Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are building a free cash flow to the firm model. You expect sales to grow from $2 billion for the year that just

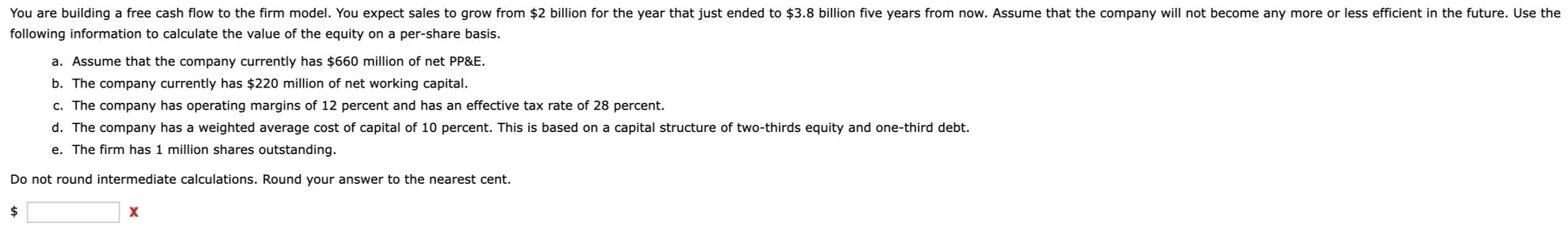

You are building a free cash flow to the firm model. You expect sales to grow from $2 billion for the year that just ended to $3.8 billion five years from now. Assume that the company will not become any more or less efficient in the future. Use the following information to calculate the value of the equity on a per-share basis. a. Assume that the company currently has $660 million of net PP&E. b. The company currently has $220 million of net working capital. c. The company has operating margins of 12 percent and has an effective tax rate of 28 percent. d. The company has a weighted average cost of capital of 10 percent. This is based on a capital structure of two-thirds equity and one-third debt. e. The firm has 1 million shares outstanding. Do not round intermediate calculations. Round your answer to the nearest cent. $ x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of equity per share using the free cash flow to the firm FCFF model well follow these steps 1 Calculate the free cash flow to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started