Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an investor looking at two options. The first option is a to buy a sole proprietorship with pre-tax income 250,000$. The second

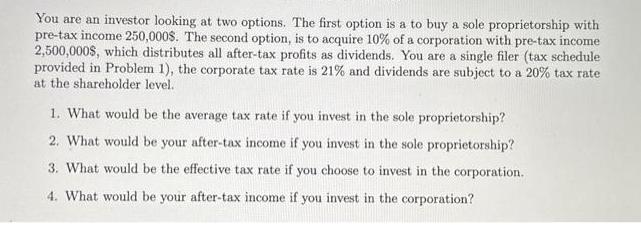

You are an investor looking at two options. The first option is a to buy a sole proprietorship with pre-tax income 250,000$. The second option, is to acquire 10% of a corporation with pre-tax income 2,500,000$, which distributes all after-tax profits as dividends. You are a single filer (tax schedule provided in Problem 1), the corporate tax rate is 21% and dividends are subject to a 20% tax rate at the shareholder level. 1. What would be the average tax rate if you invest in the sole proprietorship? 2. What would be your after-tax income if you invest in the sole proprietorship? 3. What would be the effective tax rate if you choose to invest in the corporation. 4. What would be your after-tax income if you invest in the corporation?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the tax implications for both options Option 1 Sole Proprietorship 1 To calculate the average tax rate we need to find the total tax pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started