Answered step by step

Verified Expert Solution

Question

1 Approved Answer

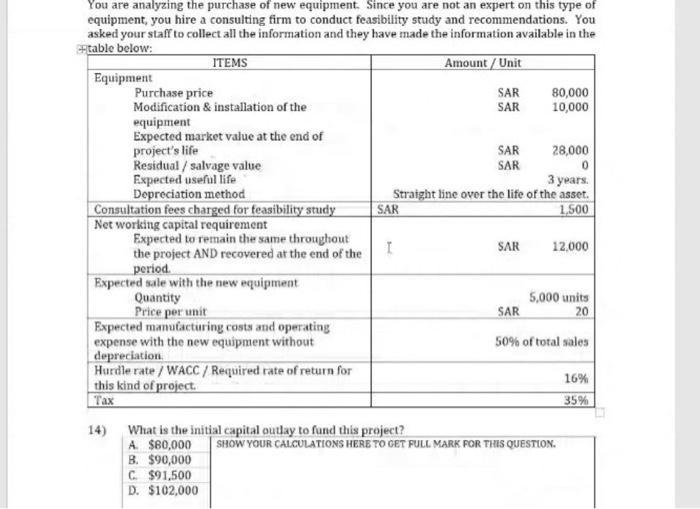

You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm

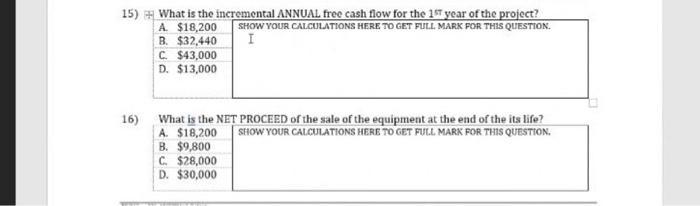

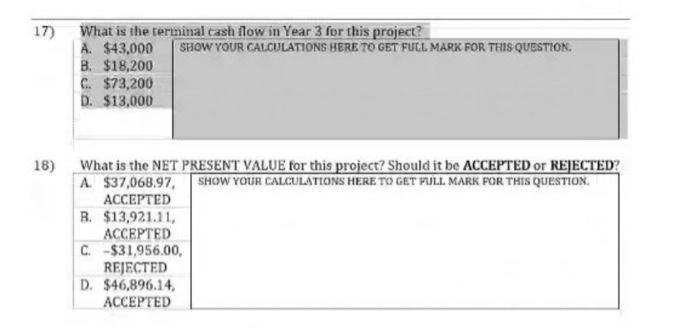

You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm to conduct feasibility study and recommendations. You asked your staff to collect all the information and they have made the information available in the table below: ITEMS Amount / Unit Equipment Purchase price Modification & installation of the equipment Expected market value at the end of project's life Residual/salvage value Expected useful life Depreciation method Consultation fees charged for feasibility study Net working capital requirement Expected to remain the same throughout the project AND recovered at the end of the period. Expected sale with the new equipment Quantity Price per unit Expected manufacturing costs and operating expense with the new equipment without depreciation 14) Hurdle rate/ WACC / Required rate of return for this kind of project. Tax I SAR SAR What is the initial capital outlay to fund this project? A $80,000 B. $90,000 C. $91,500 D. $102,000 SAR SAR 28,000 0 3 years. Straight line over the life of the asset. SAR 1,500 80,000 10,000 SAR 12,000 5,000 units 20 SAR 50% of total sales SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. 16% 35% 15) What is the incremental ANNUAL free cash flow for the 1st year of the project? A. $18,200 SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. B. $32,440 I C. $43,000 D. $13,000 16) What is the NET PROCEED of the sale of the equipment at the end of the its life? A. $18,200 SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. B. $9,800 C. $28,000 D. $30,000 17) 18) What is the terminal cash flow in Year 3 for this project? A. $43,000 SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. B. $18,200 C. $73,200 D. $13,000 What is the NET PRESENT VALUE for this project? Should it be ACCEPTED or REJECTED? A. $37,068.97, SHOW YOUR CALCULATIONS HERE TO GET PULL MARK FOR THIS QUESTION. ACCEPTED B. $13,921.11, ACCEPTED C. -$31,956.00, REJECTED D. $46,896.14, ACCEPTED

Step by Step Solution

★★★★★

3.59 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Initial Capital Outlay Initial Capital Outlay Equipment Purchase Price Modification Installation Consultation Fees Net Working Capital Requirement Ini...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started