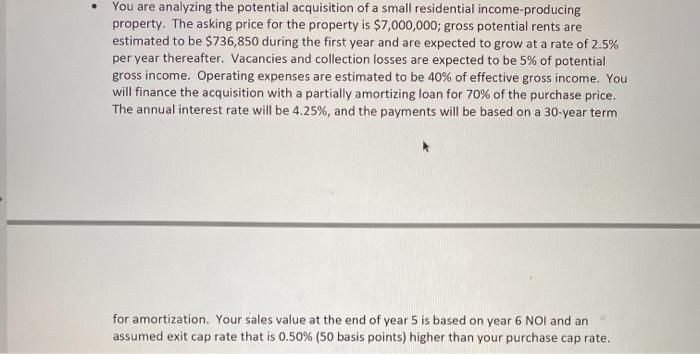

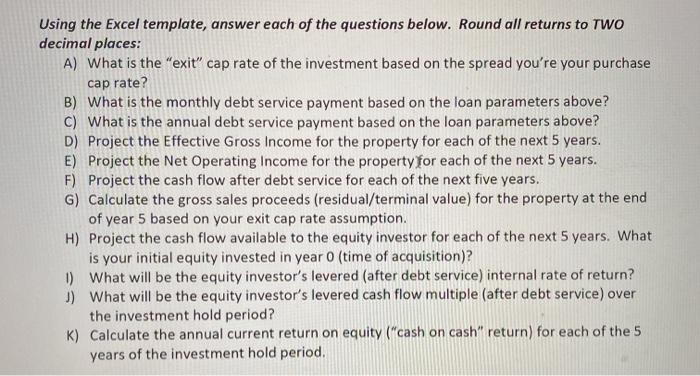

You are analyzing the potential acquisition of a small residential income-producing property. The asking price for the property is $7,000,000; gross potential rents are estimated to be $736,850 during the first year and are expected to grow at a rate of 2.5% per year thereafter. Vacancies and collection losses are expected to be 5% of potential gross income. Operating expenses are estimated to be 40% of effective gross income. You will finance the acquisition with a partially amortizing loan for 70% of the purchase price, The annual interest rate will be 4.25%, and the payments will be based on a 30-year term for amortization. Your sales value at the end of year 5 is based on year 6 NOI and an assumed exit cap rate that is 0.50% (50 basis points) higher than your purchase cap rate. Using the Excel template, answer each of the questions below. Round all returns to TWO decimal places: A) What is the "exit" cap rate of the investment based on the spread you're your purchase cap rate? B) What is the monthly debt service payment based on the loan parameters above? C) What is the annual debt service payment based on the loan parameters above? D) Project the Effective Gross Income for the property for each of the next 5 years. E) Project the Net Operating Income for the property for each of the next 5 years. F) Project the cash flow after debt service for each of the next five years. G) Calculate the gross sales proceeds (residual/terminal value) for the property at the end of year 5 based on your exit cap rate assumption. H) Project the cash flow available to the equity investor for each of the next 5 years. What is your initial equity invested in year 0 (time of acquisition)? 1) What will be the equity investor's levered (after debt service) internal rate of return? 3) What will be the equity investor's levered cash flow multiple (after debt service) over the investment hold period? K) Calculate the annual current return on equity ("cash on cash" return) for each of the 5 years of the investment hold period. $ 7,000,000 S 736,850 5% 40% % of EGI 0% 0.50X 70% 4.25% 30 years 1 2 Purchase Price 3 Year 1 PGI 4 Vacancy & Collection Loss 5 Operating Expenses 6 Purchase Cap Rate 7 Exit Cap Rate Spread 8 Exit Cap Rate 9 LTV 10 Annual Interest Rate 11 Term for Amortitation 12 Loan Amount 13 Monthly Debt Service Payment 14 Annual Debt Service Payment 15 16 Rental Income Growth Rate 17 18 Year 19 Potential Gross Income 20 Less: 21 22 Lest: 23 24 Less 25 26 Expected Gross Sales Proceeds 27 Less 28 2.SON 2.50% 2.SON 2.50N 2.SON 0 2 3 4 5 $ 1 736,850 30 Levered Equity RR 31 Equity Cash Flow Multiple 33 Current Cash Flow Available to quity 34 Current Return on Equity 35 36 37 You are analyzing the potential acquisition of a small residential income-producing property. The asking price for the property is $7,000,000; gross potential rents are estimated to be $736,850 during the first year and are expected to grow at a rate of 2.5% per year thereafter. Vacancies and collection losses are expected to be 5% of potential gross income. Operating expenses are estimated to be 40% of effective gross income. You will finance the acquisition with a partially amortizing loan for 70% of the purchase price, The annual interest rate will be 4.25%, and the payments will be based on a 30-year term for amortization. Your sales value at the end of year 5 is based on year 6 NOI and an assumed exit cap rate that is 0.50% (50 basis points) higher than your purchase cap rate. Using the Excel template, answer each of the questions below. Round all returns to TWO decimal places: A) What is the "exit" cap rate of the investment based on the spread you're your purchase cap rate? B) What is the monthly debt service payment based on the loan parameters above? C) What is the annual debt service payment based on the loan parameters above? D) Project the Effective Gross Income for the property for each of the next 5 years. E) Project the Net Operating Income for the property for each of the next 5 years. F) Project the cash flow after debt service for each of the next five years. G) Calculate the gross sales proceeds (residual/terminal value) for the property at the end of year 5 based on your exit cap rate assumption. H) Project the cash flow available to the equity investor for each of the next 5 years. What is your initial equity invested in year 0 (time of acquisition)? 1) What will be the equity investor's levered (after debt service) internal rate of return? 3) What will be the equity investor's levered cash flow multiple (after debt service) over the investment hold period? K) Calculate the annual current return on equity ("cash on cash" return) for each of the 5 years of the investment hold period. $ 7,000,000 S 736,850 5% 40% % of EGI 0% 0.50X 70% 4.25% 30 years 1 2 Purchase Price 3 Year 1 PGI 4 Vacancy & Collection Loss 5 Operating Expenses 6 Purchase Cap Rate 7 Exit Cap Rate Spread 8 Exit Cap Rate 9 LTV 10 Annual Interest Rate 11 Term for Amortitation 12 Loan Amount 13 Monthly Debt Service Payment 14 Annual Debt Service Payment 15 16 Rental Income Growth Rate 17 18 Year 19 Potential Gross Income 20 Less: 21 22 Lest: 23 24 Less 25 26 Expected Gross Sales Proceeds 27 Less 28 2.SON 2.50% 2.SON 2.50N 2.SON 0 2 3 4 5 $ 1 736,850 30 Levered Equity RR 31 Equity Cash Flow Multiple 33 Current Cash Flow Available to quity 34 Current Return on Equity 35 36 37