Question

You are an equity analyst (external) for a large U.S. equity mutual fund. Your fund has a sizable position in Amazon, Inc. (AMZN). Historically, its

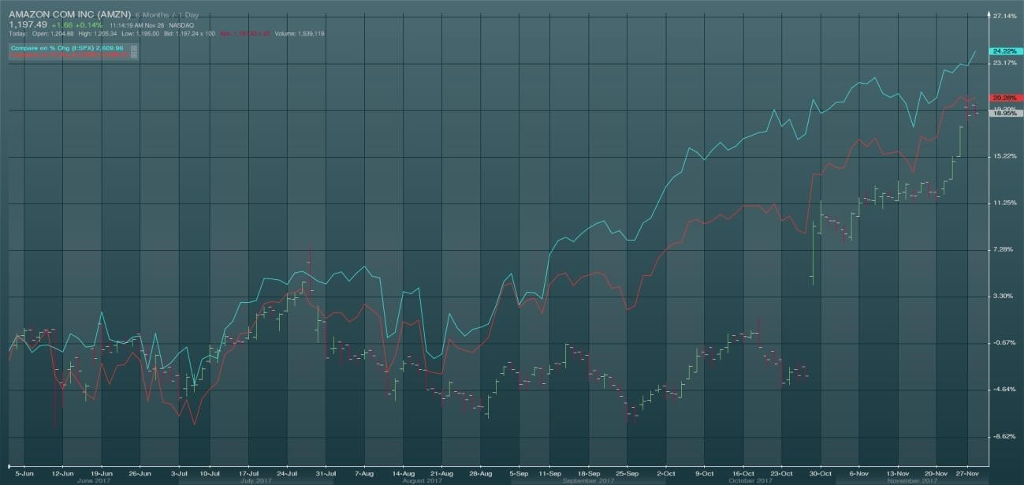

You are an equity analyst (external) for a large U.S. equity mutual fund. Your fund has a sizable position in Amazon, Inc. (AMZN). Historically, its been a gem. I mean, NOT owning AMZN in a fund is a kind of investment sacrilege. The 10 year performance, even inclusive of the financial crisis, looks pretty. Its up 1224.43% in that time period. Below is a 10 year chart of AMZN (red/green bar chart) and the S&P 500 (in blue). Even considering that were in a low interest rate environment and the market (SP500) has done spectacularly well this past decade, AMZN has outperformed.

So, as we do in investment management, its time for a thorough review. Your boss wants you to run the numbers and report back as to what to do with the funds position. Ultimately, you want to give a buy/sell/hold recommendation. Your argument must be well reasoned and backed by fundamental analysis.

So, as we do in investment management, its time for a thorough review. Your boss wants you to run the numbers and report back as to what to do with the funds position. Ultimately, you want to give a buy/sell/hold recommendation. Your argument must be well reasoned and backed by fundamental analysis.

Using the most recent SEC filings, the 10K (annual report) and your own tools and research, complete the following: Calculate the growth rate over the past few years. Feel free to use older 10K filings to get a longer view of trends. What do you believe to be a reasonable growth rate of revenues for the next three years? What are your numbers, and why do you believe these are reasonable projections?

(this was all of the info included in the directions)

AMAZON COM INC (AMZN) 1o Yearsy 1 Day 1,197.15-132 +0.11% 1104:40 AM No. 28 NASOAQ 562 54% 120.85% Dec-Apr-08 Aug.08 oc.08 r-09 Au009 Dac-09 Apr. 10 Aug. 10 Dec-10 Apr 11 Ao-11 Dec.11 Apr-t2 Au 12 Dooi2 Apr-13 Ao-13 Dec. 13 Apr. 14 Ai-14 Dec. 14 Apr. 15 Air15 Doo' 15 Apr-16 Aug,16 Doc' 16 Apr-17 Aug. 17Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started