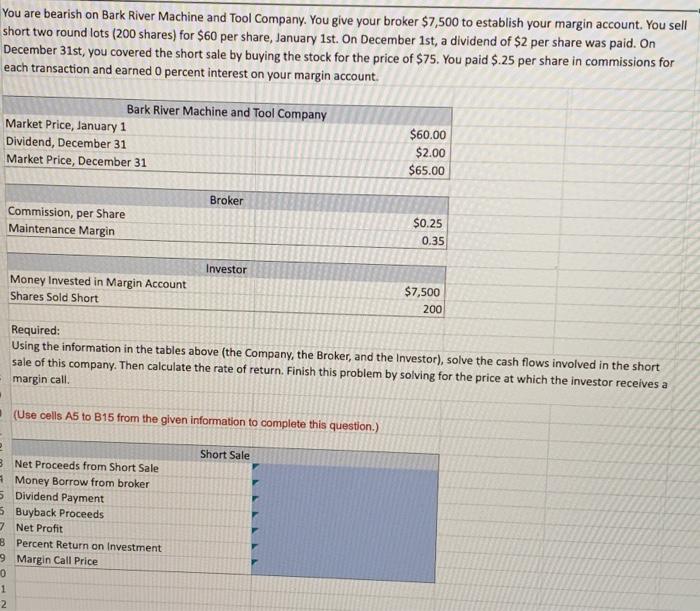

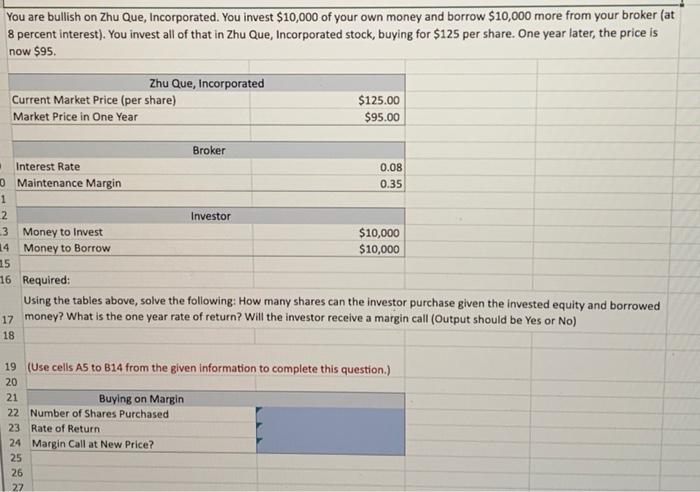

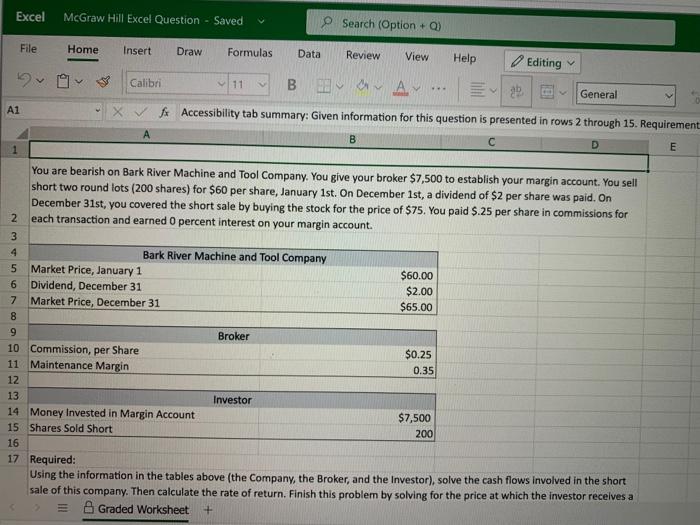

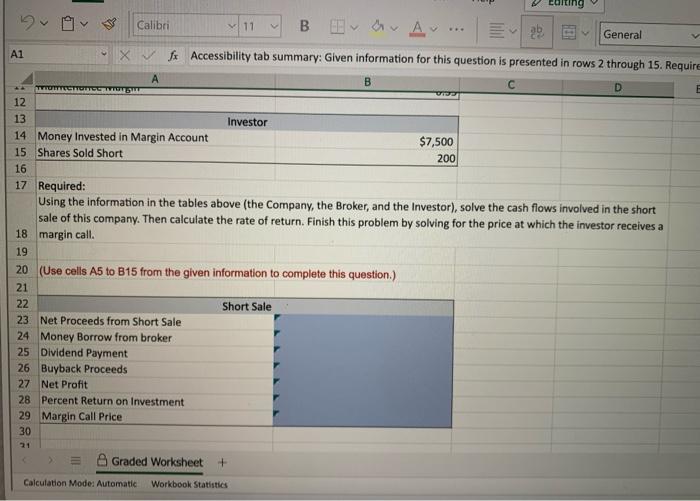

You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell short two round lots (200 shares) for $60 per share, January 1st. On December 1st, a dividend of $2 per share was paid. On December 31st, you covered the short sale by buying the stock for the price of $75. You paid $.25 per share in commissions for each transaction and earned 0 percent interest on your margin account. Bark River Machine and Tool Company Market Price, January 1 Dividend, December 31 $60.00 $2.00 $65.00 Market Price, December 31 Broker Commission, per Share $0.25 Maintenance Margin 0.35 Investor Money Invested in Margin Account $7,500 200 Shares Sold Short Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call. (Use cells A5 to B15 from the given information to complete this question.) 2 Short Sale 3 Net Proceeds from Short Sale Money Borrow from broker 5 Dividend Payment 5 Buyback Proceeds 7Net Profit B Percent Return on Investment 9 Margin Call Price 0 1 2 You are bullish on Zhu Que, Incorporated. You invest $10,000 of your own money and borrow $10,000 more from your broker (at 8 percent interest). You invest all of that in Zhu Que, Incorporated stock, buying for $125 per share. One year later, the price is now $95. Zhu Que, Incorporated Current Market Price (per share) Market Price in One Year $125.00 $95.00 Broker ( Interest Rate 0.08 0 Maintenance Margin 0.35 1 2 Investor 3 Money to Invest $10,000 $10,000 4 Money to Borrow 15 16 Required: Using the tables above, solve the following: How many shares can the investor purchase given the invested equity and borrowed 17 money? What is the one year rate of return? Will the investor receive a margin call (Output should be Yes or No) 18 19 (Use cells A5 to B14 from the given information to complete this question.) 20 21 Buying on Margin 22 Number of Shares Purchased 23 Rate of Return 24 Margin Call at New Price? 25 26 27 Excel McGraw Hill Excel Question - Saved Search (Option +Q) File Home Insert Draw Formulas. Data Review View Help Editing General 20 V Calibri 11 BA *** 22. A1 X fx Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Requirement A B C D E 1 You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell short two round lots (200 shares) for $60 per share, January 1st. On December 1st, a dividend of $2 per share was paid. On December 31st, you covered the short sale by buying the stock for the price of $75. You paid $.25 per share in commissions for each transaction and earned 0 percent interest on your margin account. Bark River Machine and Tool Company Market Price, January 1 Dividend, December 31 $60.00 $2.00 Market Price, December 31 $65.00 9 Broker 10 Commission, per Share $0.25 11 Maintenance Margin 0.35 12 13 Investor 14 Money Invested in Margin Account $7,500 200 15 Shares Sold Short 16 17 Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a Graded Worksheet + 23456 7 8 Calibri 11 B & A ..... Eb General Xfx Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Require A B E TUBE 8195 13 Investor 14 Money Invested in Margin Account $7,500 200 15 Shares Sold Short 16 17 Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call. 18 19 20 (Use cells A5 to B15 from the given information to complete this question.) 21 22 Short Sale 23 Net Proceeds from Short Sale 24 Money Borrow from broker 25 Dividend Payment 26 Buyback Proceeds 27 Net Profit 28 Percent Return on Investment 29 Margin Call Price 30 21 = Graded Worksheet + Calculation Mode: Automatic Workbook Statistics A1 2BHSKA 12 You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell short two round lots (200 shares) for $60 per share, January 1st. On December 1st, a dividend of $2 per share was paid. On December 31st, you covered the short sale by buying the stock for the price of $75. You paid $.25 per share in commissions for each transaction and earned 0 percent interest on your margin account. Bark River Machine and Tool Company Market Price, January 1 Dividend, December 31 $60.00 $2.00 $65.00 Market Price, December 31 Broker Commission, per Share $0.25 Maintenance Margin 0.35 Investor Money Invested in Margin Account $7,500 200 Shares Sold Short Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call. (Use cells A5 to B15 from the given information to complete this question.) 2 Short Sale 3 Net Proceeds from Short Sale Money Borrow from broker 5 Dividend Payment 5 Buyback Proceeds 7Net Profit B Percent Return on Investment 9 Margin Call Price 0 1 2 You are bullish on Zhu Que, Incorporated. You invest $10,000 of your own money and borrow $10,000 more from your broker (at 8 percent interest). You invest all of that in Zhu Que, Incorporated stock, buying for $125 per share. One year later, the price is now $95. Zhu Que, Incorporated Current Market Price (per share) Market Price in One Year $125.00 $95.00 Broker ( Interest Rate 0.08 0 Maintenance Margin 0.35 1 2 Investor 3 Money to Invest $10,000 $10,000 4 Money to Borrow 15 16 Required: Using the tables above, solve the following: How many shares can the investor purchase given the invested equity and borrowed 17 money? What is the one year rate of return? Will the investor receive a margin call (Output should be Yes or No) 18 19 (Use cells A5 to B14 from the given information to complete this question.) 20 21 Buying on Margin 22 Number of Shares Purchased 23 Rate of Return 24 Margin Call at New Price? 25 26 27 Excel McGraw Hill Excel Question - Saved Search (Option +Q) File Home Insert Draw Formulas. Data Review View Help Editing General 20 V Calibri 11 BA *** 22. A1 X fx Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Requirement A B C D E 1 You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell short two round lots (200 shares) for $60 per share, January 1st. On December 1st, a dividend of $2 per share was paid. On December 31st, you covered the short sale by buying the stock for the price of $75. You paid $.25 per share in commissions for each transaction and earned 0 percent interest on your margin account. Bark River Machine and Tool Company Market Price, January 1 Dividend, December 31 $60.00 $2.00 Market Price, December 31 $65.00 9 Broker 10 Commission, per Share $0.25 11 Maintenance Margin 0.35 12 13 Investor 14 Money Invested in Margin Account $7,500 200 15 Shares Sold Short 16 17 Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a Graded Worksheet + 23456 7 8 Calibri 11 B & A ..... Eb General Xfx Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Require A B E TUBE 8195 13 Investor 14 Money Invested in Margin Account $7,500 200 15 Shares Sold Short 16 17 Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call. 18 19 20 (Use cells A5 to B15 from the given information to complete this question.) 21 22 Short Sale 23 Net Proceeds from Short Sale 24 Money Borrow from broker 25 Dividend Payment 26 Buyback Proceeds 27 Net Profit 28 Percent Return on Investment 29 Margin Call Price 30 21 = Graded Worksheet + Calculation Mode: Automatic Workbook Statistics A1 2BHSKA 12