Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an auditor in William & Associates, a mid-tier audit firm. You are deciding whether to continue with the audit engagement of G&L

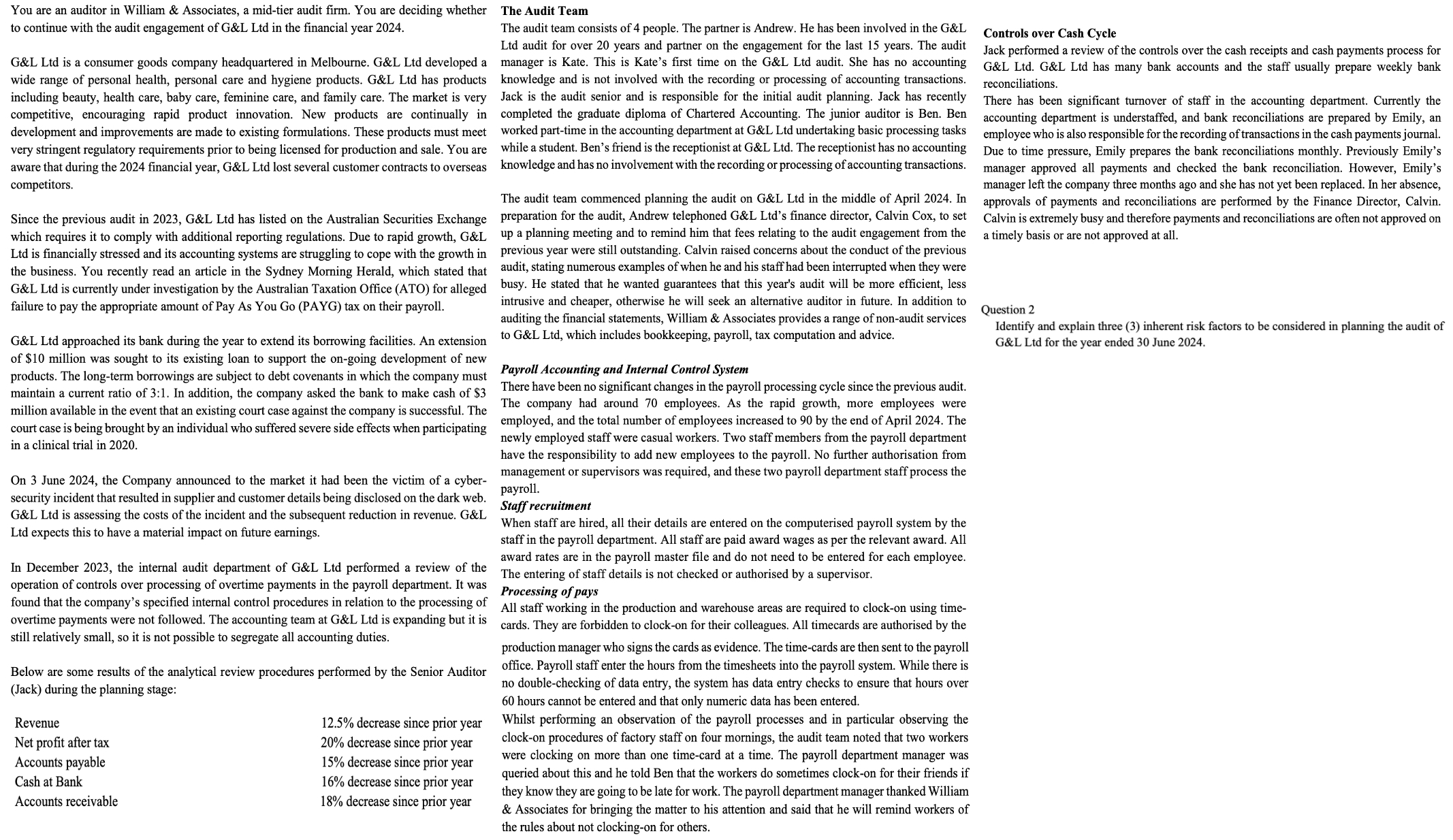

You are an auditor in William & Associates, a mid-tier audit firm. You are deciding whether to continue with the audit engagement of G&L Ltd in the financial year 2024. G&L Ltd is a consumer goods company headquartered in Melbourne. G&L Ltd developed a wide range of personal health, personal care and hygiene products. G&L Ltd has products including beauty, health care, baby care, feminine care, and family care. The market is very competitive, encouraging rapid product innovation. New products are continually in development and improvements are made to existing formulations. These products must meet very stringent regulatory requirements prior to being licensed for production and sale. You are aware that during the 2024 financial year, G&L Ltd lost several customer contracts to overseas competitors. Since the previous audit in 2023, G&L Ltd has listed on the Australian Securities Exchange which requires it to comply with additional reporting regulations. Due to rapid growth, G&L Ltd is financially stressed and its accounting systems are struggling to cope with the growth in the business. You recently read an article in the Sydney Morning Herald, which stated that G&L Ltd is currently under investigation by the Australian Taxation Office (ATO) for alleged failure to pay the appropriate amount of Pay As You Go (PAYG) tax on their payroll. G&L Ltd approached its bank during the year to extend its borrowing facilities. An extension of $10 million was sought to its existing loan to support the on-going development of new products. The long-term borrowings are subject to debt covenants in which the company must maintain a current ratio of 3:1. In addition, the company asked the bank to make cash of $3 million available in the event that an existing court case against the company is successful. The The Audit Team The audit team consists of 4 people. The partner is Andrew. He has been involved in the G&L Ltd audit for over 20 years and partner on the engagement for the last 15 years. The audit manager is Kate. This is Kate's first time on the G&L Ltd audit. She has no accounting knowledge and is not involved with the recording or processing of accounting transactions. Jack is the audit senior and is responsible for the initial audit planning. Jack has recently completed the graduate diploma of Chartered Accounting. The junior auditor is Ben. Ben worked part-time in the accounting department at G&L Ltd undertaking basic processing tasks while a student. Ben's friend is the receptionist at G&L Ltd. The receptionist has no accounting knowledge and has no involvement with the recording or processing of accounting transactions. The audit team commenced planning the audit on G&L Ltd in the middle of April 2024. In preparation for the audit, Andrew telephoned G&L Ltd's finance director, Calvin Cox, to set up a planning meeting and to remind him that fees relating to the audit engagement from the previous year were still outstanding. Calvin raised concerns about the conduct of the previous audit, stating numerous examples of when he and his staff had been interrupted when they were busy. He stated that he wanted guarantees that this year's audit will be more efficient, less intrusive and cheaper, otherwise he will seek an alternative auditor in future. In addition to auditing the financial statements, William & Associates provides a range of non-audit services to G&L Ltd, which includes bookkeeping, payroll, tax computation and advice. Payroll Accounting and Internal Control System There have been no significant changes in the payroll processing cycle since the previous audit. The company had around 70 employees. As the rapid growth, more employees were court case is being brought by an individual who suffered severe side effects when participating employed, and the total number of employees increased to 90 by the end of April 2024. The in a clinical trial in 2020. On 3 June 2024, the Company announced to the market it had been the victim of a cyber- security incident that resulted in supplier and customer details being disclosed on the dark web. G&L Ltd is assessing the costs of the incident and the subsequent reduction in revenue. G&L Ltd expects this to have a material impact on future earnings. In December 2023, the internal audit department of G&L Ltd performed a review of the operation of controls over processing of overtime payments in the payroll department. It was found that the company's specified internal control procedures in relation to the processing of overtime payments were not followed. The accounting team at G&L Ltd is expanding but it is still relatively small, so it is not possible to segregate all accounting duties. Below are some results of the analytical review procedures performed by the Senior Auditor (Jack) during the planning stage: Revenue Net profit after tax Accounts payable Cash at Bank Accounts receivable 12.5% decrease since prior year 20% decrease since prior year 15% decrease since prior year 16% decrease since prior year 18% decrease since prior year newly employed staff were casual workers. Two staff members from the payroll department have the responsibility to add new employees to the payroll. No further authorisation from management or supervisors was required, and these two payroll department staff process the payroll. Staff recruitment When staff are hired, all their details are entered on the computerised payroll system by the staff in the payroll department. All staff are paid award wages as per the relevant award. All award rates are in the payroll master file and do not need to be entered for each employee. The entering of staff details is not checked or authorised by a supervisor. Processing of pays All staff working in the production and warehouse areas are required to clock-on using time- cards. They are forbidden to clock-on for their colleagues. All timecards are authorised by the production manager who signs the cards as evidence. The time-cards are then sent to the payroll office. Payroll staff enter the hours from the timesheets into the payroll system. While there is no double-checking of data entry, the system has data entry checks to ensure that hours over 60 hours cannot be entered and that only numeric data has been entered. Whilst performing an observation of the payroll processes and in particular observing the clock-on procedures of factory staff on four mornings, the audit team noted that two workers were clocking on more than one time-card at a time. The payroll department manager was queried about this and he told Ben that the workers do sometimes clock-on for their friends if they know they are going to be late for work. The payroll department manager thanked William & Associates for bringing the matter to his attention and said that he will remind workers of the rules about not clocking-on for others. Controls over Cash Cycle Jack performed a review of the controls over the cash receipts and cash payments process for G&L Ltd. G&L Ltd has many bank accounts and the staff usually prepare weekly bank reconciliations. There has been significant turnover of staff in the accounting department. Currently the accounting department is understaffed, and bank reconciliations are prepared by Emily, an employee who is also responsible for the recording of transactions in the cash payments journal. Due to time pressure, Emily prepares the bank reconciliations monthly. Previously Emily's manager approved all payments and checked the bank reconciliation. However, Emily's manager left the company three months ago and she has not yet been replaced. In her absence, approvals of payments and reconciliations are performed by the Finance Director, Calvin. Calvin is extremely busy and therefore payments and reconciliations are often not approved on a timely basis or are not approved at all. Question 2 Identify and explain three (3) inherent risk factors to be considered in planning the audit of G&L Ltd for the year ended 30 June 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started