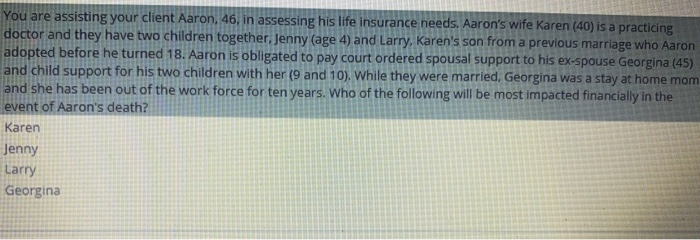

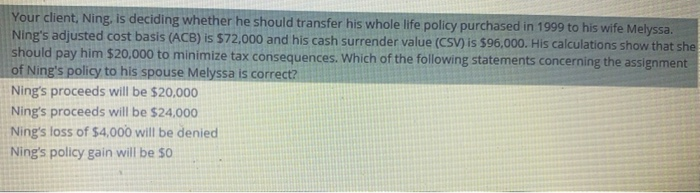

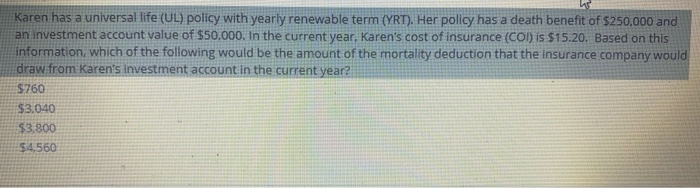

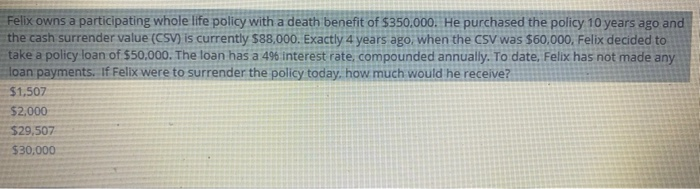

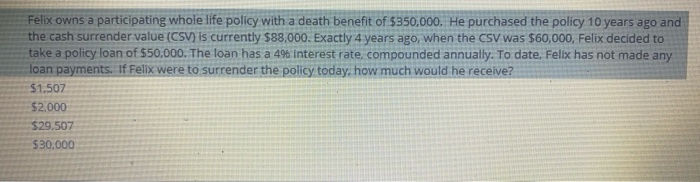

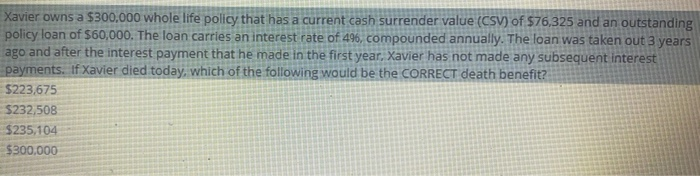

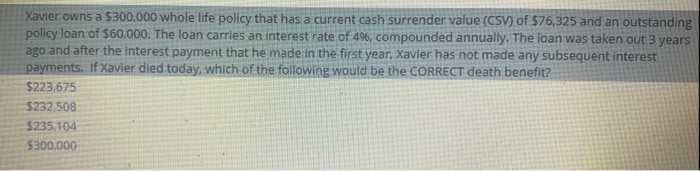

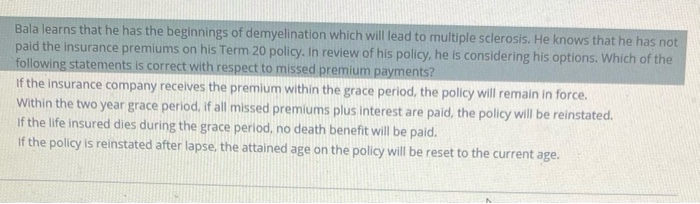

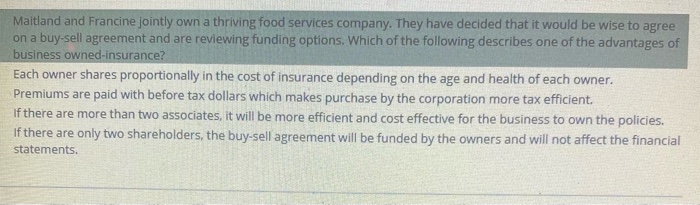

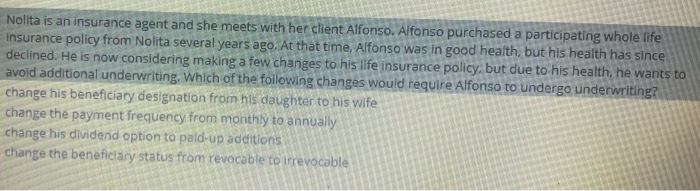

You are assisting your client Aaron, 46, in assessing his life insurance needs. Aaron's wife Karen (40) is a practicing doctor and they have two children together, Jenny (age 4) and Larry, Karen's son from a previous marriage who Aaron adopted before he turned 18. Aaron is obligated to pay court ordered spousal support to his ex-spouse Georgina (45) and child support for his two children with her (9 and 10). While they were married, Georgina was a stay at home mom and she has been out of the work force for ten years. Who of the following will be most impacted financially in the event of Aaron's death? Karen Jenny Larry Georgina Your client, Ning, is deciding whether he should transfer his whole life policy purchased in 1999 to his wife Melyssa. Ning's adjusted cost basis (ACB) is $72,000 and his cash surrender value (CSV) is 596,000. His calculations show that she should pay him $20,000 to minimize tax consequences. Which of the following statements concerning the assignment of Ning's policy to his spouse Melyssa is correct? Ning's proceeds will be $20,000 Ning's proceeds will be $24,000 Ning's loss of $4,000 will be denied Ning's policy gain will be $0 Karen has a universal life (UL) policy with yearly renewable term (YRT). Her policy has a death benefit of $250,000 and an investment account value of $50.000. In the current year, Karen's cost of insurance (CO) is $15.20. Based on this information, which of the following would be the amount of the mortality deduction that the insurance company would draw from Karen's investment account in the current year? $760 $3.040 $3,800 $4,560 Felix owns a participating whole life policy with a death benefit of $350,000. He purchased the policy 10 years ago and the cash surrender value (CSV) is currently $88,000. Exactly 4 years ago, when the CSV was $60,000, Felix decided to take a policy loan of $50,000. The loan has a 496 interest rate, compounded annually. To date, Felix has not made any loan payments. If Felix were to surrender the policy today, how much would he receive? $1,507 $2,000 $29,507 $30,000 Felix owns a participating whole life policy with a death benefit of $350,000. He purchased the policy 10 years ago and the cash surrender value (CSV) is currently $88,000. Exactly 4 years ago, when the CSV was $60,000, Felix decided to take a policy loan of $50,000. The loan has a 496 interest rate, compounded annually. To date, Felix has not made any loan payments. If Felix were to surrender the policy today, how much would he receive? $1,507 $2.000 $29,507 $30,000 Xavier owns a $300,000 whole life policy that has a current cash surrender value (CSV) of $76,325 and an outstanding policy loan of $60,000. The loan carries an interest rate of 496, compounded annually. The loan was taken out 3 years ago and after the interest payment that he made in the first year, Xavier has not made any subsequent interest payments. If Xavier died today, which of the following would be the CORRECT death benefit? $223,675 $232.508 $235.104 $300,000 Xavier owns a $300,000 whole life policy that has a current cash surrender value (CSV) of 576,325 and an outstanding policy loan of $60,000. The loan carries an interest rate of 496, compounded annually. The loan was taken out 3 years ago and after the interest payment that he made in the first year, Xavier has not made any subsequent interest payments. If Xavier died today, which of the following would be the CORRECT death benefit? $223,675 $232,508 $235,104 $300,000 Bala learns that he has the beginnings of demyelination which will lead to multiple sclerosis. He knows that he has not paid the insurance premiums on his Term 20 policy. In review of his policy, he is considering his options. Which of the following statements is correct with respect to missed premium payments? If the insurance company receives the premium within the grace period, the policy will remain in force. Within the two year grace period, if all missed premiums plus interest are paid, the policy will be reinstated. If the life insured dies during the grace period, no death benefit will be paid. If the policy is reinstated after lapse, the attained age on the policy will be reset to the current age. Maitland and Francine jointly own a thriving food services company. They have decided that it would be wise to agree on a buy-sell agreement and are reviewing funding options. Which of the following describes one of the advantages of business owned-insurance? Each owner shares proportionally in the cost of insurance depending on the age and health of each owner. Premiums are paid with before tax dollars which makes purchase by the corporation more tax efficient If there are more than two associates, it will be more efficient and cost effective for the business to own the policies. If there are only two shareholders, the buy-sell agreement will be funded by the owners and will not affect the financial statements. Nolita is an insurance agent and she meets with her client Alfonso. Alfonso purchased a participating whole life insurance policy from Nolita several years ago. At that time, Alfonso was in good health, but his health has since declined. He is now considering making a few changes to his life insurance policy, but due to his health, he wants to avoid additional underwriting. Which of the following changes would require Alfonso to undergo underwriting? change his beneficiary designation from his daughter to his wife change the payment frequency from monthly to annually change his dividend option to pald-up additions change the beneficiary status from revocable to irrevocable