You are an equity analyst at an investment bank. You have been asked to perform valuation of Novice Ltd., a company that specialises in

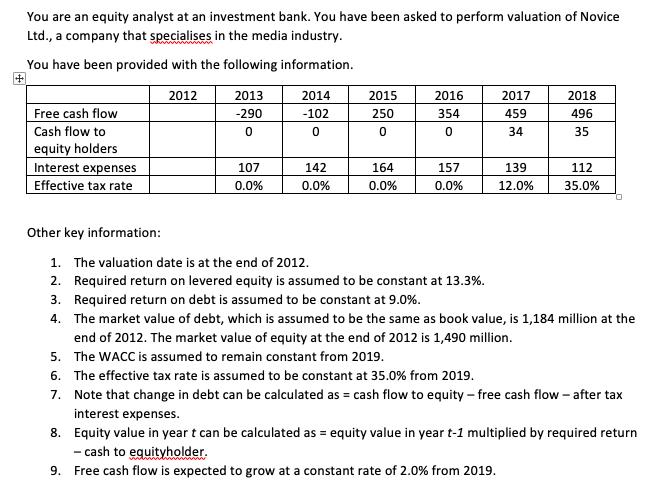

You are an equity analyst at an investment bank. You have been asked to perform valuation of Novice Ltd., a company that specialises in the media industry. You have been provided with the following information. Free cash flow Cash flow to equity holders Interest expenses Effective tax rate 2012 2013 -290 0 107 0.0% 2014 -102 0 142 0.0% 2015 250 0 164 0.0% 2016 354 0 157 0.0% 2017 459 34 139 12.0% 2018 496 35 112 35.0% Other key information: 1. The valuation date is at the end of 2012. 2. Required return on levered equity is assumed to be constant at 13.3%. 3. Required return on debt is assumed to be constant at 9.0%. 4. The market value of debt, which is assumed to be the same as book value, is 1,184 million at the end of 2012. The market value of equity at the end of 2012 is 1,490 million. 5. The WACC is assumed to remain constant from 2019. 6. The effective tax rate is assumed to be constant at 35.0% from 2019. 7. Note that change in debt can be calculated as = cash flow to equity-free cash flow - after tax interest expenses. 8. Equity value in year t can be calculated as = equity value in year t-1 multiplied by required return - cash to equityholder. 9. Free cash flow is expected to grow at a constant rate of 2.0% from 2019. Using the WACC method, perform the valuation of equity for each year between 2012 and 2018

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

2013 Calculate Free Cash Flow FCF FCF Cash Flow to Equity Holders Interest Expenses FCF 290 million 107 million FCF 397 million Calculate the Change i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started