Question

You are analyzing the beta for HP and have broken down the business of The company into four divisions. The company has $1 billion

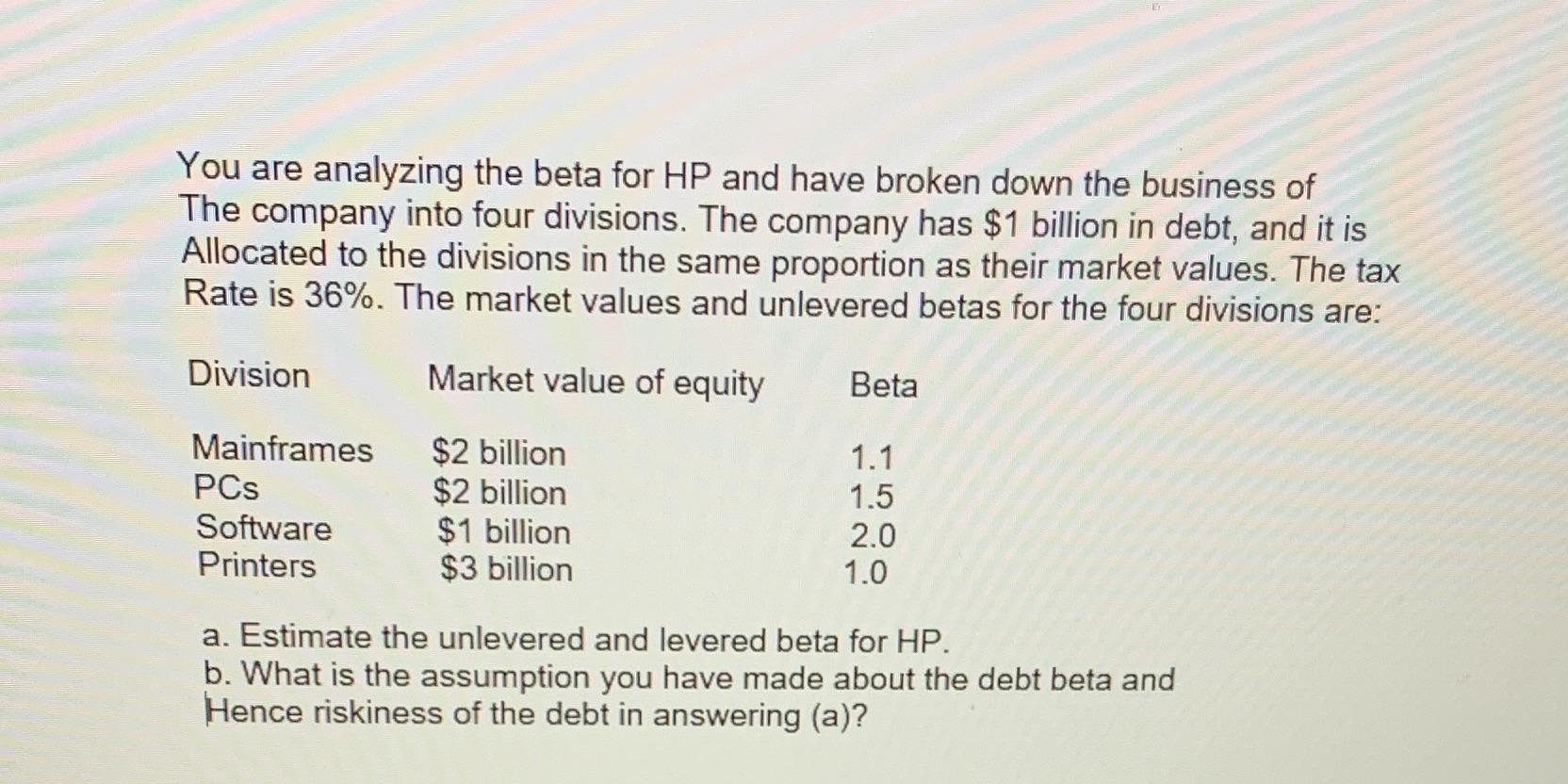

You are analyzing the beta for HP and have broken down the business of The company into four divisions. The company has $1 billion in debt, and it is Allocated to the divisions in the same proportion as their market values. The tax Rate is 36%. The market values and unlevered betas for the four divisions are: Market value of equity $2 billion $2 billion $1 billion $3 billion Division Mainframes PCs Software Printers Beta 1.1 1.5 2.0 1.0 a. Estimate the unlevered and levered beta for HP. b. What is the assumption you have made about the debt beta and Hence riskiness of the debt in answering (a)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Total Market Value of Equity is 2 2 1 3 8 Unlevered beta of HP can be calculate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App