Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an options market maker at Kentucky Securities, and you are trying to write a European put option on GIO stock. The option

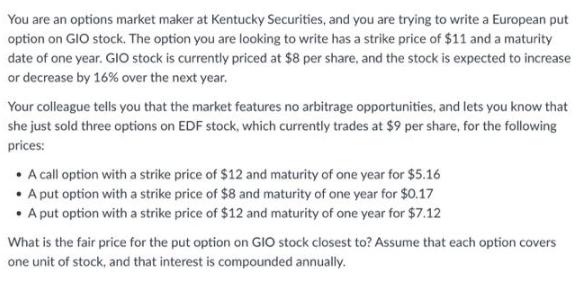

You are an options market maker at Kentucky Securities, and you are trying to write a European put option on GIO stock. The option you are looking to write has a strike price of $11 and a maturity date of one year. GIO stock is currently priced at $8 per share, and the stock is expected to increase or decrease by 16% over the next year. Your colleague tells you that the market features no arbitrage opportunities, and lets you know that she just sold three options on EDF stock, which currently trades at $9 per share, for the following prices: A call option with a strike price of $12 and maturity of one year for $5.16 A put option with a strike price of $8 and maturity of one year for $0.17 A put option with a strike price of $12 and maturity of one year for $7.12 What is the fair price for the put option on GIO stock closest to? Assume that each option covers one unit of stock, and that interest is compounded annually.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To price the European put option on GIO stock we can use the putcall parity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started