Question: You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the

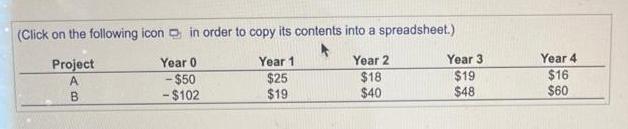

You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRs of the two projects? b. If your discount rate is 5.1%, what are the NPVS of the two projects? c. Why do IRR and NPV rank the two projects differently? (Click on the following icon in order to copy its contents into a spreadsheet.) Project AB Year 0 -$50 - $102 Year 1 $25 $19 Year 2 $18. $40 Year 3 $19 $48 Year 4 $16 $60

Step by Step Solution

There are 3 Steps involved in it

To address each of the questions I will need the provided cash flows for both projects Lets start by calculating the Internal Rate of Return IRR for e... View full answer

Get step-by-step solutions from verified subject matter experts