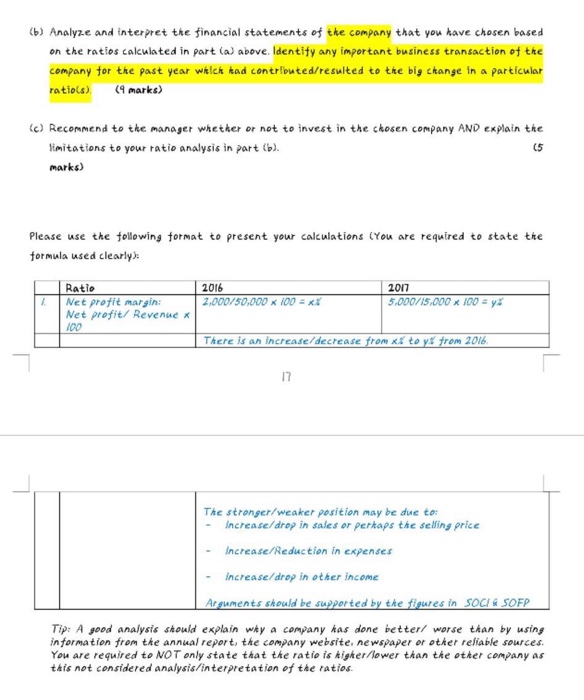

You are an intern working in Invest Hub Sdn. Bkd (HSB). Currently InsB is interested to invest RM500,000 in the stock market. Your manager has asked you to interpret the financial statement of a company of your choice (you may choose any public listed company from Bursa 16 Malaysia) for the financial year 2017. Your team is required to produce an analysis report, whick focuses on specific aspects o inancial performance and financial position ot the ckosen company Your report should contain the following a) Prepare the following ratio calculations (ckoose ratios) based on the 2017 financial statements (use company figures rather than group figures). Please DONOT select companies that kas mutual fundstrust funds REITs or whatever funds as their main type o business. Funds companies are NOT able to provide enough information needed for our ratio calculations Try not to choose fully service oriented company with no products to sell instead try to choose companies that sell products (for the purpose of obtaining closing inventory) Tke tinancial statements namely SOCI, SoE, SoFP ot the company showld be attacked in the assignment submission Profitability net projit margin, return on capital employed, capital turnover Liquidity current ratio, quick ratic Working capital trade receivables collection period, trade payables payment period, inventory turnover Long-term solvency - debt to assets ratlo gearing tatio, interest coverage. You are an intern working in Invest Hub Sdn. Bkd (HSB). Currently InsB is interested to invest RM500,000 in the stock market. Your manager has asked you to interpret the financial statement of a company of your choice (you may choose any public listed company from Bursa 16 Malaysia) for the financial year 2017. Your team is required to produce an analysis report, whick focuses on specific aspects o inancial performance and financial position ot the ckosen company Your report should contain the following a) Prepare the following ratio calculations (ckoose ratios) based on the 2017 financial statements (use company figures rather than group figures). Please DONOT select companies that kas mutual fundstrust funds REITs or whatever funds as their main type o business. Funds companies are NOT able to provide enough information needed for our ratio calculations Try not to choose fully service oriented company with no products to sell instead try to choose companies that sell products (for the purpose of obtaining closing inventory) Tke tinancial statements namely SOCI, SoE, SoFP ot the company showld be attacked in the assignment submission Profitability net projit margin, return on capital employed, capital turnover Liquidity current ratio, quick ratic Working capital trade receivables collection period, trade payables payment period, inventory turnover Long-term solvency - debt to assets ratlo gearing tatio, interest coverage