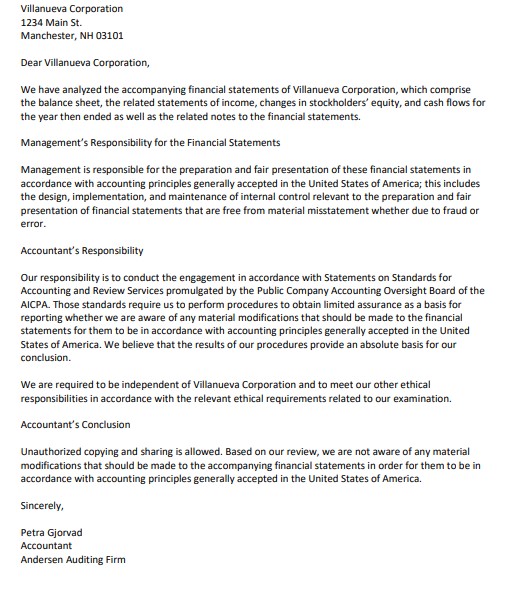

You are an auditor at Andersen Auditing Firm. Your manager has asked you to evaluate a colleague's engagement and identify the engagement type based on

You are an auditor at Andersen Auditing Firm. Your manager has asked you to evaluate a colleague's engagement and identify the engagement type based on the Statements on Standards for Accounting and Review Services (SSARS). Due to previous violations of ethical and behavioral standards within the company, your manager has also asked you to explain how your colleague has followed AICPA ethical standards. You will need to write a report to your manager that evaluates your colleague's engagement and explains how they followed AICPA ethical standards.

Specifically, you must address the following rubric criteria:

- Determine the type of engagement that your colleague completed for the client.

- Justify the selected engagement type for the client.

- Assess the purpose of each financial statement for the client's engagement report.

- Examine how the alternative SSARS engagements were inappropriate for the client.

- Determine the missing information needed in the client's engagement report.

- Analyze the CPA quality control elements that apply to the engagement report.

- Explain which AICPA rule has been violated in the engagement report and the implications of this violation.

- Recommend an appropriate strategy for resolving the AICPA violation.

- Assess the role of ethical frameworks in shaping your colleague's actions throughout the engagement.

- Justify the importance of conducting this engagement in an unbiased and principled manner.

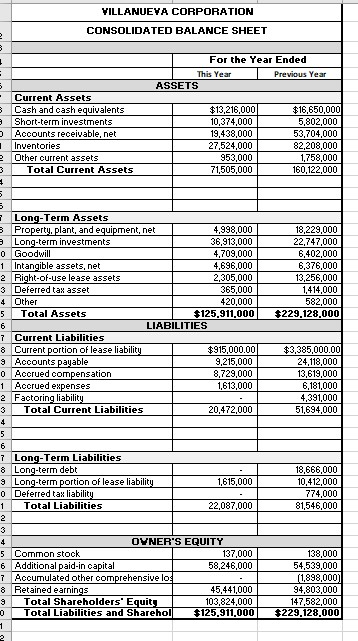

2 VILLANUEVA CORPORATION CONSOLIDATED BALANCE SHEET + For the Year Ended = This Year Previous Year 5 ASSETS Current Assets 3 Cash and cash equivalents $16,650,000 3 Short-term investments $13,216,000 10,374,000 5,802,000 0 Accounts receivable, net 19,438,000 53,704,000 Inventories 27,524,000 82,208,000 2 Other current assets 953,000 1,758,000 3 Total Current Assets 71,505,000 160,122,000 + 5 5 7 Long-Term Assets 8 Property, plant, and equipment, net 4,998,000 18,229,000 Long-term investments 36,913,000 22,747,000 0 Goodwill 4,709,000 6,402,000 1 Intangible assets, net 4,696,000 6,376,000 2 Right-of-use lease assets 3 Deferred tax asset 4 Other 2,305,000 13,256,000 365,000 1,414,000 420,000 582,000 5 Total Assets 6 7 Current Liabilities $125,911,000 $229,128,000 LIABILITIES 8 Current portion of lease liability $915,000.00 $3,385,000.00 9 Accounts payable 9,215,000 24,118,000 0 Accrued compensation 8,729,000 13,619,000 1 Accrued expenses 1,613,000 6,181,000 2 Factoring liability 4,391,000 3 Total Current Liabilities 20,472,000 51,694,000 4 5 6 7 Long-Term Liabilities 8 Long-term debt 18,666,000 9 Long-term portion of lease liability 1,615,000 10,412,000 o Deferred tax liability 774,000 1 Total Liabilities 22,087,000 81,546,000 2 3 4 5 Common stock 6 Additional paid-in capital 7 Accumulated other comprehensive los 8 Retained earnings 6 Total Shareholders' Equity 0 Total Liabilities and Sharehol 1 OVNER'S EQUITY 137,000 58,246,000 138,000 54,539,000 (1,898,000) 45,441,000 94,803,000 103,824,000 147,582,000 $125,911,000 $229,128,000 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Dear Manager Subject Evaluation of Colleagues Engagement and Adherence to AICPA Ethical Standards I have thoroughly reviewed the engagement conducted by my colleague at Andersen Auditing Firm f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started