Question

You are CFO of a very profitable hotel. You are considering a new investment project: opening a restaurant. The project would require an initial investment

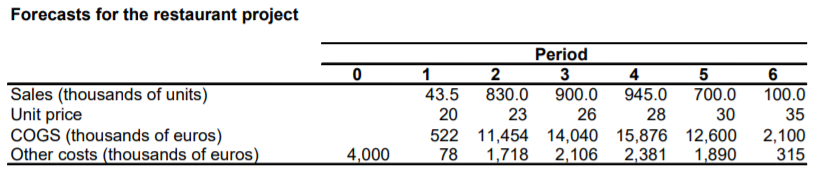

You are CFO of a very profitable hotel. You are considering a new investment project: opening a restaurant. The project would require an initial investment of 8.5 million in fixed assets, and it is forecasted that an additional 2 million will need to be invested in year 3. Resale value of all these fixed assets (at the end of period 4) is 4 million, and it is estimated that in periods 5 and 6 this figure will go down by 20% and 50% respectively. Fixed assets are fully depreciated linearly in 5 years (i.e. assume the resale value does not affect depreciation). Profits in the sale of fixed assets will be taxed at the same rate as regular profits (35%). You can find below the (uncertain) forecasts for sales and production costs. Accounts receivable will represent 20% of total sales whereas accounts payable will be 15% of COGS. No stock will be necessary. The project beta -high, since it's a "nouveau cuisine" project- is 2.5. The riskless rate is 5%. The market has been asking for a 15% return on the company (which has a beta of 2). If the restaurant project is approved, it is expected to be a temporary project (we expect "cuisine" trends to be quite volatile after 6 years), so we are considering the possibility of abandoning the project at the end of years 4, 5 or 6. Is this an attractive project? When should we abandon it and sell off the fixed assets? Please make the calculations and analysis clear (write the formulas).

Forecasts for the restaurant project 0 Sales (thousands of units) Unit price COGS (thousands of euros) Other costs (thousands of euros) Period 1 2 3 4 5 43.5 830.0 900.0 945.0 700.0 20 23 26 28 30 522 11,454 14,040 15,876 12,600 78 1,718 2,106 2,381 1,890 6 100.0 35 2,100 315 4,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started