Answered step by step

Verified Expert Solution

Question

1 Approved Answer

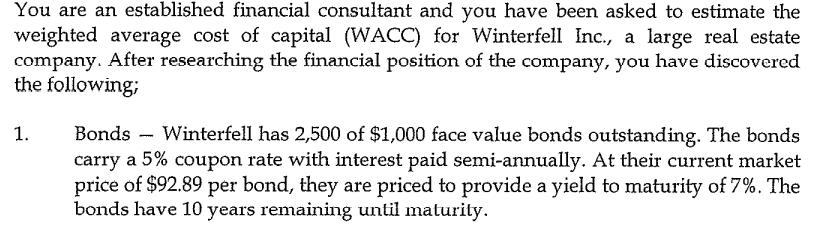

You are an established financial consultant and you have been asked to estimate the weighted average cost of capital (WACC) for Winterfell Inc., a

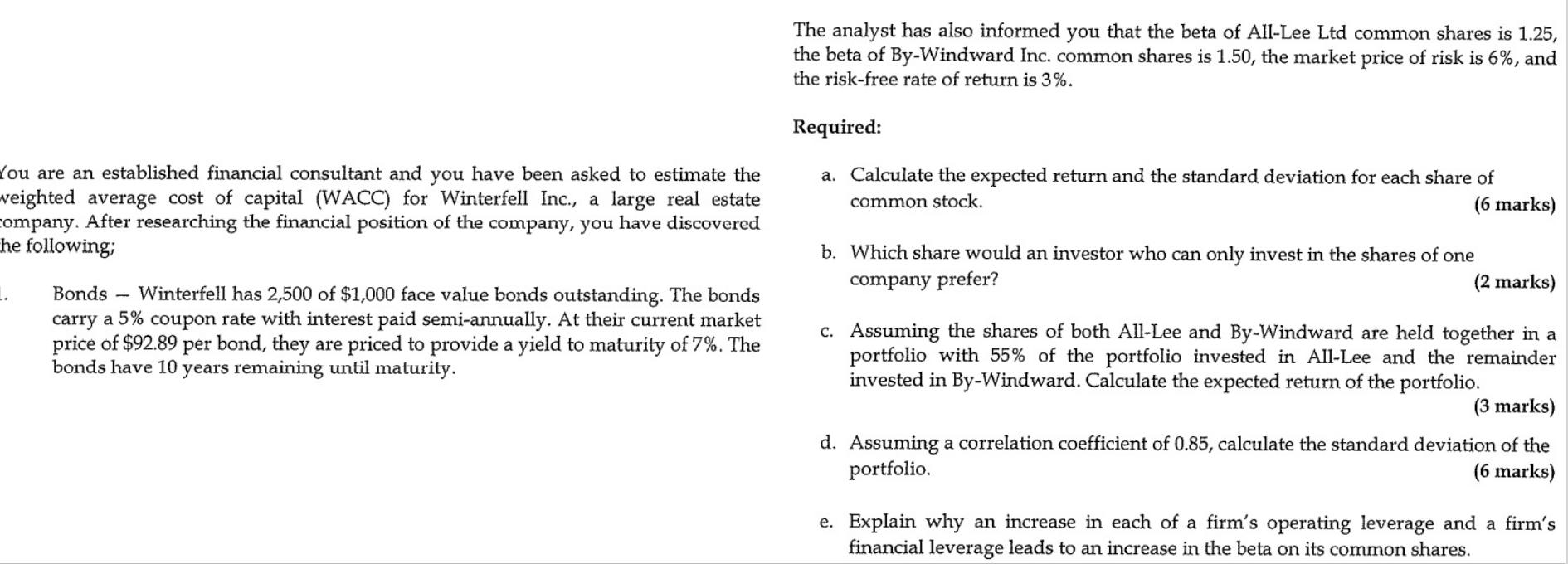

You are an established financial consultant and you have been asked to estimate the weighted average cost of capital (WACC) for Winterfell Inc., a large real estate company. After researching the financial position of the company, you have discovered the following; 1. Bonds Winterfell has 2,500 of $1,000 face value bonds outstanding. The bonds carry a 5% coupon rate with interest paid semi-annually. At their current market price of $92.89 per bond, they are priced to provide a yield to maturity of 7%. The bonds have 10 years remaining until maturity. - You are an established financial consultant and you have been asked to estimate the weighted average cost of capital (WACC) for Winterfell Inc., a large real estate company. After researching the financial position of the company, you have discovered he following; Bonds Winterfell has 2,500 of $1,000 face value bonds outstanding. The bonds carry a 5% coupon rate with interest paid semi-annually. At their current market price of $92.89 per bond, they are priced to provide a yield to maturity of 7%. The bonds have 10 years remaining until maturity. - The analyst has also informed you that the beta of All-Lee Ltd common shares is 1.25, the beta of By-Windward Inc. common shares is 1.50, the market price of risk is 6%, and the risk-free rate of return is 3%. Required: a. Calculate the expected return and the standard deviation for each share of common stock. (6 marks) b. Which share would an investor who can only invest in the shares of one company prefer? (2 marks) c. Assuming the shares of both All-Lee and By-Windward are held together in a portfolio with 55% of the portfolio invested in All-Lee and the remainder invested in By-Windward. Calculate the ted return of the portfolio. (3 marks) d. Assuming a correlation coefficient of 0.85, calculate the standard deviation of the portfolio. (6 marks) e. Explain why an increase in each of a firm's operating leverage and a firm's financial leverage leads to an increase in the beta on its common shares.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the expected return and the standard deviation for each share of common stock6 marks ANSWER Expected return Rf RM Rf For AllLee Ltd common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started