Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are assisting the chief financial officer (CFO) to conduct a due diligence to determine the acquisition price of a target firm. Because the target

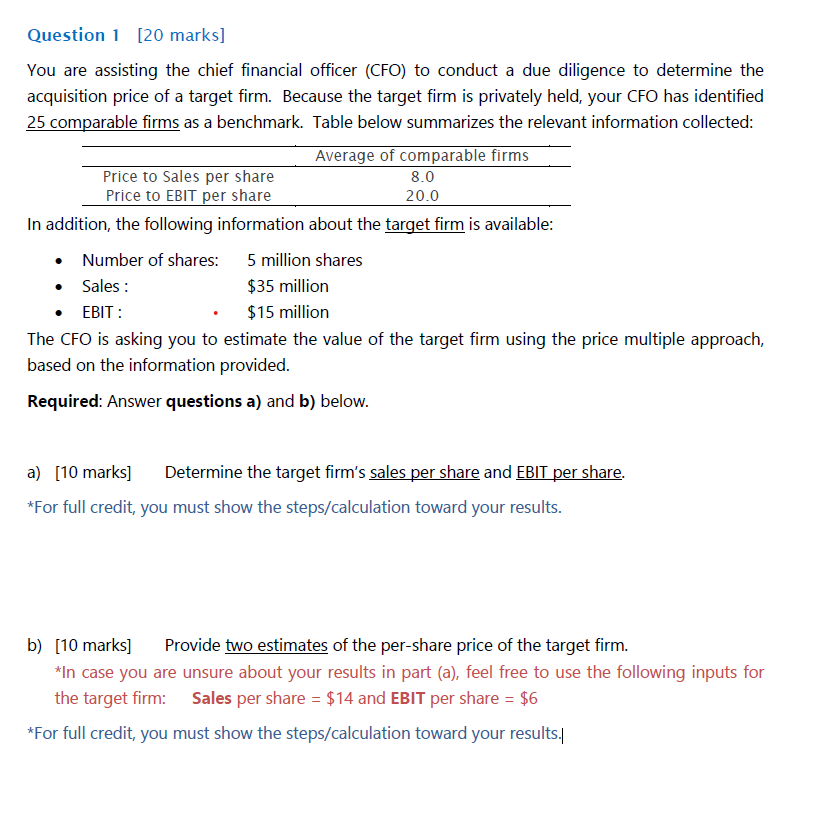

You are assisting the chief financial officer (CFO) to conduct a due diligence to determine the acquisition price of a target firm. Because the target firm is privately held, your CFO has identified 25 comparable firms as a benchmark. Table below summarizes the relevant information collected: In addition, the following information about the target firm is available: - Number of shares: 5 million shares - Sales: $35 million - EBIT: $15 million The CFO is asking you to estimate the value of the target firm using the price multiple approach, based on the information provided. Required: Answer questions a) and b) below. a) [10 marks] Determine the target firm's sales per share and EBIT per share. *For full credit, you must show the steps/calculation toward your results. b) [10 marks] Provide two estimates of the per-share price of the target firm. *In case you are unsure about your results in part (a), feel free to use the following inputs for the target firm: Sales per share =$14 and EBIT per share =$6 *For full credit, you must show the steps/calculation toward your results

You are assisting the chief financial officer (CFO) to conduct a due diligence to determine the acquisition price of a target firm. Because the target firm is privately held, your CFO has identified 25 comparable firms as a benchmark. Table below summarizes the relevant information collected: In addition, the following information about the target firm is available: - Number of shares: 5 million shares - Sales: $35 million - EBIT: $15 million The CFO is asking you to estimate the value of the target firm using the price multiple approach, based on the information provided. Required: Answer questions a) and b) below. a) [10 marks] Determine the target firm's sales per share and EBIT per share. *For full credit, you must show the steps/calculation toward your results. b) [10 marks] Provide two estimates of the per-share price of the target firm. *In case you are unsure about your results in part (a), feel free to use the following inputs for the target firm: Sales per share =$14 and EBIT per share =$6 *For full credit, you must show the steps/calculation toward your results Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started