Answered step by step

Verified Expert Solution

Question

1 Approved Answer

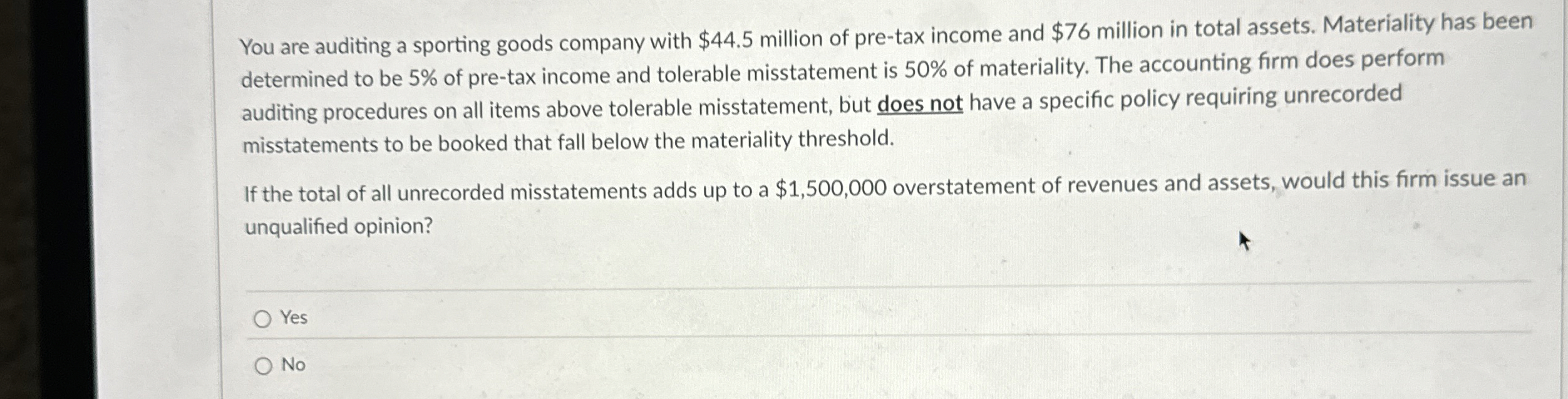

You are auditing a sporting goods company with $ 4 4 . 5 million of pre - tax income and $ 7 6 million in

You are auditing a sporting goods company with $ million of pretax income and $ million in total assets. Materiality has been

determined to be of pretax income and tolerable misstatement is of materiality. The accounting firm does perform

auditing procedures on all items above tolerable misstatement, but does not have a specific policy requiring unrecorded

misstatements to be booked that fall below the materiality threshold.

If the total of all unrecorded misstatements adds up to a $ overstatement of revenues and assets, would this firm issue an

unqualified opinion?

Yes

No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started