Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are analyzing the behavior of long-term interest rates. You regress the change in the log yield on an m-period bond onto the log

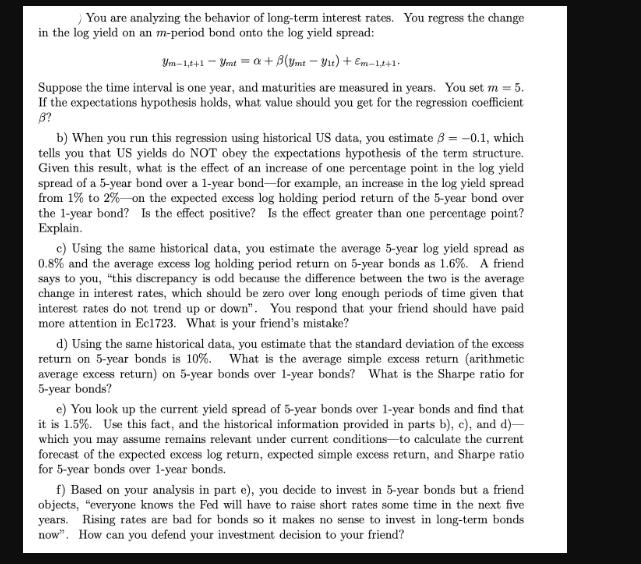

You are analyzing the behavior of long-term interest rates. You regress the change in the log yield on an m-period bond onto the log yield spread: Um-1,t+1-ymt = a+B(me - Vit) + Em-1t+1+ Suppose the time interval is one year, and maturities are measured in years. You set m = 5. If the expectations hypothesis holds, what value should you get for the regression coefficient B? b) When you run this regression using historical US data, you estimate 8 = -0.1, which tells you that US yields do NOT obey the expectations hypothesis of the term structure. Given this result, what is the effect of an increase of one percentage point in the log yield spread of a 5-year bond over a 1-year bond-for example, an increase in the log yield spread from 1% to 2% on the expected excess log holding period return of the 5-year bond over the 1-year bond? Is the effect positive? Is the effect greater than one percentage point? Explain. c) Using the same historical data, you estimate the average 5-year log yield spread as 0.8% and the average excess log holding period return on 5-year bonds as 1.6%. A friend says to you, "this discrepancy is odd because the difference between the two is the average change in interest rates, which should be zero over long enough periods of time given that interest rates do not trend up or down". You respond that your friend should have paid more attention in Ec1723. What is your friend's mistake? d) Using the same historical data, you estimate that the standard deviation of the excess return on 5-year bonds is 10%. What is the average simple excess return (arithmetic average excess return) on 5-year bonds over 1-year bonds? What is the Sharpe ratio for 5-year bonds? e) You look up the current yield spread of 5-year bonds over 1-year bonds and find that it is 1.5%. Use this fact, and the historical information provided in parts b), c), and d)- which you may assume remains relevant under current conditions to calculate the current forecast of the expected excess log return, expected simple excess return, and Sharpe ratio for 5-year bonds over 1-year bonds. f) Based on your analysis in part e), you decide to invest in 5-year bonds but a friend objects, "everyone knows the Fed will have to raise short rates some time in the next five years. Rising rates are bad for bonds so it makes no sense to invest in long-term bonds now". How can you defend your investment decision to your friend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analysis of LongTerm Interest Rates and Investment Decisions a Expectations Hypothesis and Regression Coefficient Under the expectations hypothesis the change in the longterm yield should be equal to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started