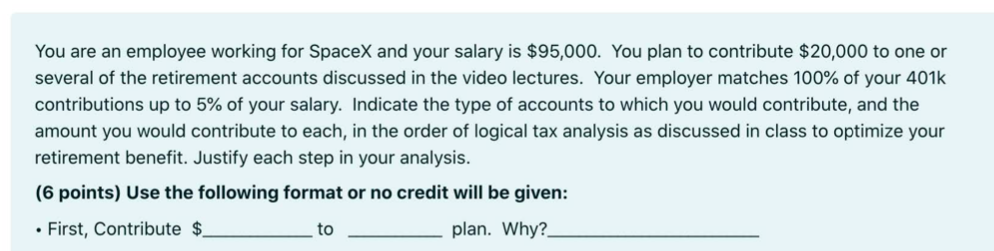

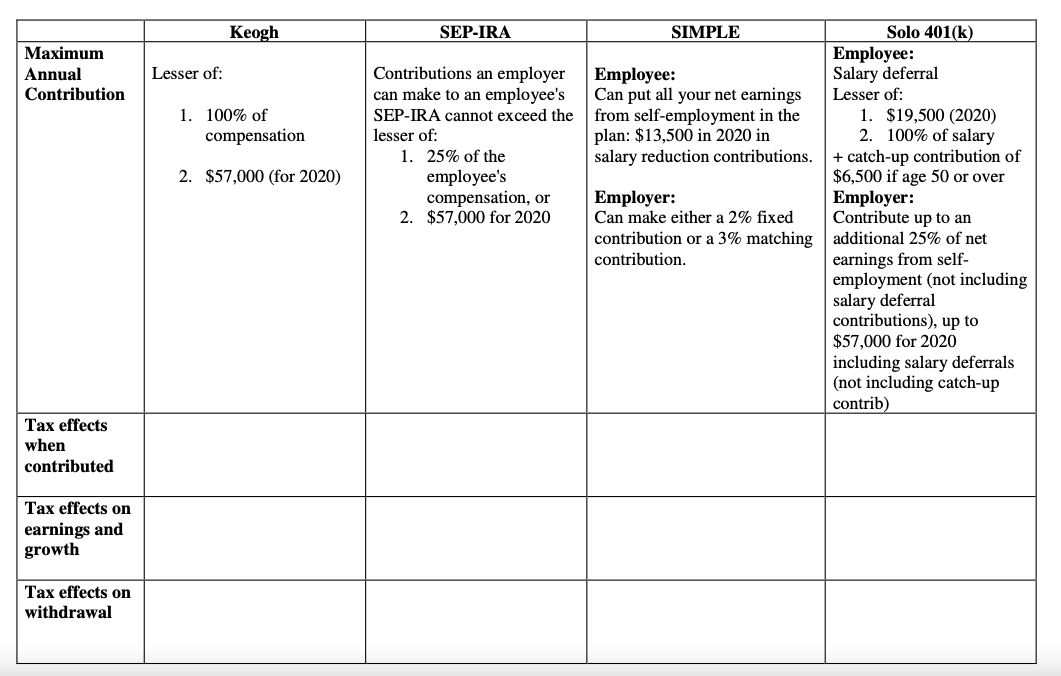

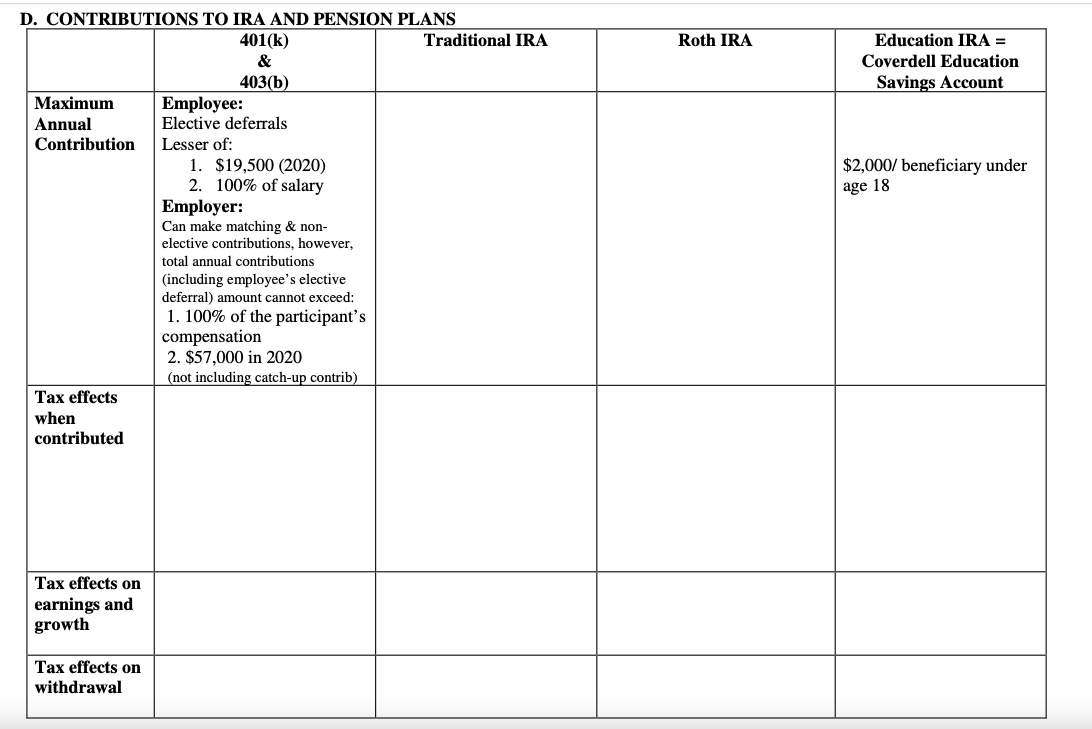

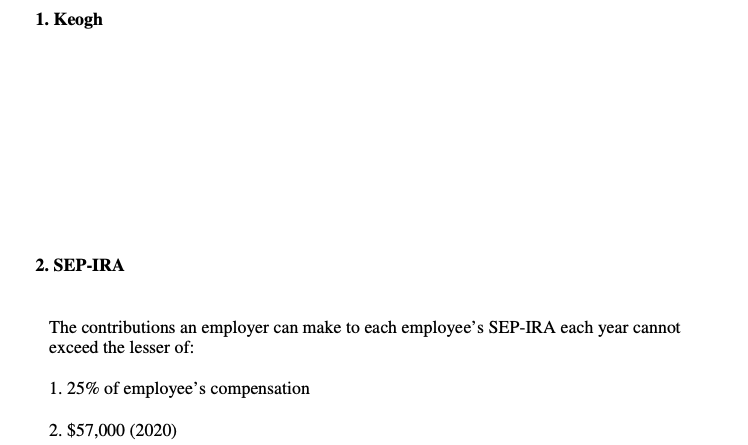

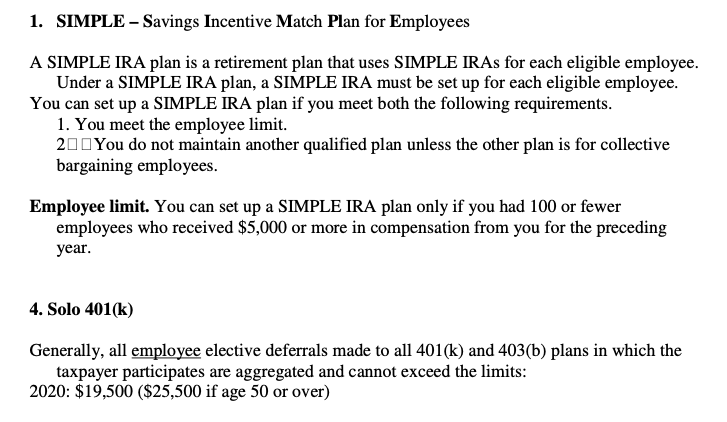

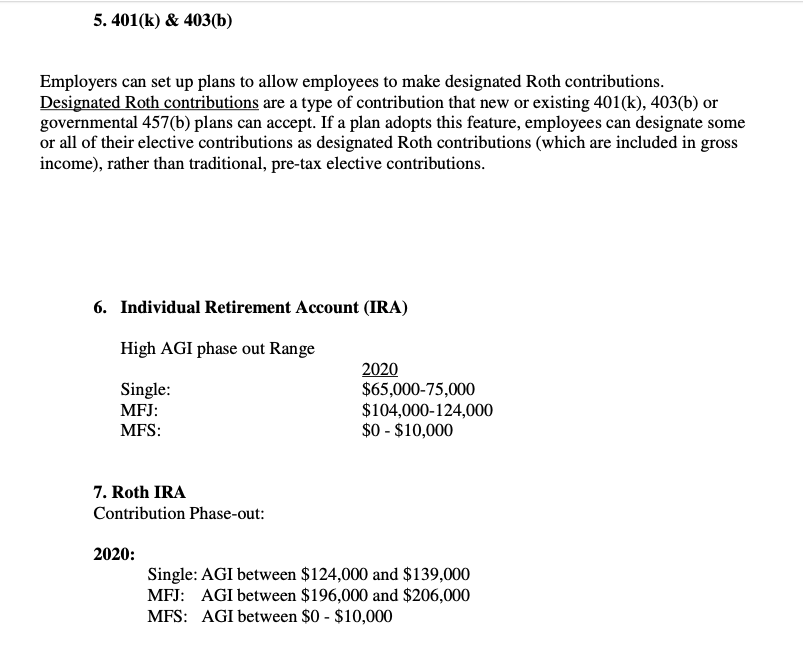

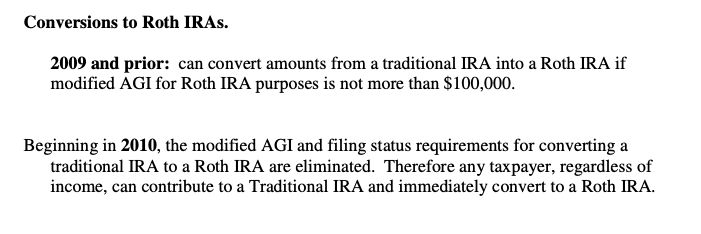

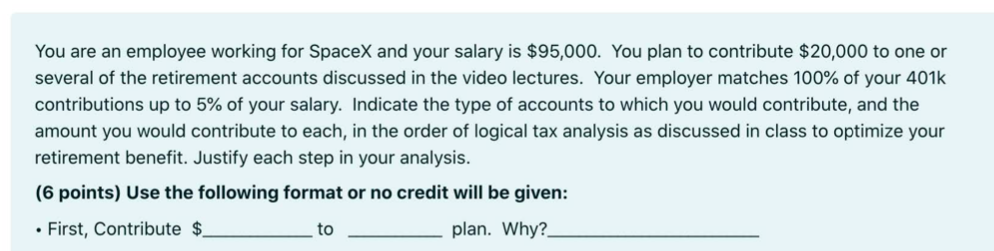

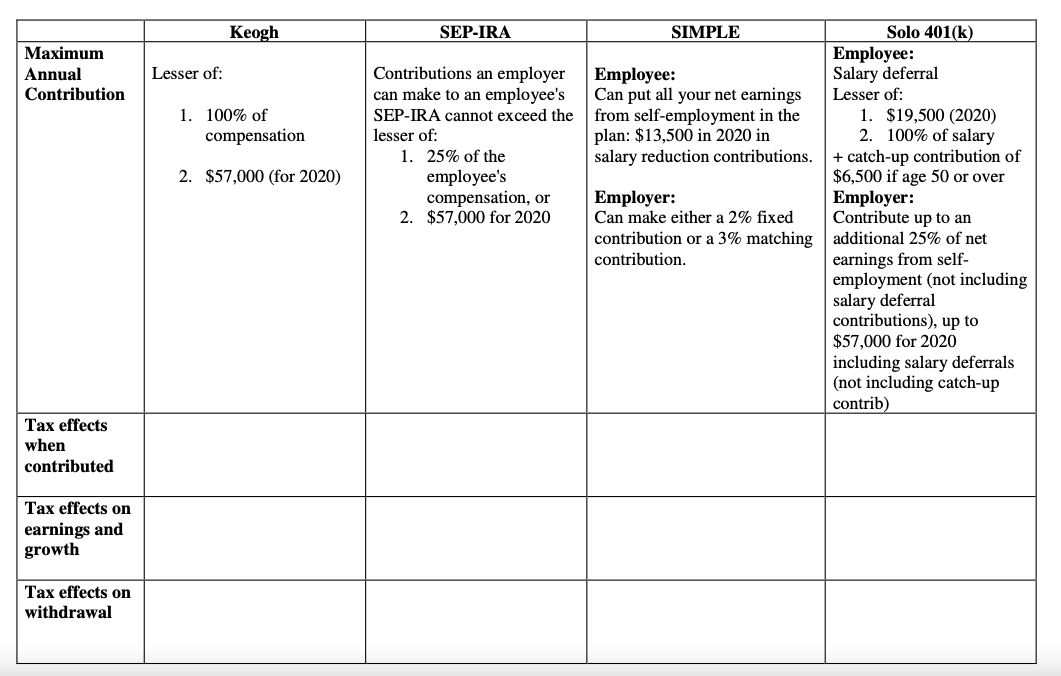

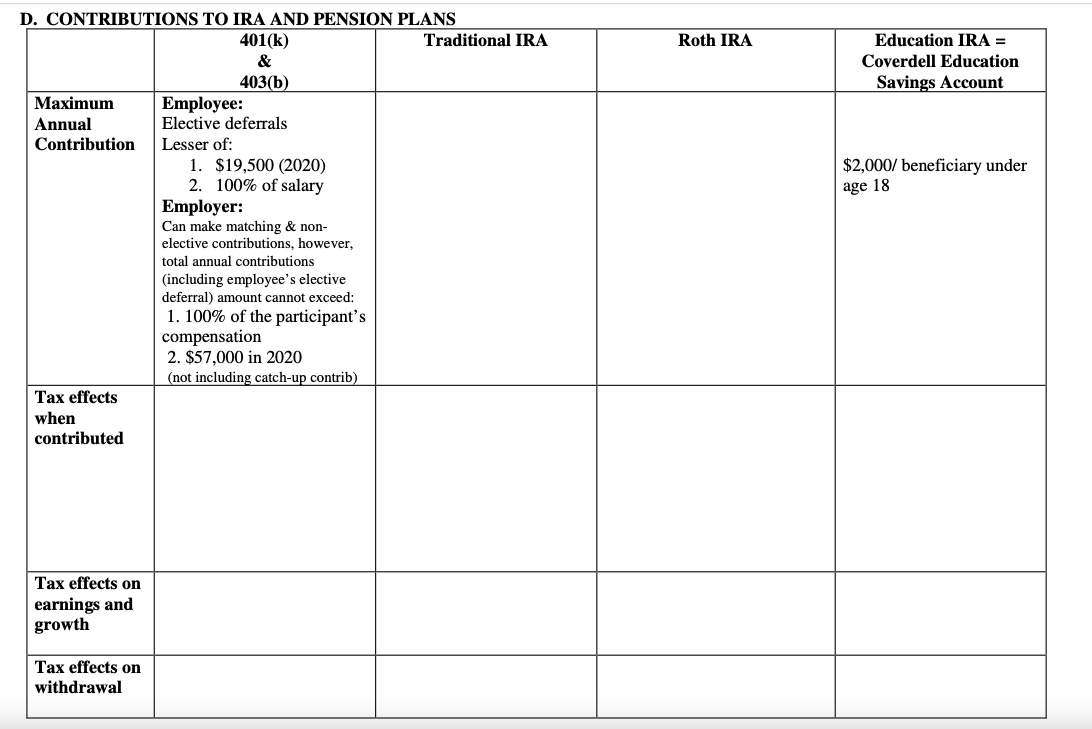

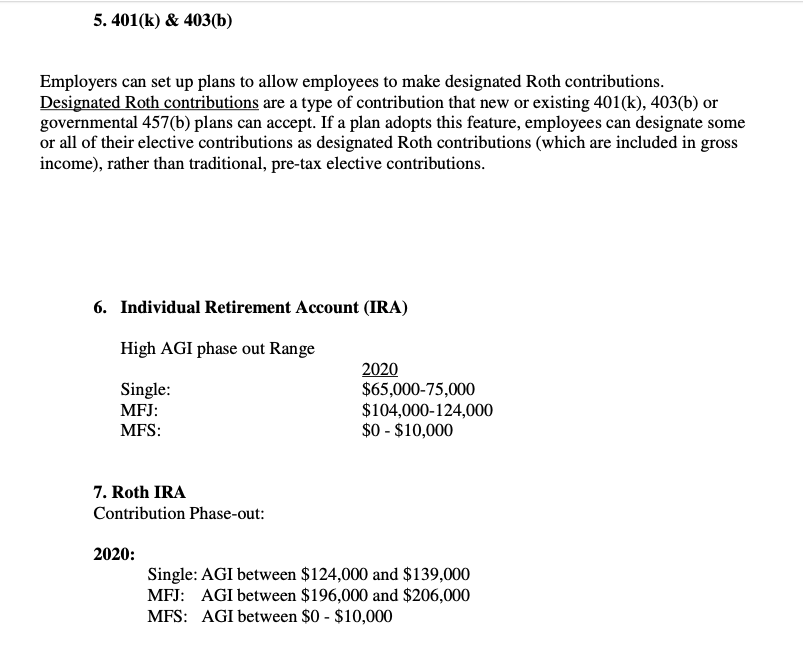

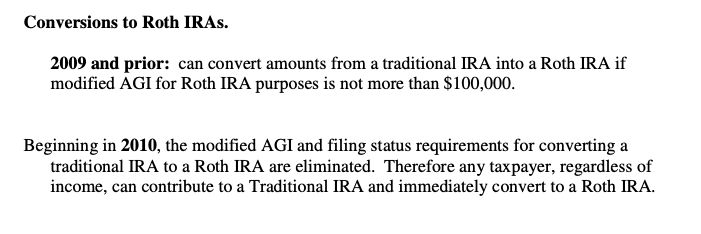

You are an employee working for SpaceX and your salary is $95,000. You plan to contribute $20,000 to one or several of the retirement accounts discussed in the video lectures. Your employer matches 100% of your 401k contributions up to 5% of your salary. Indicate the type of accounts to which you would contribute, and the amount you would contribute to each, in the order of logical tax analysis as discussed in class to optimize your retirement benefit. Justify each step in your analysis. (6 points) Use the following format or no credit will be given: First, Contribute $ to plan. Why? Keogh SEP-IRA Maximum Annual Contribution Lesser of: 1. 100% of compensation Contributions an employer can make to an employee's SEP-IRA cannot exceed the lesser of: 1. 25% of the employee's compensation, or 2. $57,000 for 2020 2. $57,000 (for 2020) SIMPLE Solo 401(k) Employee: Employee: Salary deferral Can put all your net earnings Lesser of: from self-employment in the 1. $19,500 (2020) plan: $13,500 in 2020 in 2. 100% of salary salary reduction contributions. + catch-up contribution of $6,500 if age 50 or over Employer: Employer: Can make either a 2% fixed Contribute up to an contribution or a 3% matching additional 25% of net contribution. earnings from self- employment (not including salary deferral contributions), up to $57,000 for 2020 including salary deferrals (not including catch-up contrib) Tax effects when contributed Tax effects on earnings and growth Tax effects on withdrawal Roth IRA Education IRA = Coverdell Education Savings Account $2,000/ beneficiary under age 18 D. CONTRIBUTIONS TO IRA AND PENSION PLANS 401(k) Traditional IRA & 403(b) Maximum Employee: Annual Elective deferrals Contribution Lesser of: 1. $19,500 (2020) 2. 100% of salary Employer: Can make matching & non- elective contributions, however, total annual contributions (including employee's elective deferral) amount cannot exceed: 1. 100% of the participant's compensation 2. $57,000 in 2020 (not including catch-up contrib) Tax effects when contributed Tax effects on earnings and growth Tax effects on withdrawal 1. Keogh 2. SEP-IRA The contributions an employer can make to each employee's SEP-IRA each year cannot exceed the lesser of: 1. 25% of employee's compensation 2. $57,000 (2020) 1. SIMPLE - Savings Incentive Match Plan for Employees A SIMPLE IRA plan is a retirement plan that uses SIMPLE IRAs for each eligible employee. Under a SIMPLE IRA plan, a SIMPLE IRA must be set up for each eligible employee. You can set up a SIMPLE IRA plan if you meet both the following requirements. 1. You meet the employee limit. 200 You do not maintain another qualified plan unless the other plan is for collective bargaining employees. Employee limit. You can set up a SIMPLE IRA plan only if you had 100 or fewer employees who received $5,000 or more in compensation from you for the preceding year. 4. Solo 401(k) Generally, all employee elective deferrals made to all 401(k) and 403(b) plans in which the taxpayer participates are aggregated and cannot exceed the limits: 2020: $19,500 ($25,500 if age 50 or over) 5.401(k) & 403(b) Employers can set up plans to allow employees to make designated Roth contributions. Designated Roth contributions are a type of contribution that new or existing 401(k), 403(b) or governmental 457(b) plans can accept. If a plan adopts this feature, employees can designate some or all of their elective contributions as designated Roth contributions (which are included in gross income), rather than traditional, pre-tax elective contributions. 6. Individual Retirement Account (IRA) High AGI phase out Range Single: MFJ: MFS: 2020 $65,000-75,000 $104,000-124,000 $0 - $10,000 7. Roth IRA Contribution Phase-out: 2020: Single: AGI between $124,000 and $139,000 MFJ: AGI between $196,000 and $206,000 MFS: AGI between $0 - $10,000 Conversions to Roth IRAs. 2009 and prior: can convert amounts from a traditional IRA into a Roth IRA if modified AGI for Roth IRA purposes is not more than $100,000. Beginning in 2010, the modified AGI and filing status requirements for converting a traditional IRA to a Roth IRA are eliminated. Therefore any taxpayer, regardless of income, can contribute to a Traditional IRA and immediately convert to a Roth IRA. You are an employee working for SpaceX and your salary is $95,000. You plan to contribute $20,000 to one or several of the retirement accounts discussed in the video lectures. Your employer matches 100% of your 401k contributions up to 5% of your salary. Indicate the type of accounts to which you would contribute, and the amount you would contribute to each, in the order of logical tax analysis as discussed in class to optimize your retirement benefit. Justify each step in your analysis. (6 points) Use the following format or no credit will be given: First, Contribute $ to plan. Why? Keogh SEP-IRA Maximum Annual Contribution Lesser of: 1. 100% of compensation Contributions an employer can make to an employee's SEP-IRA cannot exceed the lesser of: 1. 25% of the employee's compensation, or 2. $57,000 for 2020 2. $57,000 (for 2020) SIMPLE Solo 401(k) Employee: Employee: Salary deferral Can put all your net earnings Lesser of: from self-employment in the 1. $19,500 (2020) plan: $13,500 in 2020 in 2. 100% of salary salary reduction contributions. + catch-up contribution of $6,500 if age 50 or over Employer: Employer: Can make either a 2% fixed Contribute up to an contribution or a 3% matching additional 25% of net contribution. earnings from self- employment (not including salary deferral contributions), up to $57,000 for 2020 including salary deferrals (not including catch-up contrib) Tax effects when contributed Tax effects on earnings and growth Tax effects on withdrawal Roth IRA Education IRA = Coverdell Education Savings Account $2,000/ beneficiary under age 18 D. CONTRIBUTIONS TO IRA AND PENSION PLANS 401(k) Traditional IRA & 403(b) Maximum Employee: Annual Elective deferrals Contribution Lesser of: 1. $19,500 (2020) 2. 100% of salary Employer: Can make matching & non- elective contributions, however, total annual contributions (including employee's elective deferral) amount cannot exceed: 1. 100% of the participant's compensation 2. $57,000 in 2020 (not including catch-up contrib) Tax effects when contributed Tax effects on earnings and growth Tax effects on withdrawal 1. Keogh 2. SEP-IRA The contributions an employer can make to each employee's SEP-IRA each year cannot exceed the lesser of: 1. 25% of employee's compensation 2. $57,000 (2020) 1. SIMPLE - Savings Incentive Match Plan for Employees A SIMPLE IRA plan is a retirement plan that uses SIMPLE IRAs for each eligible employee. Under a SIMPLE IRA plan, a SIMPLE IRA must be set up for each eligible employee. You can set up a SIMPLE IRA plan if you meet both the following requirements. 1. You meet the employee limit. 200 You do not maintain another qualified plan unless the other plan is for collective bargaining employees. Employee limit. You can set up a SIMPLE IRA plan only if you had 100 or fewer employees who received $5,000 or more in compensation from you for the preceding year. 4. Solo 401(k) Generally, all employee elective deferrals made to all 401(k) and 403(b) plans in which the taxpayer participates are aggregated and cannot exceed the limits: 2020: $19,500 ($25,500 if age 50 or over) 5.401(k) & 403(b) Employers can set up plans to allow employees to make designated Roth contributions. Designated Roth contributions are a type of contribution that new or existing 401(k), 403(b) or governmental 457(b) plans can accept. If a plan adopts this feature, employees can designate some or all of their elective contributions as designated Roth contributions (which are included in gross income), rather than traditional, pre-tax elective contributions. 6. Individual Retirement Account (IRA) High AGI phase out Range Single: MFJ: MFS: 2020 $65,000-75,000 $104,000-124,000 $0 - $10,000 7. Roth IRA Contribution Phase-out: 2020: Single: AGI between $124,000 and $139,000 MFJ: AGI between $196,000 and $206,000 MFS: AGI between $0 - $10,000 Conversions to Roth IRAs. 2009 and prior: can convert amounts from a traditional IRA into a Roth IRA if modified AGI for Roth IRA purposes is not more than $100,000. Beginning in 2010, the modified AGI and filing status requirements for converting a traditional IRA to a Roth IRA are eliminated. Therefore any taxpayer, regardless of income, can contribute to a Traditional IRA and immediately convert to a Roth IRA