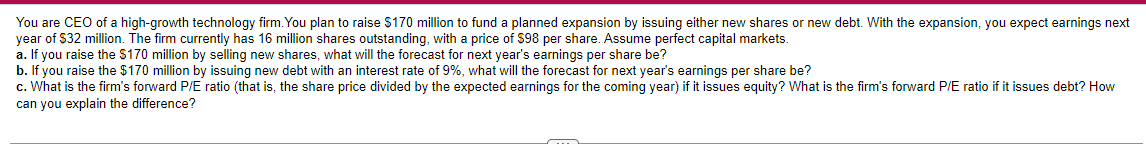

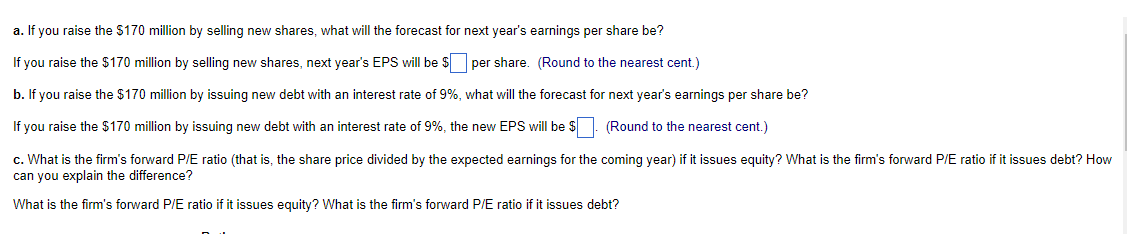

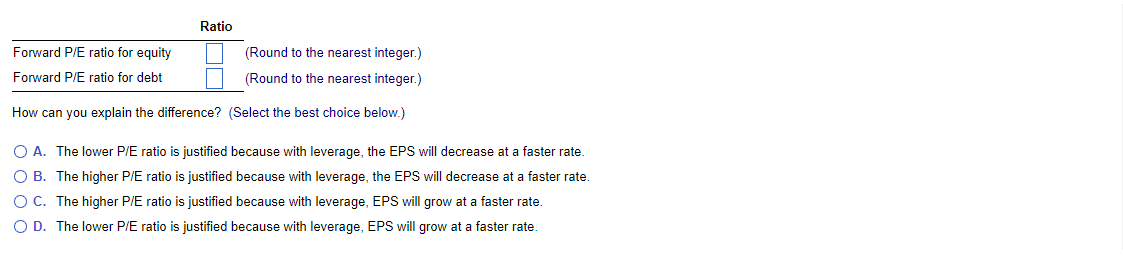

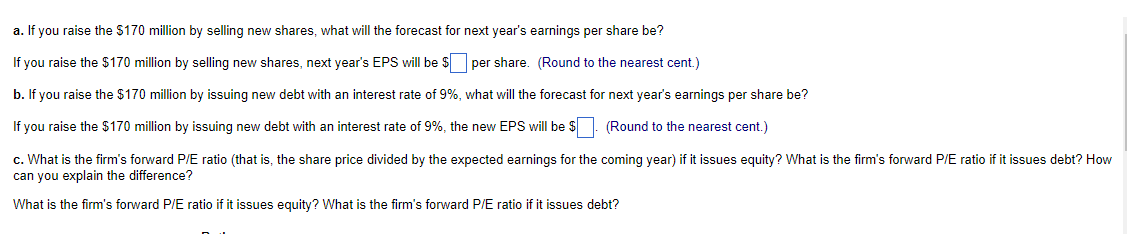

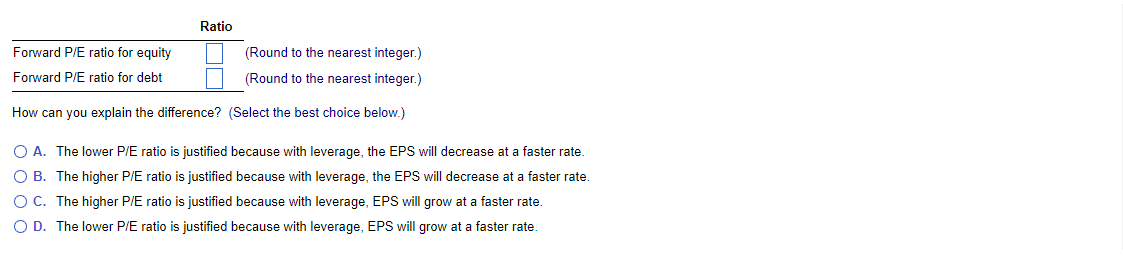

You are CEO of a high-growth technology firm. You plan to raise $170 million to fund a planned expansion by issuing either new shares or new debt. With the expansion, you expect earnings next year of $32 million. The firm currently has 16 million shares outstanding, with a price of $98 per share. Assume perfect capital markets. a. If you raise the $170 million by selling new shares, what will the forecast for next year's earnings per share be? b. If you raise the $170 million by issuing new debt with an interest rate of 9%, what will the forecast for next year's earnings per share be? c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? a. If you raise the $170 million by selling new shares, what will the forecast for next year's earnings per share be? If you raise the $170 million by selling new shares, next year's EPS will be $per share. (Round to the nearest cent.) b. If you raise the $170 million by issuing new debt with an interest rate of 9%, what will the forecast for next year's earnings per share be? If you raise the $170 million by issuing new debt with an interest rate of 9%, the new EPS will be $1. (Round to the nearest cent.) c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? What is the firm's forward P/E ratio if it issues equity? What is the firm's forward P/E ratio if it issues debt? Ratio Forward P/E ratio for equity (Round to the nearest integer.) (Round to the nearest integer.) Forward P/E ratio for debt How can you explain the difference? (Select the best choice below.) O A. The lower P/E ratio is justified because with leverage, the EPS will decrease at a faster rate. O B. The higher P/E ratio is justified because with leverage, the EPS will decrease at a faster rate. OC. The higher P/E ratio is justified because with leverage, EPS will grow at a faster rate. OD. The lower P/E ratio is justified because with leverage, EPS will grow at a faster rate