Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are analyzing four light fixture companies in the Light Fixture Industry. The first company, Bright's Light Fixtures, is a national manufacturer that has been

You are analyzing four light fixture companies in the Light Fixture Industry. The first company, Bright's Light Fixtures, is a national manufacturer that has been in business for 20 years. It manufactures reasonably priced, traditional light fixtures with a price range that is attractive to the general public. Retailers sell its light fixtures nation-wide, including large "do it yourself stores" such as Canadian Tire and Home Depot. After a slow start, Bright's has enjoyed considerable success over the past five years.

The company is publicly traded and its shares are currently selling for $11.50. The second company, Dull Custom Light Fixtures, also sells light fixtures, but has traditionally catered to the more discriminating buyer who is willing to pay a high price for custom designs. Recently, however the company has started to manufacture a variety of retail lines, but it is still very selective as to the retailers with whom it will deal.

Retailers must meet high quality standards before they are able to carry the Dull brand. Dull has been in business for over 100 years. The company went public five years ago, which coincided with the decision to carry the retail line of light fixtures. The movement to retail sales has been positive for Dull Custom Light fixtures and the company's share price is now $32. The third company, Warehouse Light Fixtures caters to the commercial market supplying low-cost fixtures to home builders and large volume custom designs for industrial customers. More of a niche market, the company is controlled by its founder who has no interest in changing the market segments they sell to. The company's shares are traded publicly but the founder maintains a controlling interest. Sales improve modestly each year and the company enjoys a solid brand image with loyal commercial clients. Shares have had some traction is the past year and are trading up at $8.75. While they mostly sell direct, they do rely on a limited number of wholesalers in cities that are not in their core geographic region. The fourth company Light Fixtures International (LFI) manufactures most of its products in China and sells low-cost fixtures in the discount market to value conscious customers through discount retailers throughout Canada and the US.

They make slightly differentiated products that are, "house branded" for companies like COSTCO, Walmart, Target and other discount retailers. LFI has been in business for 30 years and shares of the company have traded favorably at $16.38 on average.

The company is publicly traded and its shares are currently selling for $11.50. The second company, Dull Custom Light Fixtures, also sells light fixtures, but has traditionally catered to the more discriminating buyer who is willing to pay a high price for custom designs. Recently, however the company has started to manufacture a variety of retail lines, but it is still very selective as to the retailers with whom it will deal.

Retailers must meet high quality standards before they are able to carry the Dull brand. Dull has been in business for over 100 years. The company went public five years ago, which coincided with the decision to carry the retail line of light fixtures. The movement to retail sales has been positive for Dull Custom Light fixtures and the company's share price is now $32. The third company, Warehouse Light Fixtures caters to the commercial market supplying low-cost fixtures to home builders and large volume custom designs for industrial customers. More of a niche market, the company is controlled by its founder who has no interest in changing the market segments they sell to. The company's shares are traded publicly but the founder maintains a controlling interest. Sales improve modestly each year and the company enjoys a solid brand image with loyal commercial clients. Shares have had some traction is the past year and are trading up at $8.75. While they mostly sell direct, they do rely on a limited number of wholesalers in cities that are not in their core geographic region. The fourth company Light Fixtures International (LFI) manufactures most of its products in China and sells low-cost fixtures in the discount market to value conscious customers through discount retailers throughout Canada and the US.

They make slightly differentiated products that are, "house branded" for companies like COSTCO, Walmart, Target and other discount retailers. LFI has been in business for 30 years and shares of the company have traded favorably at $16.38 on average.

In addition to the above financial information, you have determined that the companies make all of their sales on account and that the cost of sales is about 30% for Bright's and 40% for Dull, 35% for Warehouse and 29% for LFI. All companies have a corporate tax rate of 28.5%. The most recent annual reports, available to the public, show that Bright has 4,000,000 common shares outstanding while Dull has 500,000 common shares, Warehouse has 14,000,000 and LFI has 5,000,000 shares outstanding.

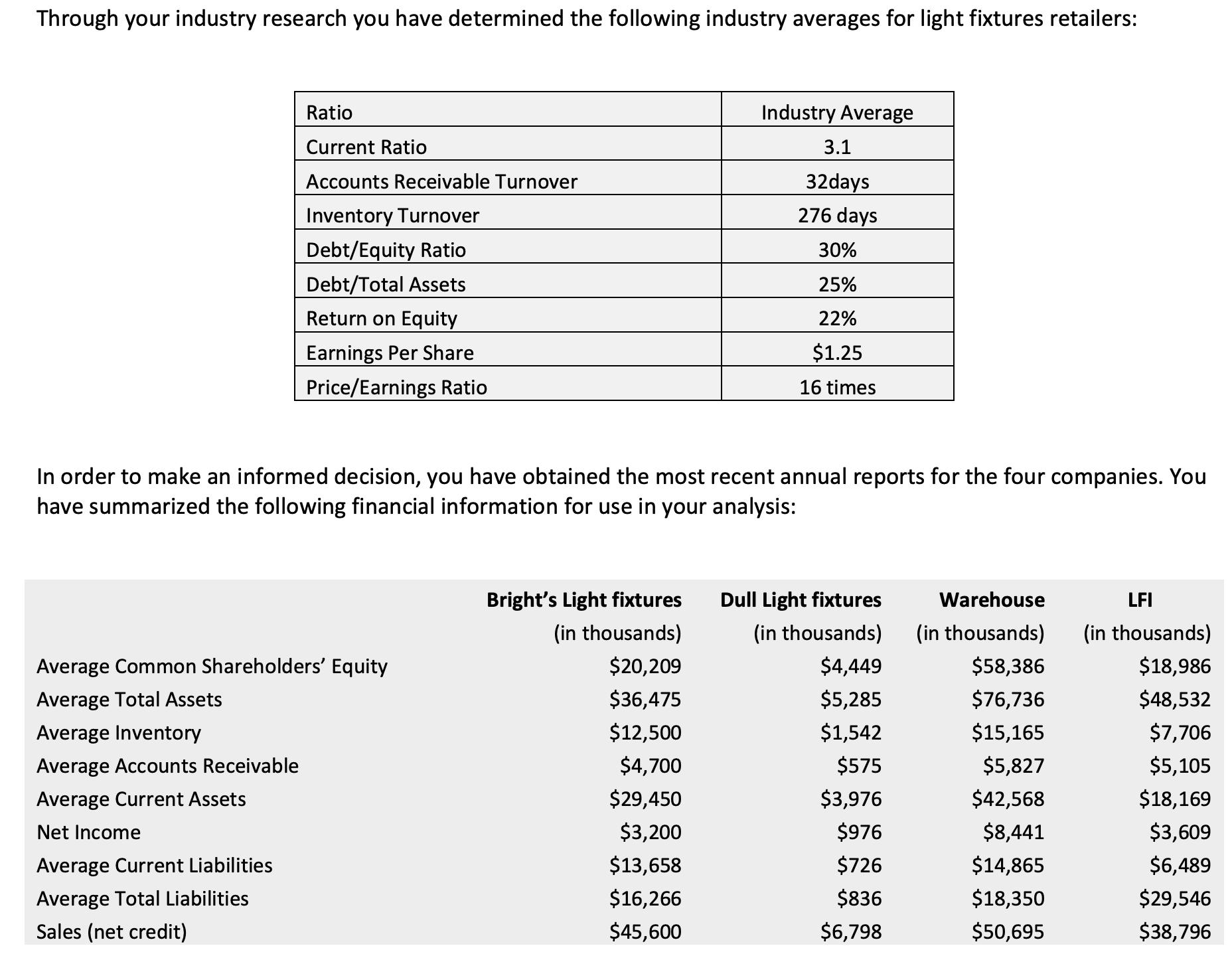

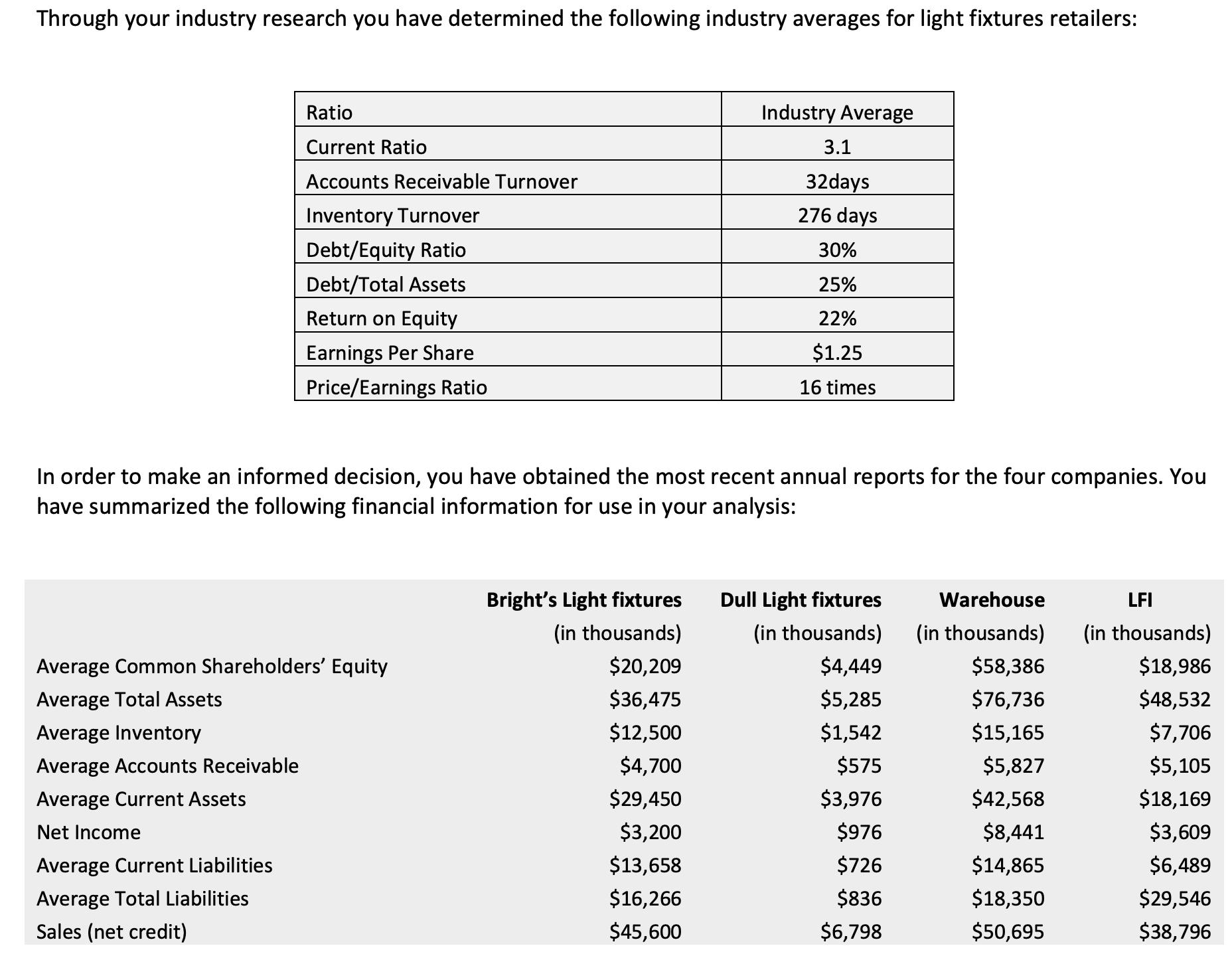

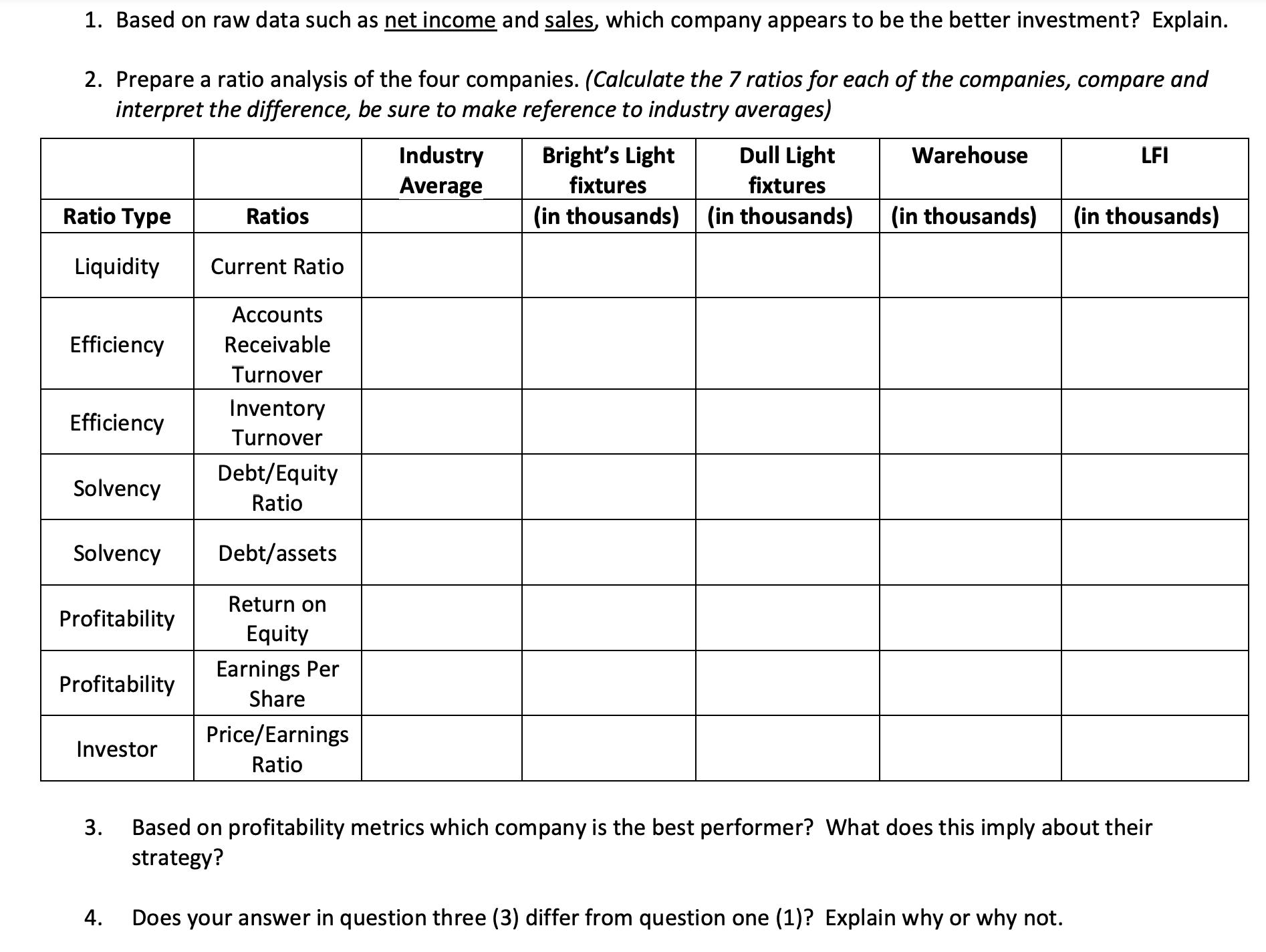

Through your industry research you have determined the following industry averages for light fixtures retailers: Ratio Current Ratio Accounts Receivable Turnover Inventory Turnover Debt/Equity Ratio Debt/Total Assets Return on Equity Earnings Per Share Price/Earnings Ratio Average Common Shareholders' Equity Average Total Assets Average Inventory Average Accounts Receivable Average Current Assets Net Income Average Current Liabilities Average Total Liabilities Sales (net credit) Bright's Light fixtures (in thousands) $20,209 $36,475 Industry Average In order to make an informed decision, you have obtained the most recent annual reports for the four companies. You have summarized the following financial information for use in your analysis: $12,500 $4,700 $29,450 $3,200 $13,658 $16,266 $45,600 3.1 32days 276 days 30% 25% 22% $1.25 16 times Dull Light fixtures (in thousands) $4,449 $5,285 $1,542 $575 $3,976 $976 $726 $836 $6,798 Warehouse (in thousands) $58,386 $76,736 $15,165 $5,827 $42,568 $8,441 $14,865 $18,350 $50,695 LFI (in thousands) $18,986 $48,532 $7,706 $5,105 $18,169 $3,609 $6,489 $29,546 $38,796

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Based on raw data such as net income and sales it is not possible to determine which company appears to be the better investment Net income and sales alone do not provide enough information to assess ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started