Question

You are asked to build a flexible loan amortization table for your summer internship at the bank. The following is basic information for the loan

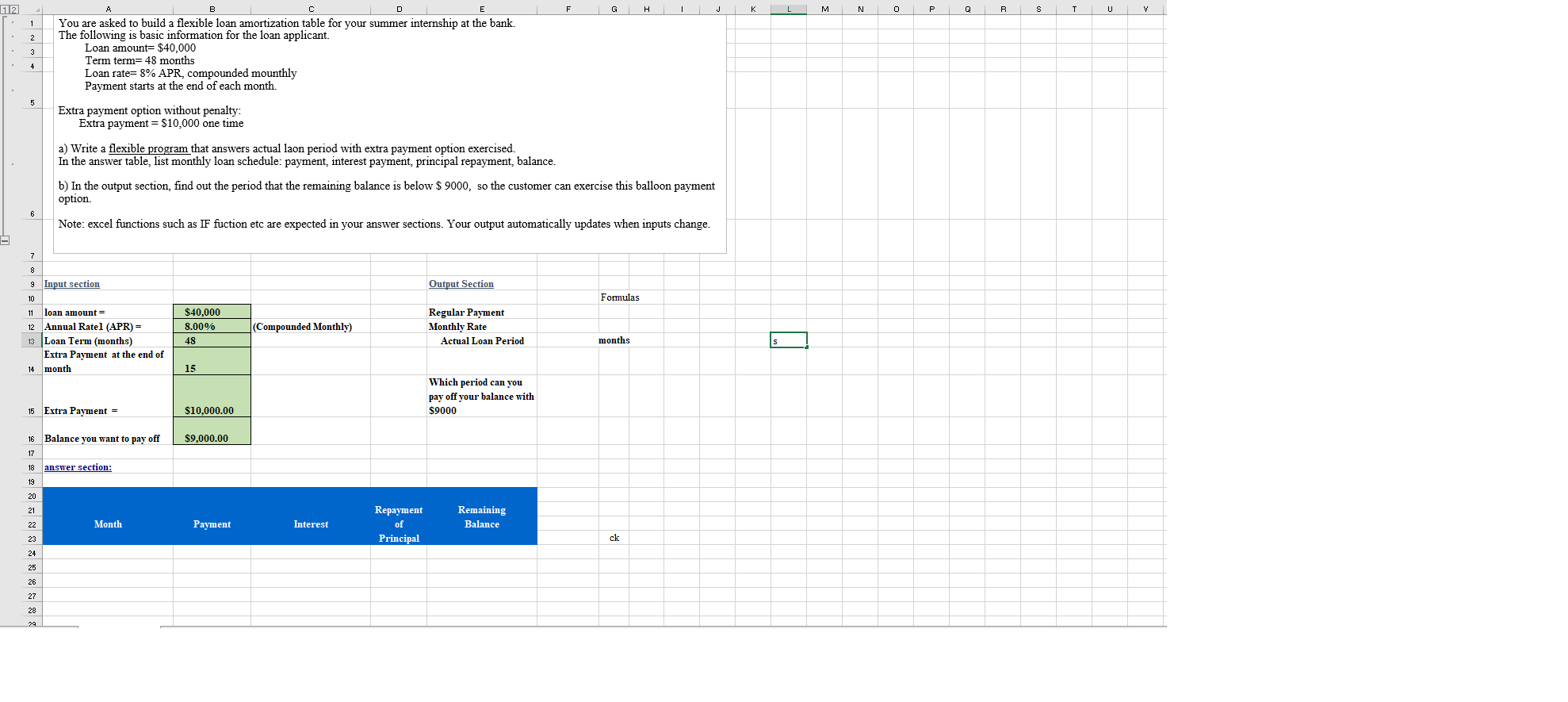

You are asked to build a flexible loan amortization table for your summer internship at the bank.

The following is basic information for the loan applicant.

Loan amount= $40,000

Term term= 48 months

Loan rate= 8% APR, compounded monthly

Payment starts at the end of each month.

Extra payment option without penalty:

Extra payment = $10,000 one time

a) give flexible program that answers actual loan period with extra payment option exercised.

In the answer table, list monthly loan schedule: payment, interest payment, principal repayment, balance.

b) In the output section, find out the period that the remaining balance is below $ 9000,so the customer can exercise this balloon payment option.

Note: excel functions such as IF fuction etc are expected in your answer sections. Your output automatically updates when inputs change.

12 1 2 D F H I J K M N 0 P Q R S T U V You are asked to build a flexible loan amortization table for your summer internship at the bank. The following is basic information for the loan applicant. Loan amount $40,000 Term term= 48 months 4 Loan rate=8% APR, compounded mounthly Payment starts at the end of each month. Extra payment option without penalty: Extra payment = $10,000 one time a) Write a flexible program that answers actual laon period with extra payment option exercised. In the answer table, list monthly loan schedule: payment, interest payment, principal repayment, balance. b) In the output section, find out the period that the remaining balance is below $9000, so the customer can exercise this balloon payment option. Note: excel functions such as IF fuction etc are expected in your answer sections. Your output automatically updates when inputs change. 7 8 9 Input section Output Section 10 11 loan amount = Formulas 12 Annual Ratel (APR) = $40,000 8.00% (Compounded Monthly) Regular Payment Monthly Rate 13 Loan Term (months) 48 Actual Loan Period months S 14 Extra Payment at the end of month 15 15 Extra Payment = 16 17 Balance you want to pay off 18 answer section: $10,000.00 $9,000.00 Which period can you pay off your balance with $9000 21 22 Month Payment Interest 23 Repayment of Principal Remaining Balance ck 20 24 25 26 27 28 - 8 8 * * 8 19 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started