Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an investor looking into investing in a firm's stock. The firm, Aero-Tyne Inc., is awaiting patent approval for an innovative line of

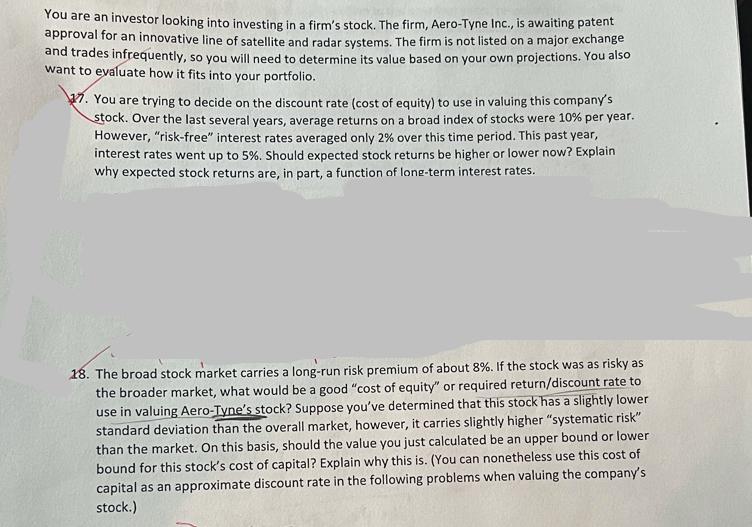

You are an investor looking into investing in a firm's stock. The firm, Aero-Tyne Inc., is awaiting patent approval for an innovative line of satellite and radar systems. The firm is not listed on a major exchange and trades infrequently, so you will need to determine its value based on your own projections. You also want to evaluate how it fits into your portfolio. 27. You are trying to decide on the discount rate (cost of equity) to use in valuing this company's stock. Over the last several years, average returns on a broad index of stocks were 10% per year. However, "risk-free" interest rates averaged only 2% over this time period. This past year, interest rates went up to 5%. Should expected stock returns be higher or lower now? Explain why expected stock returns are, in part, a function of long-term interest rates. 18. The broad stock market carries a long-run risk premium of about 8%. If the stock was as risky as the broader market, what would be a good "cost of equity" or required return/discount rate to use in valuing Aero-Tyne's stock? Suppose you've determined that this stock has a slightly lower standard deviation than the overall market, however, it carries slightly higher "systematic risk" than the market. On this basis, should the value you just calculated be an upper bound or lower bound for this stock's cost of capital? Explain why this is. (You can nonetheless use this cost of capital as an approximate discount rate in the following problems when valuing the company's stock.)

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Expected Stock Returns and Interest Rates 17 Expected stock returns are expected to be higher now even though past stock returns were higher than curr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started