Answered step by step

Verified Expert Solution

Question

1 Approved Answer

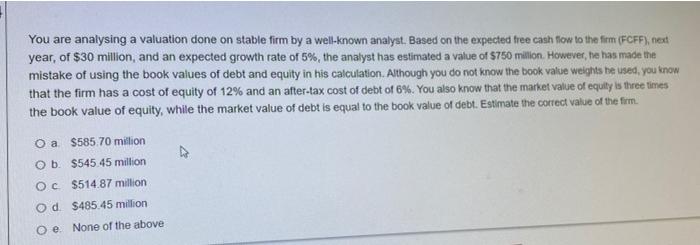

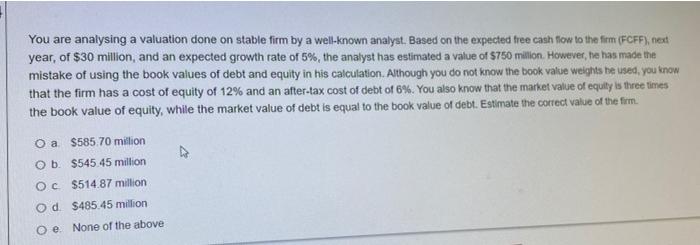

You are analysing a valuation done on stable firm by a well-known analyst. Based on the expected free cash flow to the firm (FCFF), next

You are analysing a valuation done on stable firm by a well-known analyst. Based on the expected free cash flow to the firm (FCFF), next year, of $30 million, and an expected growth rate of 5%, the analyst has estimated a value of $750 milion. However, he has made the mistake of using the book values of debt and equity in his calculation. Although you do not know the book value weights he used, you know that the firm has a cost of equity of 12% and an after-tax cost of debt of 6%. You also know that the market value of equity is three times the book value of equity, while the market value of debt is equal to the book value of debt. Estimate the correct value of the firm. O a $585.70 million Ob $545.45 million OC $514.87 million Od $485.45 million O e None of the above

You are analysing a valuation done on stable firm by a well-known analyst. Based on the expected free cash flow to the firm (FCFF), next year, of $30 million, and an expected growth rate of 5%, the analyst has estimated a value of $750 milion. However, he has made the mistake of using the book values of debt and equity in his calculation. Although you do not know the book value weights he used, you know that the firm has a cost of equity of 12% and an after-tax cost of debt of 6%. You also know that the market value of equity is three times the book value of equity, while the market value of debt is equal to the book value of debt. Estimate the correct value of the firm. O a $585.70 million Ob $545.45 million OC $514.87 million Od $485.45 million O e None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started