Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are auditing Crown Corporation for the year ended 2022, Its reported net income for the year 2021 and 2022 were P 3,000,000 and

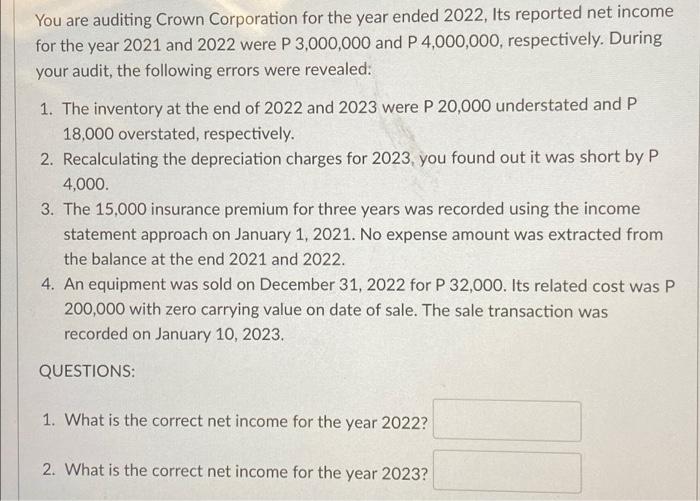

You are auditing Crown Corporation for the year ended 2022, Its reported net income for the year 2021 and 2022 were P 3,000,000 and P 4,000,000, respectively. During your audit, the following errors were revealed: 1. The inventory at the end of 2022 and 2023 were P 20,000 understated and P 18,000 overstated, respectively. 2. Recalculating the depreciation charges for 2023, you found out it was short by P 4,000. 3. The 15,000 insurance premium for three years was recorded using the income statement approach on January 1, 2021. No expense amount was extracted from the balance at the end 2021 and 2022. 4. An equipment was sold on December 31, 2022 for P 32,000. Its related cost was P 200,000 with zero carrying value on date of sale. The sale transaction was recorded on January 10, 2023. QUESTIONS: 1. What is the correct net income for the year 2022? 2. What is the correct net income for the year 2023?

Step by Step Solution

★★★★★

3.23 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Page NO I Answer Slep 1 Eso88 and ommARons axe Occursenc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started