You are asked to mark-to-market the following swap contract. All quoted rates below are APRs, except OIS rates which are continuously compounded. Swap has

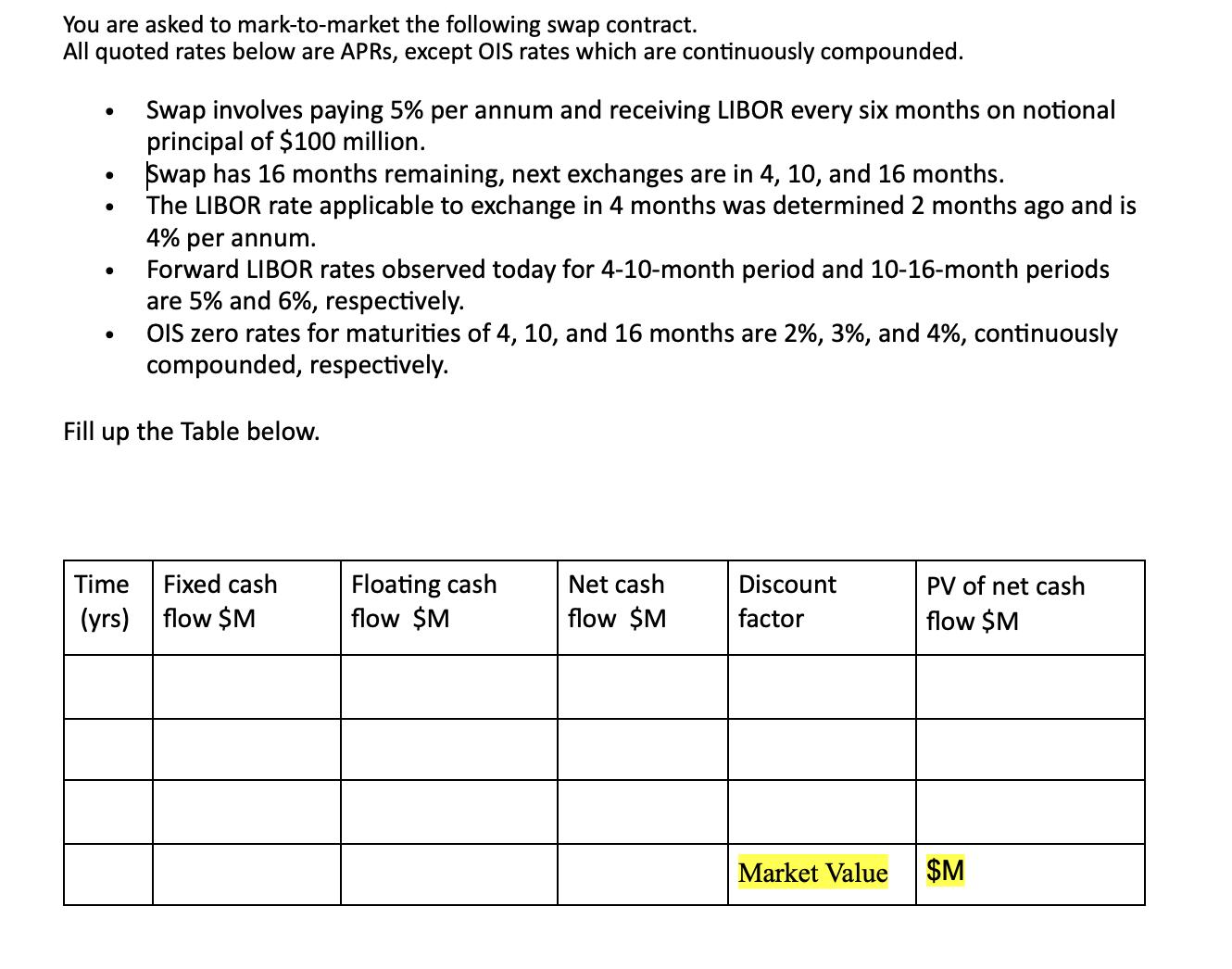

You are asked to mark-to-market the following swap contract. All quoted rates below are APRs, except OIS rates which are continuously compounded. Swap has 16 months remaining, next exchanges are in 4, 10, and 16 months. The LIBOR rate applicable to exchange in 4 months was determined 2 months ago and is 4% per annum. Forward LIBOR rates observed today for 4-10-month period and 10-16-month periods are 5% and 6%, respectively. OIS zero rates for maturities of 4, 10, and 16 months are 2%, 3%, and 4%, continuously compounded, respectively. Fill up the Table below. Swap involves paying 5% per annum and receiving LIBOR every six months on notional principal of $100 million. Time Fixed cash (yrs) flow $M Floating cash flow $M Net cash flow $M Discount factor Market Value PV of net cash flow $M $M

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To marktomarket the swap contract we need to calculate the present value of the fixed and f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started