Question

You are an investor who has currently has a $750,000 portfolio consisting entirely of an investment in the shares of Company A Ltd. You are

You are an investor who has currently has a $750,000 portfolio consisting entirely of an investment in

the shares of Company A Ltd. You are considering selling some of your existing portfolio and investing

those proceeds into the shares of Company B Ltd. Following that transaction, the total value of your

investment in shares in Company A will be twice that of your investment in Company B. You estimate

that the correlation coefficient between the returns of the shares of company A and the shares of

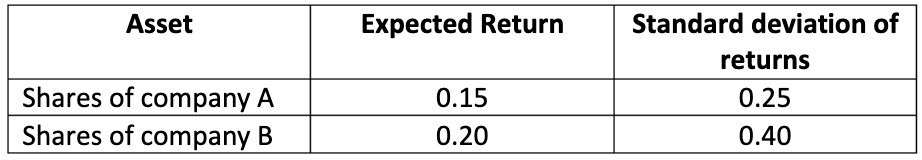

company B is 0.70. Details of the returns and variability of those returns are as follows:

a) What is the value of your investment in the shares of Company A and Company B immediately

after the transaction? What weights do these represent in your portfolio?

b) What is the expected return of your portfolio following the purchase of shares in Company B?

[express as a percentage with the final answer correctly rounded to two decimal places e.g.

50.67% p.a.]

c) What is the standard deviation of the returns from your portfolio following the purchase of

shares in Company B? [express as a percentage with the final answer correctly rounded to two

decimal places e.g. 50.67% p.a.]

\begin{tabular}{|l|c|c|} \hline \multicolumn{1}{|c|}{ Asset } & Expected Return & Standard deviation of returns \\ \hline Shares of company A & 0.15 & 0.25 \\ \hline Shares of company B & 0.20 & 0.40 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started