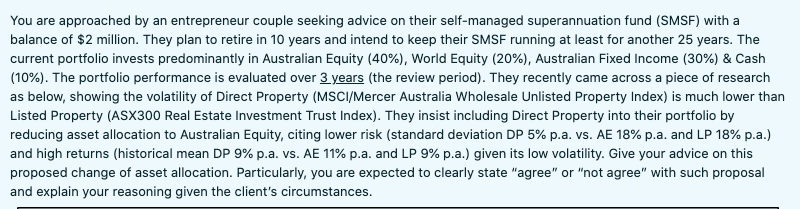

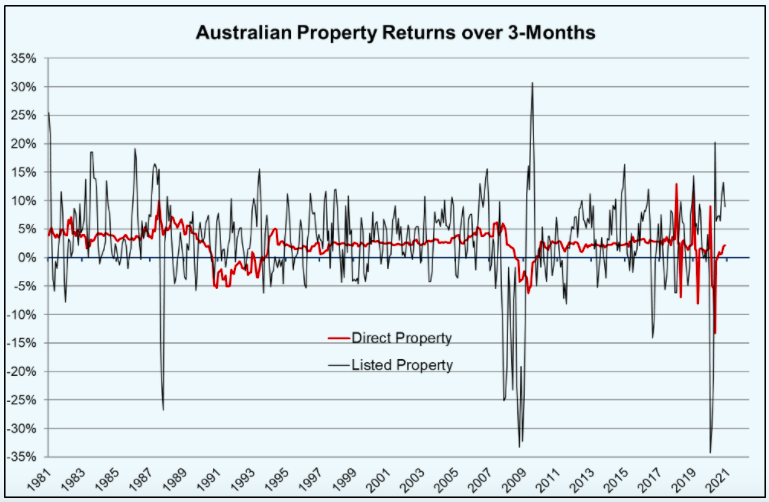

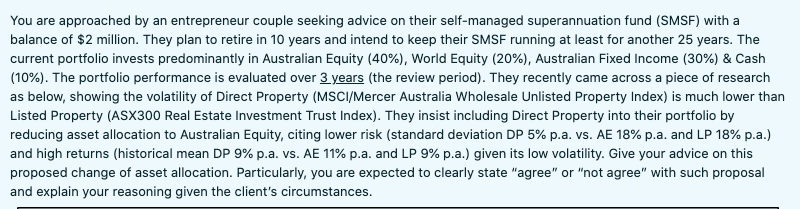

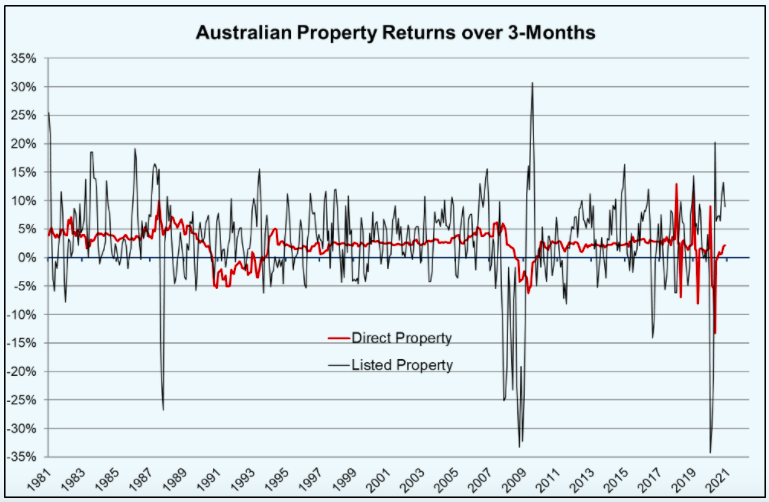

You are approached by an entrepreneur couple seeking advice on their self-managed superannuation fund (SMSF) with a balance of $2 million. They plan to retire in 10 years and intend to keep their SMSF running at least for another 25 years. The current portfolio invests predominantly in Australian Equity (40%), World Equity (20%), Australian Fixed Income (30%) & Cash (10%). The portfolio performance is evaluated over 3 years (the review period). They recently came across a piece of research as below, showing the volatility of Direct Property (MSCI/Mercer Australia Wholesale Unlisted Property Index) is much lower than Listed Property (ASX300 Real Estate Investment Trust Index). They insist including Direct Property into their portfolio by reducing asset allocation to Australian Equity, citing lower risk (standard deviation DP 5% p.a. vs. AE 18% p.a. and LP 18% p.a.) and high returns (historical mean DP 9% p.a. vs. AE 11% p.a. and LP 9% p.a.) given its low volatility. Give your advice on this proposed change of asset allocation. Particularly, you are expected to clearly state "agree" or "not agree with such proposal and explain your reasoning given the client's circumstances. Australian Property Returns over 3-Months 35% 30% 25% 20% 15% 10% 5% 0% -5% |-10% |-15% -Direct Property -Listed Property -20% -25% |-30% -35% 1983 1987 1991 1993 1995 1997 2007 2011 2013 2015 2017 2019 2021 1981 1985 1989 1999 2001 2003 2005 2009 You are approached by an entrepreneur couple seeking advice on their self-managed superannuation fund (SMSF) with a balance of $2 million. They plan to retire in 10 years and intend to keep their SMSF running at least for another 25 years. The current portfolio invests predominantly in Australian Equity (40%), World Equity (20%), Australian Fixed Income (30%) & Cash (10%). The portfolio performance is evaluated over 3 years (the review period). They recently came across a piece of research as below, showing the volatility of Direct Property (MSCI/Mercer Australia Wholesale Unlisted Property Index) is much lower than Listed Property (ASX300 Real Estate Investment Trust Index). They insist including Direct Property into their portfolio by reducing asset allocation to Australian Equity, citing lower risk (standard deviation DP 5% p.a. vs. AE 18% p.a. and LP 18% p.a.) and high returns (historical mean DP 9% p.a. vs. AE 11% p.a. and LP 9% p.a.) given its low volatility. Give your advice on this proposed change of asset allocation. Particularly, you are expected to clearly state "agree" or "not agree with such proposal and explain your reasoning given the client's circumstances. Australian Property Returns over 3-Months 35% 30% 25% 20% 15% 10% 5% 0% -5% |-10% |-15% -Direct Property -Listed Property -20% -25% |-30% -35% 1983 1987 1991 1993 1995 1997 2007 2011 2013 2015 2017 2019 2021 1981 1985 1989 1999 2001 2003 2005 2009